Should GoDaddy’s New ANS Marketplace and AI Tie-ins Require Action From GoDaddy (GDDY) Investors?

- Earlier this month, GoDaddy expanded its Agent Name Service (ANS) with a new ANS Marketplace and a suite of ANS-verified AI agents, while also teaming up with Prime Video’s Fallout series to showcase its Airo® tools through an interactive Ma June’s Sundries digital storefront.

- Together, these launches highlight how GoDaddy is trying to anchor itself at the intersection of small-business AI workflows and trusted agent identity infrastructure.

- Next, we'll examine how GoDaddy's ANS Marketplace and AI-powered tools for small businesses could influence its existing investment narrative.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

GoDaddy Investment Narrative Recap

To own GoDaddy, you generally need to believe it can keep turning its domain relationships into higher margin software, marketing and AI services for small businesses. The ANS Marketplace and AI agents reinforce that software and AI bundling remain the key near term catalyst, while execution risk around these AI products and rising competition from all in one platforms still look like the biggest swing factors. This news supports the existing narrative rather than materially changing it.

Among recent announcements, the expansion of Airo.ai with new coordinated agents stands out as most relevant. Together with ANS, it shows GoDaddy trying to deepen its role in small business workflows, which could help retention, cross selling and the Applications & Commerce segment, if customers actually adopt these tools at scale.

Yet while ANS and Airo expand GoDaddy’s AI story, investors should still watch the risk that all in one rivals increasingly bundle domains with...

Read the full narrative on GoDaddy (it's free!)

GoDaddy's narrative projects $5.9 billion revenue and $1.3 billion earnings by 2028. This requires 7.7% yearly revenue growth and an earnings increase of about $0.5 billion from $808.5 million.

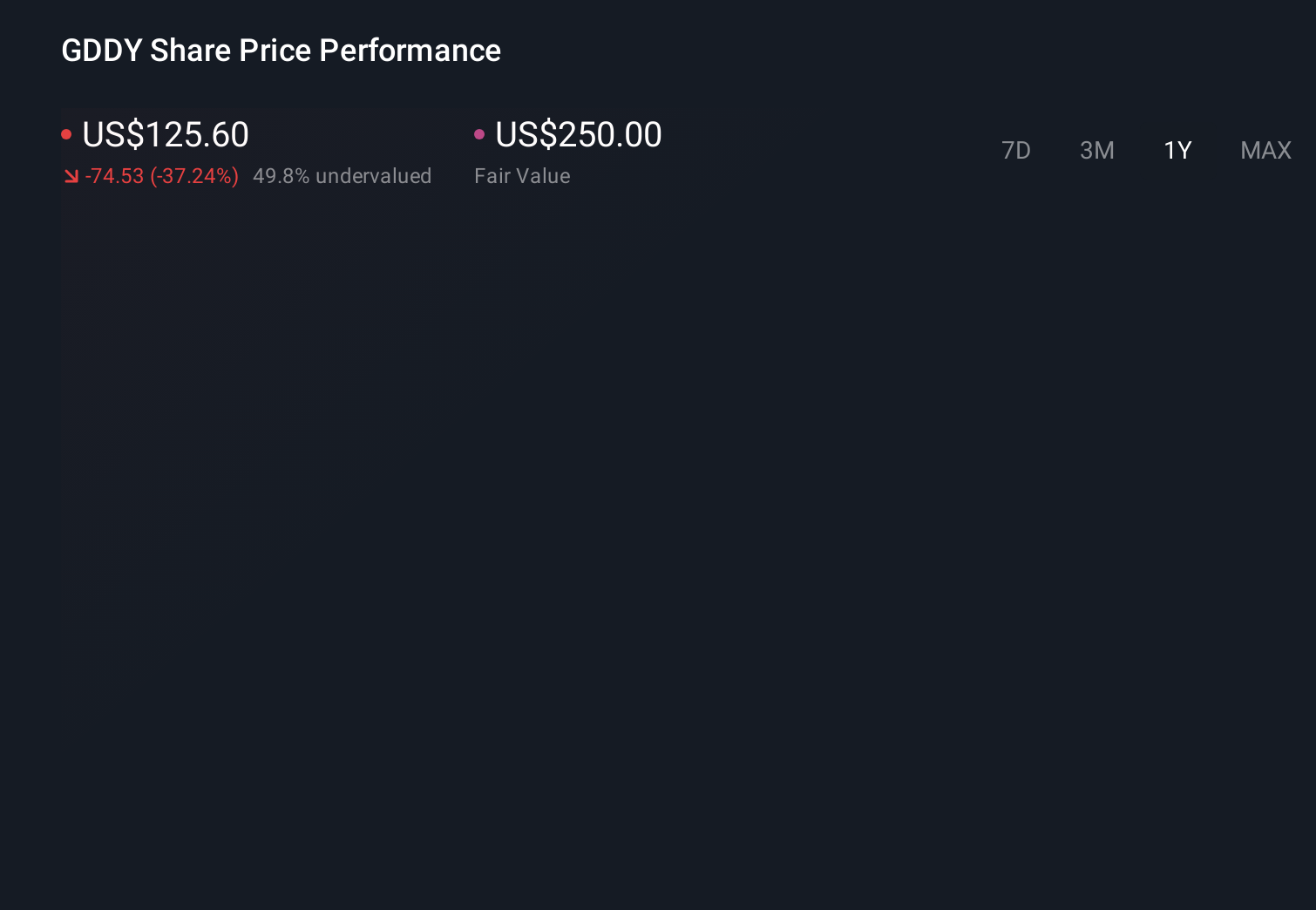

Uncover how GoDaddy's forecasts yield a $175.06 fair value, a 38% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community currently see GoDaddy’s fair value between US$175.06 and US$254.42, well above the recent share price. You may want to weigh those views against the execution risk that GoDaddy’s expanding AI and agent initiatives like ANS and Airo fail to gain enough traction with small businesses to support its broader profit story.

Explore 3 other fair value estimates on GoDaddy - why the stock might be worth just $175.06!

Build Your Own GoDaddy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GoDaddy research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free GoDaddy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GoDaddy's overall financial health at a glance.

No Opportunity In GoDaddy?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 10 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal