Regeneron (REGN): Revisiting Valuation After Japan’s Dupixent Pediatric Asthma Approval and Bullish Investor Positioning

Regeneron Pharmaceuticals (REGN) just picked up an important regulatory win in Japan, where Dupixent was cleared to treat severe pediatric asthma, and the stock is reacting as investors reassess its long term growth story.

See our latest analysis for Regeneron Pharmaceuticals.

That backdrop of new Dupixent approvals comes after a powerful run, with roughly a 41 percent 90 day share price return and a solid 5 year total shareholder return of about 65 percent, suggesting momentum is still very much in Regeneron's favor.

If this kind of steady execution appeals to you, it could be a good moment to scan other innovative drug makers through our curated healthcare stocks.

With the shares hovering near analyst targets but still trading at a sizable intrinsic discount, the question now is simple: is Regeneron still mispriced, or are investors already baking in every ounce of its future growth?

Most Popular Narrative Narrative: 0% Overvalued

With Regeneron closing at $783.71 against a narrative fair value near $781, the story hinges less on a big gap and more on how durable its growth really is.

Regeneron's broad and advancing pipeline including recent or upcoming pivotal data in immunology, oncology (notably Lynozyfic and odronextamab), genetic medicines, and obesity positions the company to benefit from demographic driven increases in demand for advanced therapies and from the rise in personalized and precision medicine, supporting future revenue growth and pipeline driven earnings upside.

Want to see what kind of steady revenue climb and margin path this narrative is baking in, and how rich a future earnings multiple it assumes? The underlying projections tell a very specific story about how much more profit Regeneron might squeeze from its pipeline strengths than the wider market expects. Curious which combination of growth, profitability, and discount rate assumptions has been used to land on that finely balanced fair value? Dive in to see how those moving parts add up.

Result: Fair Value of $781 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent Eylea competition and potential regulatory or manufacturing setbacks could quickly challenge those growth assumptions and pressure Regeneron’s carefully balanced valuation case.

Find out about the key risks to this Regeneron Pharmaceuticals narrative.

Another View: Valuation Through Earnings

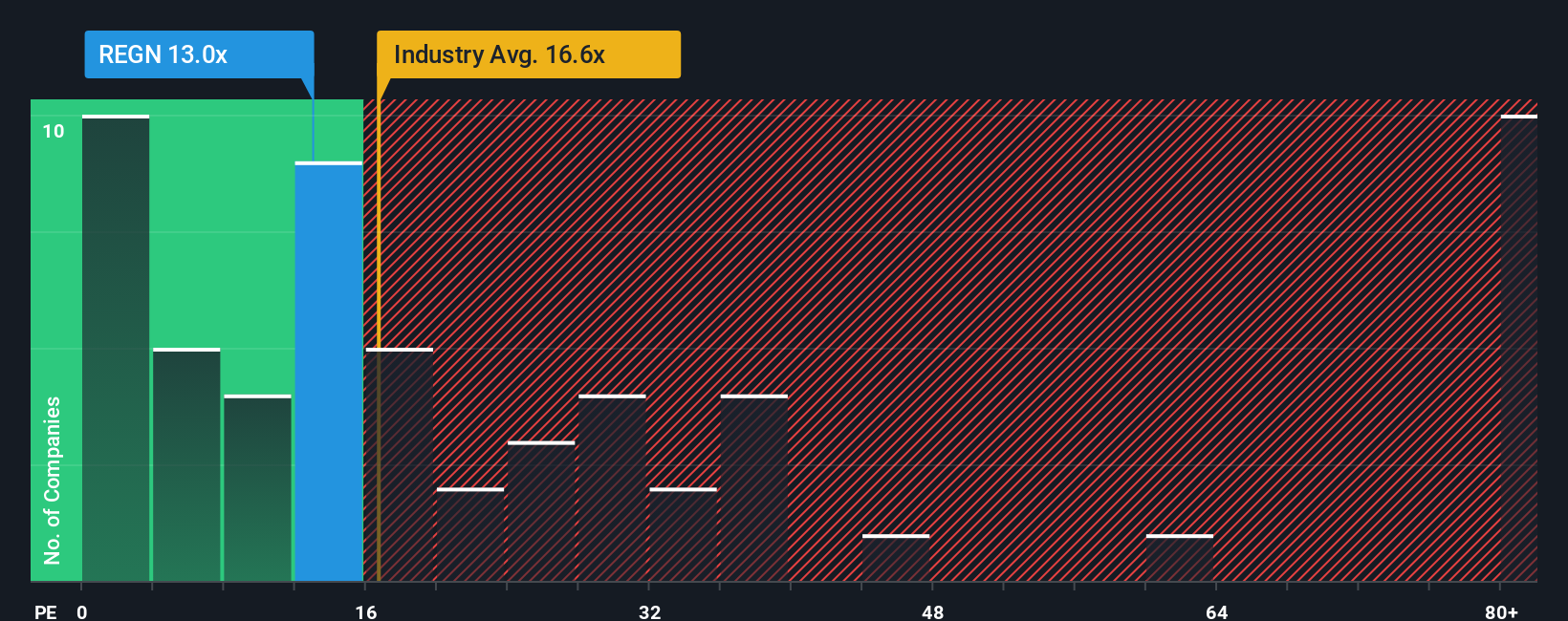

Step away from narrative fair value and REGN still looks inexpensive on plain earnings math. Its P E ratio sits around 17.6 times, versus 23.2 times for peers and 22.2 times for the wider US biotech group. Our fair ratio sits even higher at 27.6 times, which hints at upside if sentiment turns.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Regeneron Pharmaceuticals Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a custom view in just minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Regeneron Pharmaceuticals.

Looking for more investment ideas?

Before you move on, lock in a few fresh angles by scanning targeted stock ideas on Simply Wall Street that many investors overlook until it is too late.

- Explore stocks with smaller share prices and financial strength by checking out these 3626 penny stocks with strong financials with fundamentals that support their growth stories.

- Review these 24 AI penny stocks that combine artificial intelligence with scalable business models.

- Consider these 10 dividend stocks with yields > 3% that may help support long-term compounding of income and value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal