Does Eversource Energy’s 2025 Rebound Still Offer Upside for Long Term Investors?

- Wondering if Eversource Energy is still good value after its recent rebound, or if most of the upside is already baked in? Let us unpack what the market is really pricing into this utility heavyweight.

- The stock is up 17.1% year to date and 22.9% over the last year, even though longer term 3 year and 5 year returns are still slightly negative. This suggests sentiment has shifted meaningfully in the last 12 months.

- That change in mood has come as investors refocus on regulated utilities as a potential haven in a higher for longer interest rate environment and as Eversource continues to work through strategic moves like trimming non core assets and streamlining its portfolio. At the same time, the broader conversation around grid reliability, renewable integration and infrastructure spending has put names like Eversource back on the radar for income and defensively minded investors.

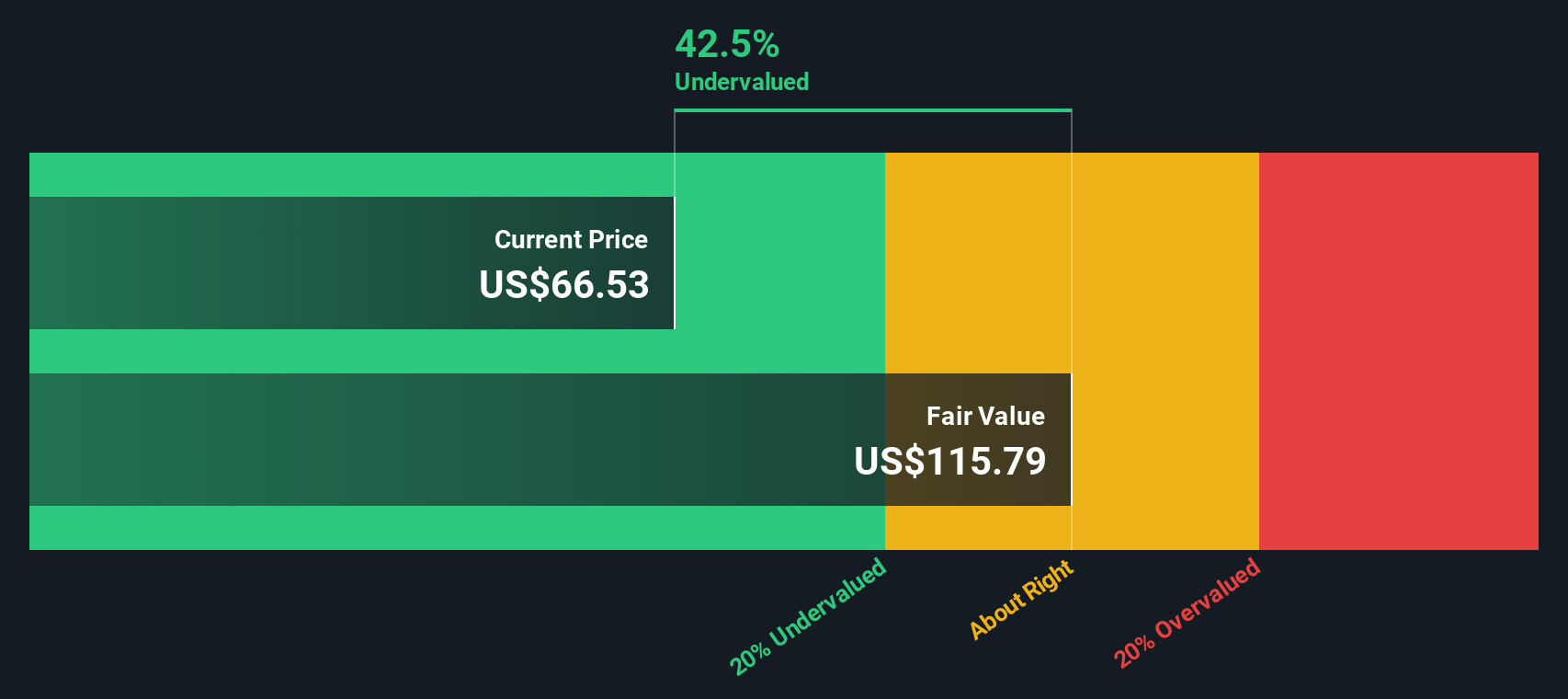

- Right now Eversource scores a 4/6 on our valuation checks, meaning it screens as undervalued on four of the six metrics we use. You can see the breakdown in our valuation score. In the rest of this article we will walk through those valuation approaches in detail, then finish with a more nuanced way to think about what the market might be missing.

Approach 1: Eversource Energy Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth today by projecting its future cash flows and discounting them back to the present. For Eversource Energy, we use a 2 stage Free Cash Flow to Equity approach based on cash flow projections in $.

Over the last twelve months, Eversource generated free cash flow of about $807 Million in the red, reflecting heavy investment and timing effects. Our model expects this to turn positive and grow steadily, reaching roughly $4.54 Billion in free cash flow by 2035. Analyst forecasts cover the early years, while the later numbers are extrapolated from those trends by Simply Wall St.

When all projected cash flows are discounted back, the DCF model suggests an intrinsic value of about $173.72 per share. Compared with the current market price, this implies the stock is trading at a 61.3% discount, which points to substantial upside if the cash flow recovery and growth occur as modeled.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Eversource Energy is undervalued by 61.3%. Track this in your watchlist or portfolio, or discover 901 more undervalued stocks based on cash flows.

Approach 2: Eversource Energy Price vs Earnings

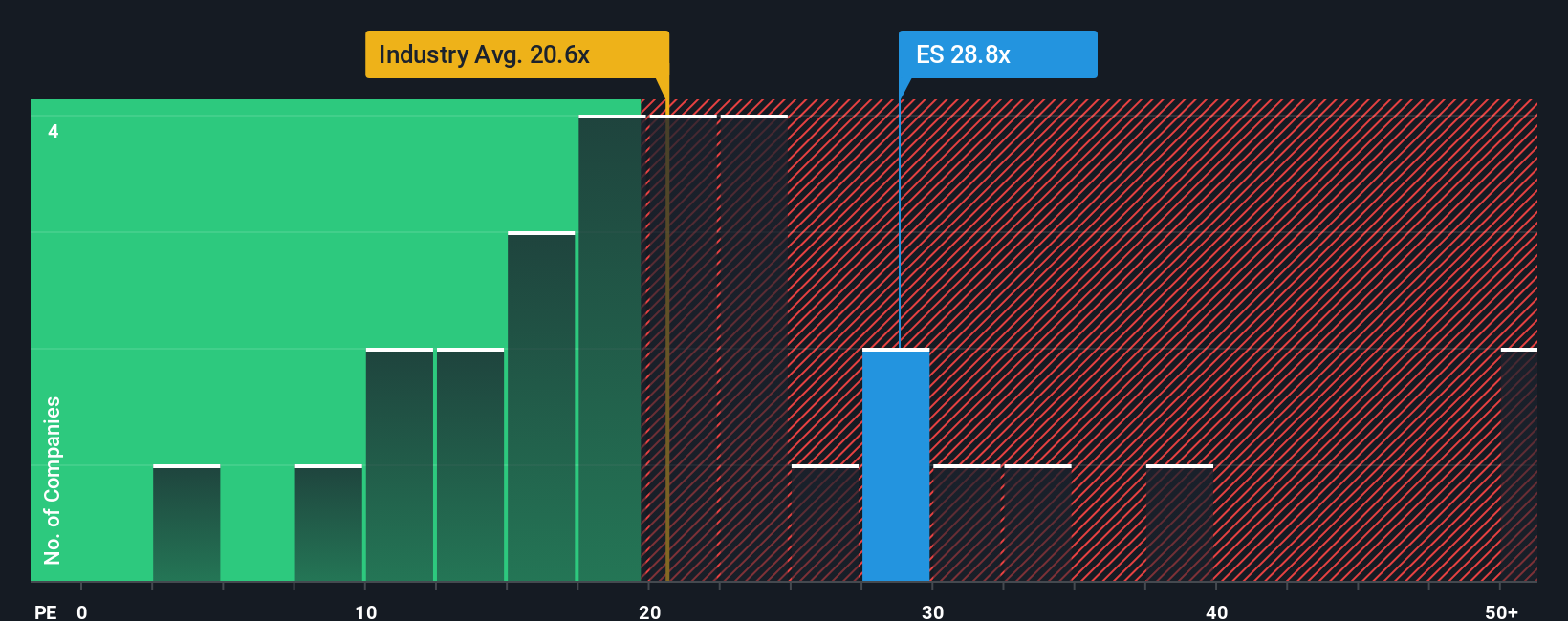

For a mature, profitable utility like Eversource Energy, the price to earnings ratio is a natural way to think about value because it compares what investors pay today with the company’s current earnings power. In general, companies with faster, more reliable growth and lower risk justify a higher PE multiple, while slower growth or higher risk usually call for a lower, more conservative PE.

Eversource currently trades on a PE of about 18.8x, which sits slightly below both the Electric Utilities industry average of roughly 19.6x and a broader peer group at about 18.4x. Simply Wall St also calculates a Fair Ratio of 24.8x. This represents the PE that might be expected given Eversource’s earnings growth outlook, margins, industry positioning, size and risk profile. This business specific Fair Ratio is more informative than a simple peer or industry comparison because it adjusts for the company’s own fundamentals rather than assuming all utilities deserve the same multiple.

Comparing Eversource’s current 18.8x PE with the Fair Ratio of 24.8x suggests the stock is trading at a discount to what its fundamentals might justify.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1460 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Eversource Energy Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework that lets you attach a clear story and set of assumptions about future revenue, earnings and margins to a company, connect that story to a financial forecast, and then translate it into your own fair value estimate.

On Simply Wall St’s Community page, used by millions of investors, Narratives make this process accessible by guiding you to spell out what you think will drive Eversource’s business, plug those expectations into a forecast, and compare the resulting Fair Value to the current share price to see how they differ.

Because Narratives are updated dynamically as new information arrives, such as earnings releases or regulatory news, your fair value view stays in sync with reality rather than being a static snapshot that quickly goes out of date.

For Eversource Energy, for example, one investor’s optimistic Narrative might support a fair value closer to 87 dollars per share, while a more cautious Narrative might land around 47 dollars, showing how the same stock can look very different once you make your assumptions explicit.

Do you think there's more to the story for Eversource Energy? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal