ACV Auctions (ACVA): Reassessing Valuation After Weak Results and Mounting Profitability Concerns

ACV Auctions (ACVA) has been under pressure after soft quarterly results and stubbornly low margins pushed the stock down about 51% over the past six months. This has forced investors to reassess its path to sustainable profitability.

See our latest analysis for ACV Auctions.

Despite the recent bounce, with a 1 month share price return of 16.01 percent and a 7 day share price return of almost 7 percent, ACV Auctions is still carrying a heavy year to date share price decline and a 1 year total shareholder return of about negative 62 percent. This shows that sentiment has improved at the margin, but long term momentum has clearly faded.

If ACV Auctions has you rethinking where growth and execution might be stronger, this could be a useful moment to explore fast growing stocks with high insider ownership.

With shares now trading at a steep discount to analyst targets despite double digit revenue growth and improving earnings, investors face a key question: is ACV Auctions a beaten down bargain, or is future growth already reflected in the price?

Most Popular Narrative Narrative: 21% Undervalued

With ACV Auctions last closing at $8.26 versus a narrative fair value of $10.46, the current share price implies a sizable valuation gap that hinges on aggressive growth and margin expansion playing out.

The ongoing integration of advanced AI and machine learning into ACV's vehicle inspection, pricing, and guarantee products positions the platform to further differentiate itself by offering real-time, highly accurate, and transparent transaction solutions. This is expected to continue driving above-industry growth in auction volumes, increase take rates, and support margin expansion.

Want to see the math behind that upside gap? The narrative leans on ambitious revenue compounding, a sharp profit swing, and a rich future earnings multiple. Curious which assumptions really move the needle here, and how sensitive that $10 plus fair value is to even small changes in those forecasts? Dive in to unpack the full playbook behind this valuation call.

Result: Fair Value of $10.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, soft dealer volumes and unproven growth initiatives mean execution missteps or slower adoption could quickly challenge the upbeat margin and valuation narrative.

Find out about the key risks to this ACV Auctions narrative.

Another Lens On Valuation

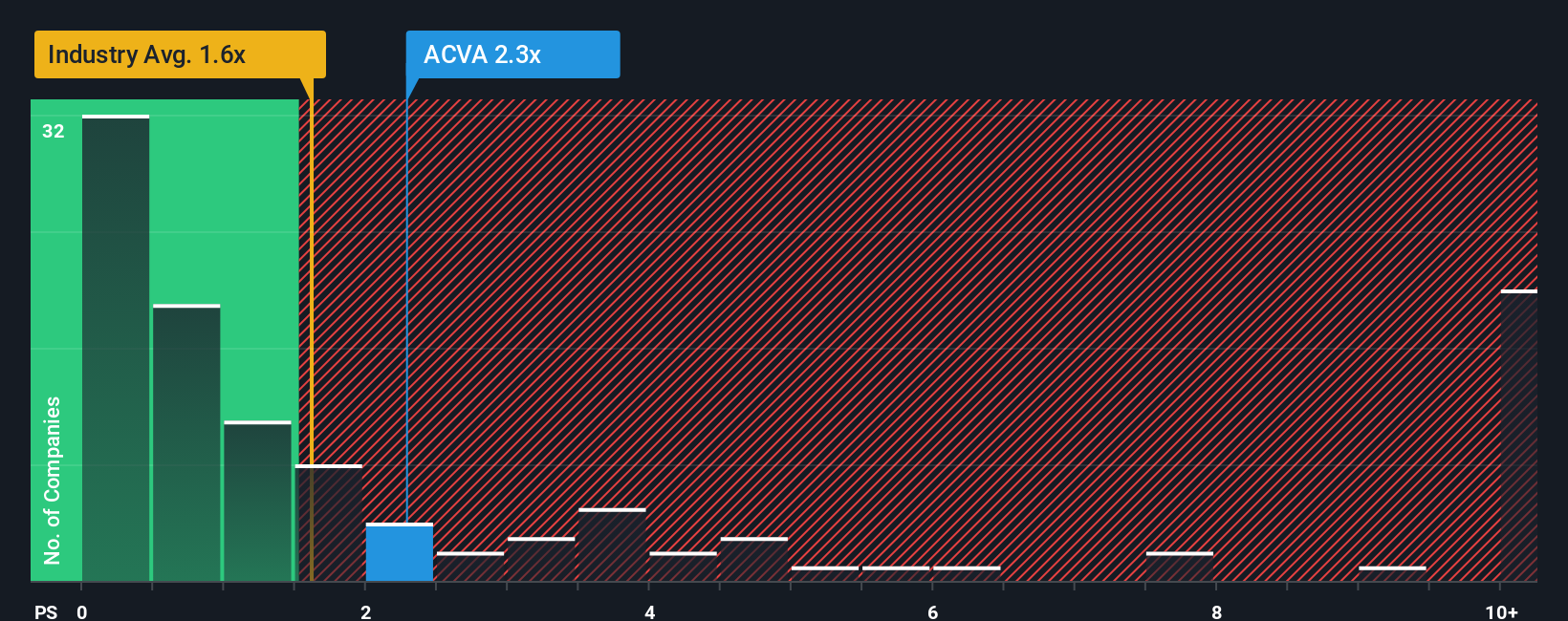

Our valuation checks paint a very different picture. On a sales basis, ACV looks pricey, trading on a 1.9 times price to sales ratio versus 1.2 times for both peers and its own fair ratio. That premium leaves less room for missteps if growth or margins disappoint.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ACV Auctions Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just a few minutes: Do it your way.

A great starting point for your ACV Auctions research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not leave your capital waiting on the sidelines. Unlock fresh opportunities now with targeted stock ideas built from real fundamentals using the Simply Wall Street Screener.

- Target income potential with these 10 dividend stocks with yields > 3% that can strengthen your portfolio with reliable cash returns while others wait for capital gains that may never arrive.

- Ride structural growth trends by using these 29 healthcare AI stocks to pinpoint companies transforming diagnostics, treatment, and patient outcomes with intelligent technology.

- Position ahead of the next digital wave through these 80 cryptocurrency and blockchain stocks, zeroing in on businesses building the backbone of decentralized finance and blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal