Alkami Technology (ALKT): Valuation Check as Jana Partners Pushes for Strategic Review and Potential Sale

Alkami Technology (ALKT) just landed on activist radar, with Jana Partners disclosing a new stake and openly urging the company to explore a sale. The firm argues that Alkami’s growth and sticky customer base are underappreciated.

See our latest analysis for Alkami Technology.

The activist interest lands after a tough stretch, with Alkami’s share price down sharply on a year to date basis and the 1 year total shareholder return also in negative territory. However, the 3 year total shareholder return is still solidly positive, suggesting long term believers have been rewarded while near term momentum has cooled.

If this kind of activist driven story has you thinking more broadly about financial technology opportunities, it could be worth exploring high growth tech and AI stocks as a way to spot other potential growth names.

With shares down sharply this year despite brisk revenue growth and a sizable discount to analyst targets, is Alkami a classic activist driven mispricing, or a case where the market already sees and values every bit of future upside?

Most Popular Narrative: 29.3% Undervalued

With the narrative fair value sitting well above Alkami Technology’s last close at $23.01, the stage is set for an aggressive upside case.

Continued rollout of new products and expansion into adjacent banking services (e.g., AI personalization, integrated data/marketing, payments), coupled with demonstrated high client retention rates, supports recurring revenue expansion and provides multiple avenues for margin improvement and long-term earnings upside.

Want to see what kind of revenue climb and margin reset justify this valuation gap, and which bold profitability jump underpins that projected earnings power? Read on.

Result: Fair Value of $32.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer revenue trends and potential client onboarding delays could still derail the margin acceleration story and keep valuation multiples under pressure.

Find out about the key risks to this Alkami Technology narrative.

Another View, Rich On Sales

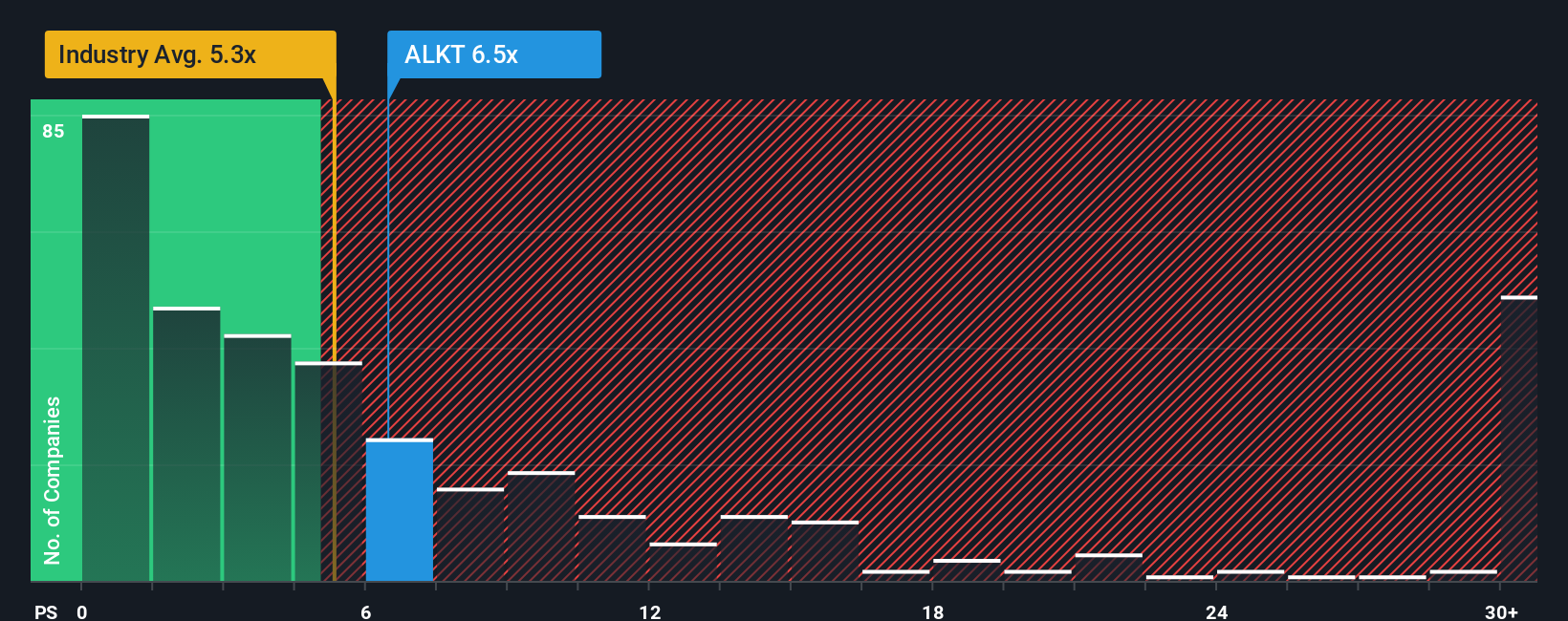

Looked at through its price to sales ratio Alkami does not look cheap at all. The stock trades at about 5.9 times sales, versus 4.9 times for the broader US software group and a fair ratio closer to 4.3 times, suggesting valuation risk if growth stalls.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Alkami Technology Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A great starting point for your Alkami Technology research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you stop with just one stock, you could miss the next big winner, so put Simply Wall Street’s powerful screener to work across these themes today.

- Capture potential market mispricing by targeting companies trading below intrinsic value with these 901 undervalued stocks based on cash flows before others catch on.

- Ride powerful secular trends by focusing on innovators reshaping the future of automation and data with these 24 AI penny stocks.

- Strengthen your income stream by zeroing in on reliable payers through these 10 dividend stocks with yields > 3% while yields remain compelling.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal