Does Tariff-Driven Margin Pressure Change The Bull Case For PVH (PVH)?

- In the most recent quarter, PVH Corp. reported a 3% year-over-year increase in inventory costs, with tariffs accounting for roughly two-thirds of the rise and an unmitigated US$65 million impact projected on FY25 earnings before interest and taxes.

- An interesting takeaway is that, despite these tariff-driven cost pressures, PVH is emphasizing confidence in its inventory management approach and its ability to offset the headwind over time.

- Next, we’ll examine how the rising tariff-driven cost burden could reshape PVH’s investment narrative and expectations for future profitability.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

PVH Investment Narrative Recap

To own PVH, you need to believe its Calvin Klein and Tommy Hilfiger brands can convert global reach, store expansion and product refreshes into improving earnings, despite margin pressure. The latest 3% rise in inventory costs, mostly tariff driven, reinforces that tariffs remain the key near term risk to profitability, but the projected US$65 million FY25 EBIT hit does not appear to alter the core growth catalyst around brand strength and operational simplification.

The most relevant recent update here is PVH’s reaffirmation of its 2025 guidance with revenue expected to grow in the low single digits, even as tariffs weigh on costs. That stance, paired with its PVH+ cost efficiency plan and ongoing digital and store investments, sets a clear test for whether management can offset tariff pressures enough to protect margins while still funding the initiatives that are supposed to drive the next leg of growth.

But investors should be aware that persistent or higher tariffs could still...

Read the full narrative on PVH (it's free!)

PVH's narrative projects $9.4 billion revenue and $707.7 million earnings by 2028. This requires 2.3% yearly revenue growth and about a $239 million earnings increase from $468.5 million today.

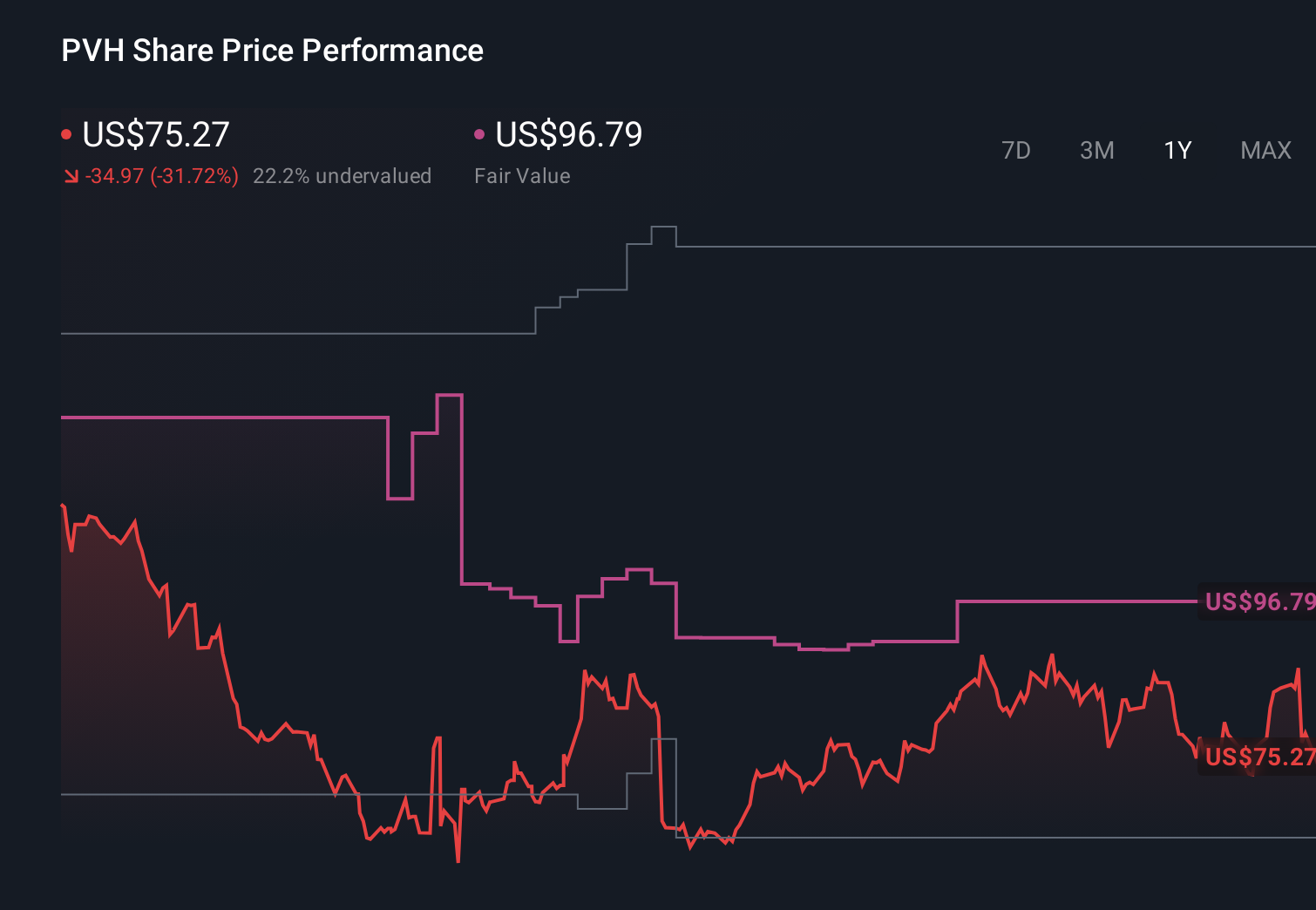

Uncover how PVH's forecasts yield a $96.79 fair value, a 40% upside to its current price.

Exploring Other Perspectives

Seven Simply Wall St Community valuations span about US$67 to US$217 per share, reflecting very different opinions on PVH’s upside. When you weigh those against rising tariff related cost pressure, it is worth comparing several viewpoints before deciding how that risk could affect PVH’s longer term earnings power.

Explore 7 other fair value estimates on PVH - why the stock might be worth over 3x more than the current price!

Build Your Own PVH Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PVH research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free PVH research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PVH's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal