CEO Satya Nadella Is Doubling Down on AI at Microsoft. Does That Make MSFT Stock a Buy Here?

In a bold move that is reshaping the future of one of the world’s most valuable companies, Microsoft Corporation (MSFT) CEO Satya Nadella is doubling down on artificial intelligence (AI), betting that the next era of tech dominance will be won by those who build the platforms, infrastructure, and cloud services that power AI at scale. From investing tens of billions of dollars in hyperscale AI data centers and strategic partnerships to embedding AI across core products, Nadella has signaled that AI is no longer just one of Microsoft’s growth vectors; it’s the company’s central strategic thrust.

Satya Nadella has become deeply hands-on with the company’s AI push, actively engaging with top engineers and closely reviewing product performance. He now runs intensive weekly meetings, issues direct product mandates, and has shifted focus away from other executive duties to act as Microsoft’s most influential product leader.

Amid rising competitive and financial pressure in AI, Nadella is also accelerating talent recruitment, personally courting elite researchers from OpenAI and Google DeepMind, signaling that he views this moment as pivotal for Microsoft’s long-term success.

While MSFT is trading near record valuations, does Nadella’s AI bet make Microsoft stock a buy today?

About Microsoft Stock

Headquartered in Redmond, Washington, Microsoft Corporation is a global technology leader known for its expansive portfolio that spans software, cloud computing, AI, gaming, and enterprise solutions. Microsoft has evolved from a dominant operating system provider into a powerhouse across multiple tech verticals. The company boasts a market cap of approximately $3.6 trillion, reflecting its heavyweight status.

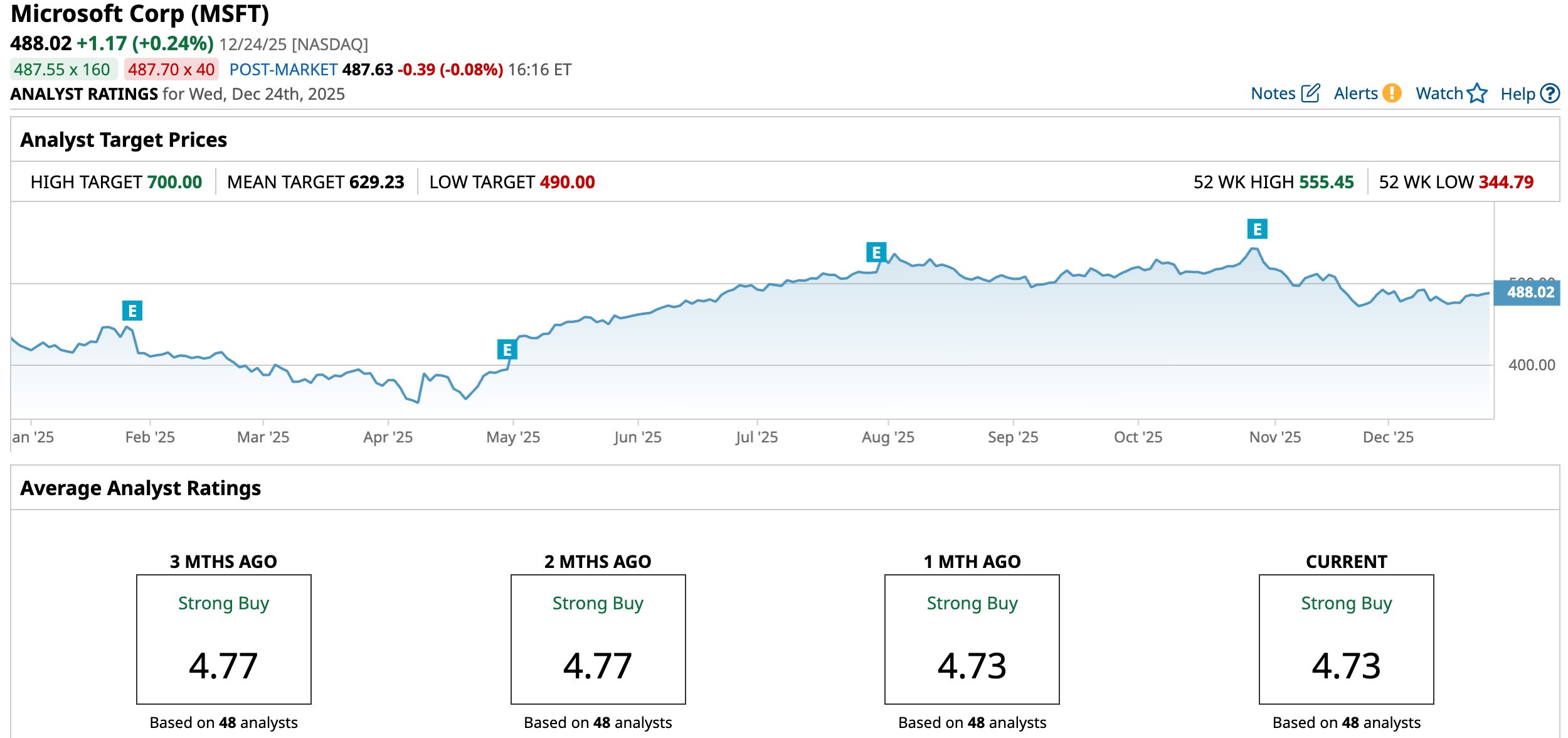

Microsoft’s stock price performance over the recent period reflects both the company’s underlying growth momentum and broader market dynamics. Owing to robust cloud revenue and early leadership in AI, MSFT shares climbed to record levels in 2025, hitting a 52-week high of $555.45, reached on July 31, underscoring robust investor confidence in its strategic direction.

However, Microsoft’s performance has not been a straight line upward. Periods of consolidation and pullbacks have emerged as investors reacted to shifts in macroeconomic conditions, and the broad technology sector, which has periodically weighed on high-growth names. The stock is down 13.8% from the high reached in July.

Despite the pullback, the stock has delivered returns of 15.8% year-to-date (YTD) and 11% over the past year. The overall optimism stems from expectations that the company’s massive investments in cloud capacity and AI tools like Copilot and Azure AI will translate into accelerated revenue growth in future periods.

Microsoft’s valuation has commanded a premium, with analyst price targets pointing to continued optimism about future earnings power. It is currently trading at 30.58 times forward earnings, higher than many of its industry peers.

Solid Q1 Performance

Microsoft reported its fiscal first quarter 2026 results on Oct. 29, after the market closed. In this quarter, the company delivered $77.7 billion in revenue, representing an 18% year-over-year (YOY) increase, comfortably above analysts’ expectations.

Total operating income also showed robust growth, climbing 24% YOY, while non-GAAP EPS rose 23% to $4.13, underscoring continued margin strength even as Microsoft scales its AI and cloud infrastructure and beating the consensus estimate.

Cloud revenue played a leading role, with the Microsoft Cloud segment up 26% YOY to $49.1 billion, and Azure and other cloud services growing an impressive 40%, highlighting strong ongoing demand for AI-enabled enterprise services. Commercial remaining performance obligations jumped 51% to $392 billion, signaling heightened multi-year customer commitments.

However, investors were reminded that substantial capital expenditures of $34.9 billion in Q1 are being deployed to expand AI capacity and data-center footprint, a factor that tempered the stock’s immediate reaction despite the earnings beat. The stock declined 2.9% on Oct. 30.

Management outlined expectations for second quarter FY2026 revenue of between $79.5 billion and $80.6 billion, implying continued double-digit growth, and maintained that demand for cloud and AI products would remain solid.

Analysts remain optimistic as they predict EPS to be around $15.86 for fiscal 2026, up 16.3% YOY, and surge another 15.6% annually to $18.33 in fiscal 2027.

What Do Analysts Expect for Microsoft Stock?

On Dec. 22, Wedbush analyst Daniel Ives reaffirmed his “Outperform” rating on Microsoft and maintained his $625 price target, signaling continued confidence in the stock’s upside and long-term growth outlook.

Also, DA Davidson reaffirmed a “Buy” rating on Microsoft with a $650 price target. The firm continues to view Microsoft as its top mega-cap pick, citing durable financial strength, and confidence in its long-term AI positioning.

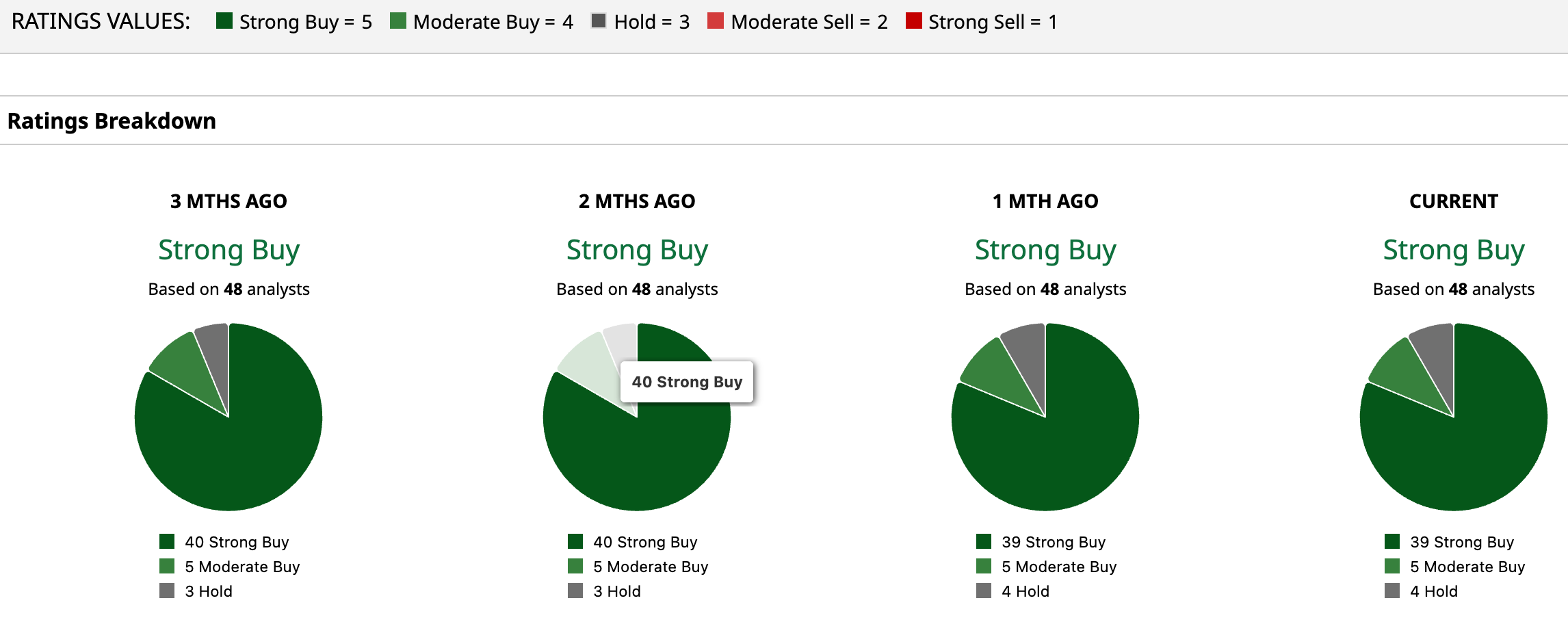

Overall, MSFT has a consensus “Strong Buy” rating. Of the 48 analysts covering the stock, 39 advise a “Strong Buy,” five suggest a “Moderate Buy,” and the remaining four analysts are on the sidelines, giving it a “Hold” rating.

The average analyst price target for MSFT is $629.23, indicating a potential upside of 29.1%. Meanwhile, the street-high target price of $700 suggests that the stock could rally as much as 43.4%.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal