Reassessing Arcellx (ACLX) Valuation After Wells Fargo’s Positive CAR‑T Coverage Launch

Wells Fargo just launched coverage on Arcellx (ACLX), spotlighting its experimental CAR T therapy for multiple myeloma as a potential future treatment pillar, and investors are now reassessing what the stock might be worth.

See our latest analysis for Arcellx.

The upbeat coverage comes after a choppy stretch, with Arcellx posting a steep double digit year to date share price loss but still delivering a strong three year total shareholder return. This suggests momentum is pausing rather than broken as investors reassess risk and reward.

If this kind of early stage biotech story interests you, it is worth comparing Arcellx with other potential innovators using our curated set of healthcare stocks.

With shares down sharply this year but still trading at a hefty discount to analyst targets, is Arcellx an overlooked immunotherapy innovator at a bargain price, or is the market already baking in years of future growth?

Price to Book of 8.7x: Is it justified?

Arcellx trades at a price to book ratio of 8.7 times, placing a premium valuation on the $66 share price relative to asset value based metrics.

The price to book multiple compares the market value of the company to its net assets on the balance sheet, a common yardstick for asset light, R and D heavy biotechs. In this case, investors are paying significantly more than the sector norm for each dollar of Arcellx's net assets, which suggests the market is baking in meaningful future success from its pipeline.

That premium stands out when set against the wider US biotechs industry, where the average price to book is just 2.7 times, and even the closest peer set trades around 5.4 times. Such a marked differential implies expectations for Arcellx's future revenue ramp and potential commercial traction are far higher than for the typical biotech name at this stage.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to book of 8.7x (OVERVALUED)

However, setbacks in pivotal trials or delays and disappointments in the Kite partnership could quickly challenge the bullish growth narrative around Arcellx.

Find out about the key risks to this Arcellx narrative.

Another View: Our DCF Model Sees Deep Value

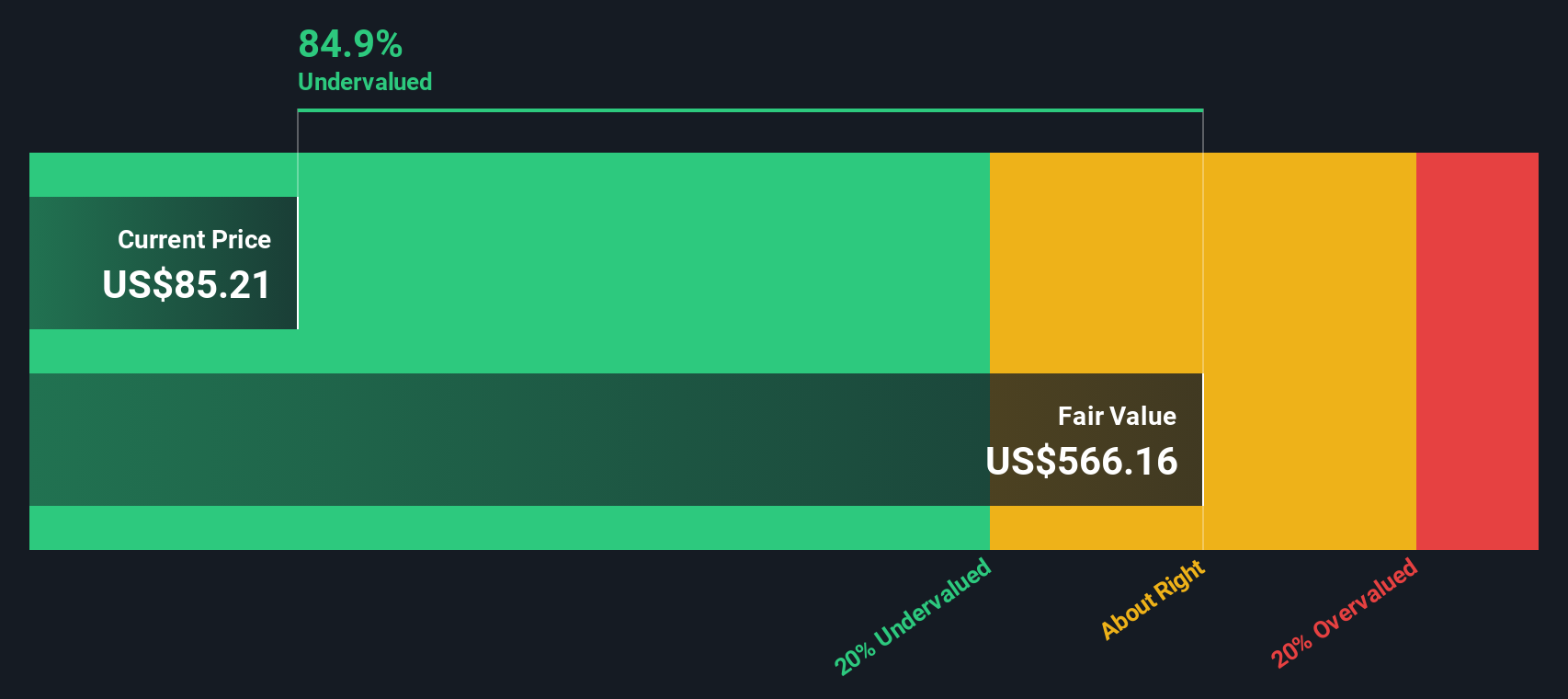

While the price to book ratio makes Arcellx look expensive, our DCF model points the other way, suggesting the shares trade about 87.7% below estimated fair value at roughly $538.77 per share. Is the market being overly cautious, or is the model too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Arcellx for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 901 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Arcellx Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just a few minutes: Do it your way.

A great starting point for your Arcellx research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop with a single stock when you can quickly scan focused, data driven lists of opportunities that other investors might be missing completely.

- Capture potential multi baggers early by checking out these 3626 penny stocks with strong financials that pair tiny market caps with solid underlying fundamentals.

- Position yourself for structural growth by reviewing these 24 AI penny stocks at the forefront of machine learning, automation, and intelligent infrastructure.

- Identify value focused opportunities by using these 901 undervalued stocks based on cash flows to find companies trading below what their cash flows may truly justify.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal