Jefferson Capital (JCAP): Evaluating Valuation After a 34% Three-Month Share Price Rally

Jefferson Capital (JCAP) has quietly outperformed the market over the past 3 months, climbing roughly 34%. This has investors asking whether this specialized debt buyer still offers a reasonable entry point.

See our latest analysis for Jefferson Capital.

Zooming out, Jefferson Capital has notched a 23.1% year to date share price return and a striking 34.3% 3 month share price return. This signals that momentum is clearly building as investors reassess both its growth prospects and risk profile at around $22.83 per share.

If this kind of steady re rating interests you, it might be worth scanning fast growing stocks with high insider ownership to spot other under the radar names gaining traction with both management and the market.

With earnings still growing but profits dipping, and the shares trading at a sizeable discount to both intrinsic value estimates and analyst targets, is Jefferson Capital a contrarian buying opportunity or is the market already pricing in future growth?

Price-to-Earnings of 8.2x: Is it justified?

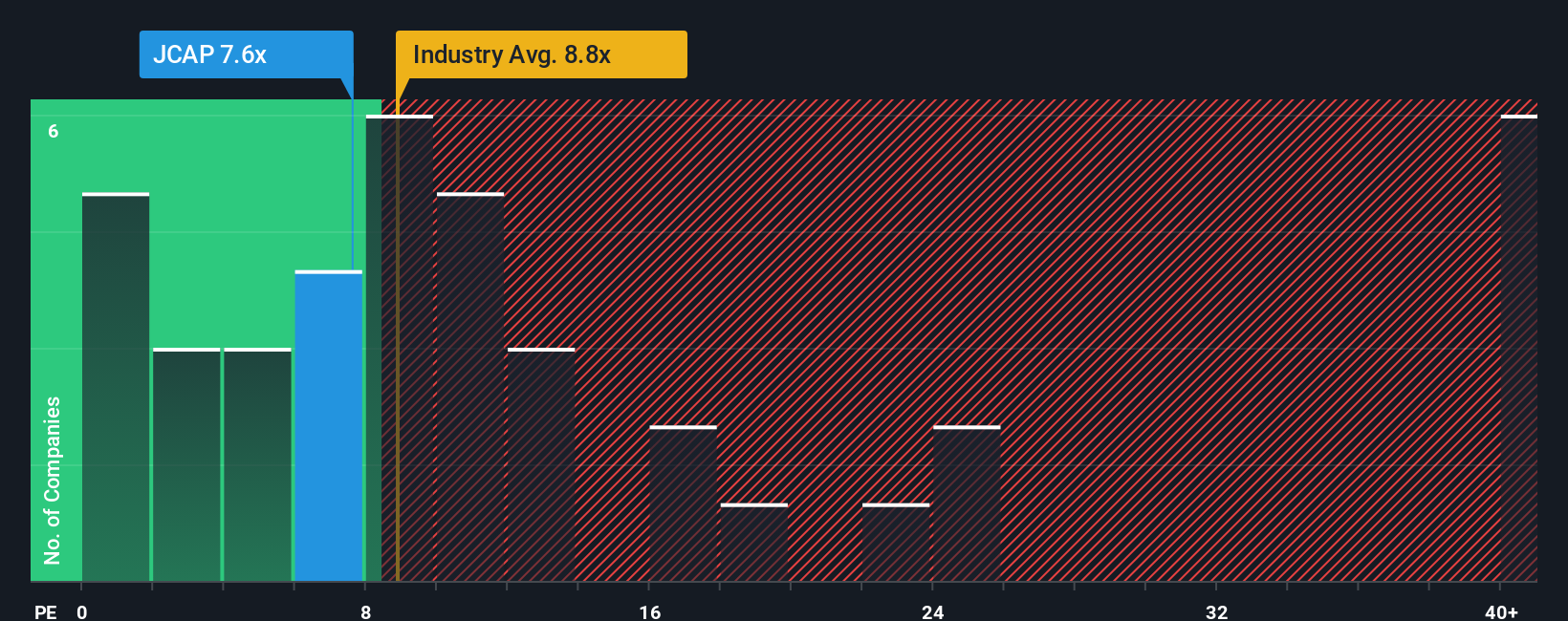

On a headline basis, Jefferson Capital trades on a modest 8.2x price to earnings multiple at $22.83 per share, implying the market is pricing in restrained expectations relative to peers.

The price to earnings ratio compares what investors pay today with the company’s current earnings, a key lens for valuing profitable, mature financial businesses like Jefferson Capital. Given this is a specialized consumer finance and debt recovery group with established profitability, earnings based metrics are particularly relevant for judging whether the share price fairly reflects its cash generating power.

What stands out is that Jefferson Capital is deemed good value on several fronts, trading at 57.6% below the SWS DCF fair value estimate and carrying a lower price to earnings multiple than both its industry and peer averages. Against the Consumer Finance industry, its 8.2x multiple sits below the roughly 10x norm, and even versus direct peers it screens cheaper than the 9x average, suggesting the market may be underpricing its high quality earnings and strong, albeit recently slower, profit growth backdrop. With an estimated fair price to earnings ratio of 11.2x based on regression analysis, there is clear headroom for the market multiple to move higher if sentiment and earnings visibility improve.

Explore the SWS fair ratio for Jefferson Capital

Result: Price-to-Earnings of 8.2x (UNDERVALUED)

However, investors should watch slowing net income growth and regulatory shifts in consumer finance, as either could compress margins and challenge the undervaluation thesis.

Find out about the key risks to this Jefferson Capital narrative.

Another View Using Fair Ratio

Looking at Jefferson Capital through its 8.2x price to earnings ratio, the gap versus the 11.2x fair ratio hints at further upside if sentiment normalizes. It also trades cheaper than the 10x industry and 9x peer averages, but is the discount a margin of safety or a warning sign?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Jefferson Capital for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 901 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Jefferson Capital Narrative

If you are not fully aligned with this view or simply prefer to dig into the numbers yourself, you can build a custom thesis in just a few minutes, Do it your way.

A great starting point for your Jefferson Capital research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Ready for your next move? Use our powerful screener to uncover data driven stock ideas that match your style before other investors catch on.

- Capitalize on underpriced opportunities by targeting these 901 undervalued stocks based on cash flows that the market has not fully appreciated yet.

- Tap into cutting edge innovation through these 24 AI penny stocks, where advanced technologies are reshaping entire industries and long term growth stories are still unfolding.

- Strengthen your income strategy with these 10 dividend stocks with yields > 3%, focusing on companies offering robust yields and the potential for reliable cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal