Sphere Entertainment (SPHR): Valuation Check After New CTO Hire to Drive Immersive Tech Innovation

Sphere Entertainment (SPHR) just handed the technical keys to its immersive venues to Felicia Yue, a veteran behind innovations like the NFL yellow line and CNNs election Magic Wall. The move directly targets its growth narrative.

See our latest analysis for Sphere Entertainment.

That tech focused hire is landing against a powerful backdrop, with the share price up 20.59 percent over the past month and a 126.43 percent year to date share price return, while the 1 year total shareholder return of 144.64 percent signals strong momentum rather than a short lived spike.

If this kind of narrative driven growth appeals to you, it could be worth exploring fast growing stocks with high insider ownership as another source of fast moving, high conviction ideas.

Yet with revenue growth still modest, negative earnings and the share price now above the average analyst target but trading at a steep intrinsic discount, is this the next leg up, or is future growth already priced in?

Most Popular Narrative: 24.8% Overvalued

With the narrative fair value sitting below Sphere Entertainment's last close of $93.99, the story leans toward optimism that markets may have already embraced.

The analysts have a consensus price target of $53.9 for Sphere Entertainment based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $75.0, and the most bearish reporting a price target of just $35.0.

Want to see how a still unprofitable business wins such a rich future multiple? The secret mix of growth, margins and share dilution may surprise you. Dig into the full narrative to uncover the assumptions powering that valuation jump.

Result: Fair Value of $75.30 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained Vegas demand weakness or costly international expansion missteps could quickly challenge assumptions about Sphere's scalability and long term earnings power.

Find out about the key risks to this Sphere Entertainment narrative.

Another View on Valuation

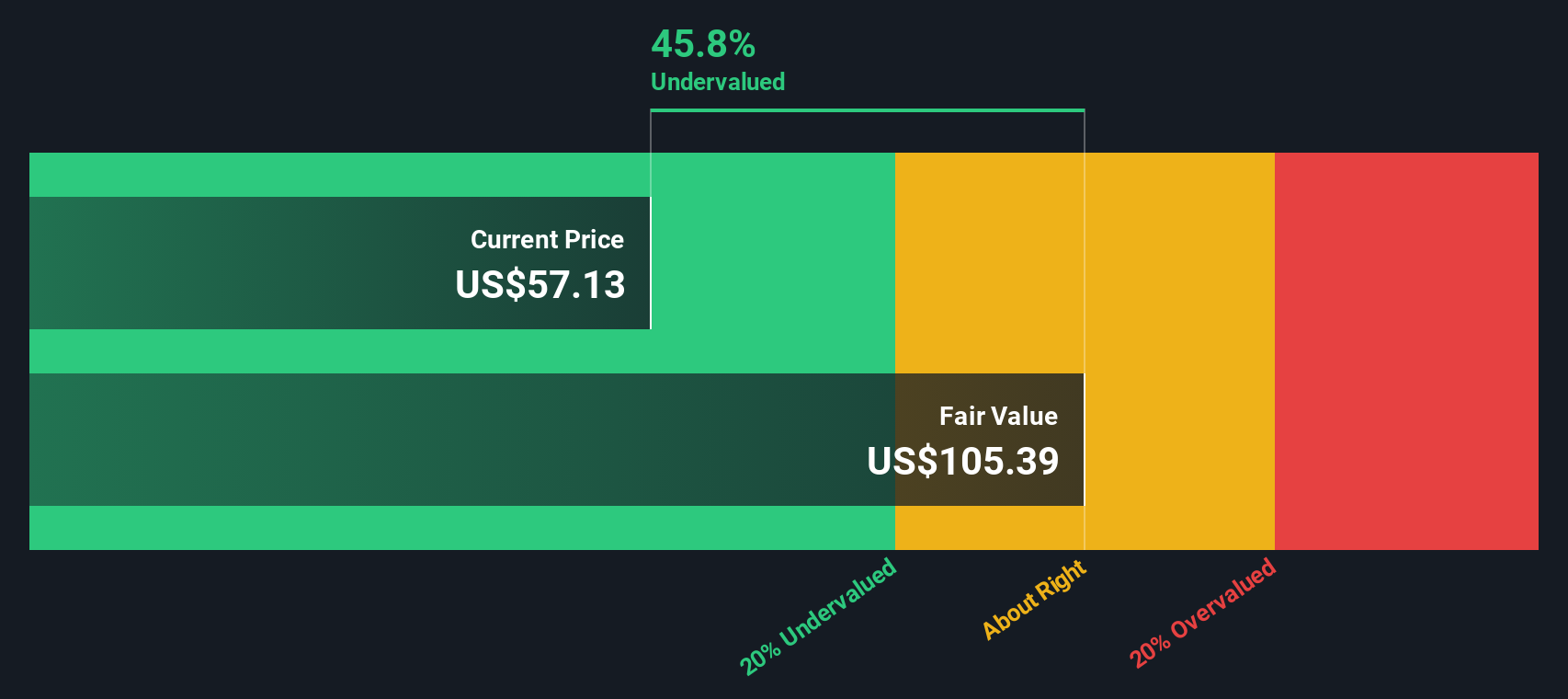

While the narrative fair value suggests Sphere Entertainment is 24.8 percent overvalued at $93.99, our DCF model presents a different perspective and points to a fair value of about $198. That gap implies either a stretched story or a market still catching up. Which do you trust?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sphere Entertainment for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 901 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sphere Entertainment Narrative

If you are skeptical of this take or simply prefer your own homework, you can shape a personalized view in under three minutes: Do it your way.

A great starting point for your Sphere Entertainment research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Sphere might be compelling, but do not stop here. Use the Simply Wall St Screener now so you do not miss the next standout opportunities.

- Capture potential mispricings by targeting companies trading below their intrinsic value with these 901 undervalued stocks based on cash flows, which puts cash flow strength at the center of your process.

- Ride structural growth trends by zeroing in on innovators shaping the future of automation and intelligence through these 24 AI penny stocks before the crowd fully catches on.

- Strengthen your portfolio’s income engine by focusing on resilient businesses offering meaningful yields above 3 percent using these 10 dividend stocks with yields > 3% as your filter.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal