Sparebanken Norge (OB:SBNOR): Valuation Check After Refreshing Its Green Bond Framework and Sustainability Push

Sparebanken Norge (OB:SBNOR) just refreshed its Green Bond Framework, sharpening its focus on financing energy efficient buildings and renewable projects across Norway, and the move is already filtering into how investors think about the stock.

See our latest analysis for Sparebanken Norge.

The refreshed Green Bond Framework lands at a time when momentum in Sparebanken Norge is already strong, with a 30 day share price return of 10.53 percent and a 5 year total shareholder return of 261.79 percent. This suggests investors see both growth potential and improving risk dynamics.

If this sustainability push has you rethinking where banks fit in your portfolio, it could be worth scanning the market for fast growing stocks with high insider ownership as potential future outperformers.

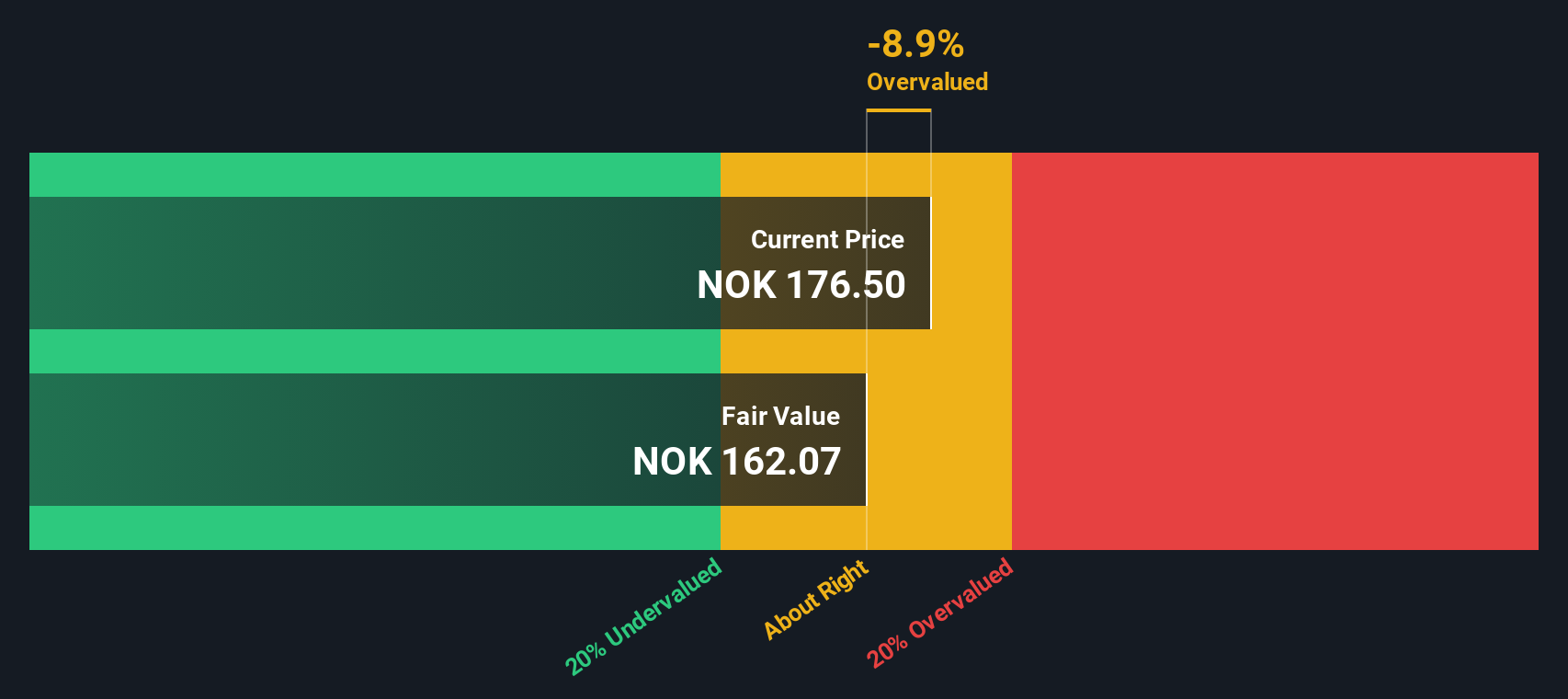

Yet with the share price near record highs and trading above analyst targets, the key question now is whether Sparebanken Norge is still undervalued or if the market is already pricing in its future growth.

Price-to-Earnings of 14.5x: Is it justified?

Sparebanken Norge trades at a price-to-earnings ratio of 14.5x, which signals a richer valuation than many Norwegian bank peers at the current share price.

The price-to-earnings multiple compares what investors pay today with the bank's current earnings, a key lens for assessing profitability driven businesses like lenders.

Here, the market appears to be paying up for Sparebanken Norge's faster than average earnings growth and expected profit acceleration, even though returns on equity are still described as low and net profit margins have slipped versus last year. This suggests optimism about future delivery rather than current efficiency.

Compared to the Norwegian Banks industry average P/E of 11.1x, and even a fair value P/E estimate of 14.4x, Sparebanken Norge's 14.5x stands out as noticeably more expensive. This implies investors are already pricing in a premium performance narrative relative to both peers and the level our fair ratio suggests the market could eventually gravitate toward.

Explore the SWS fair ratio for Sparebanken Norge

Result: Price-to-Earnings of 14.5x (OVERVALUED).

However, its stretched valuation leaves little room for error if earnings growth slows. Any setback in its green lending strategy could also quickly sour sentiment.

Find out about the key risks to this Sparebanken Norge narrative.

Another View on Valuation

Our DCF model paints a different picture. At NOK161.93 per share, Sparebanken Norge screens as overvalued versus the current NOK194 price, even with strong growth forecasts baked in. Is the market sensibly front running that growth, or stretching too far ahead of fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sparebanken Norge for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 901 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sparebanken Norge Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalised view in just a few minutes: Do it your way.

A great starting point for your Sparebanken Norge research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at one bank. Use the Simply Wall St Screener to hunt for focused opportunities that match your style before the market moves first.

- Capture potential mispricing by scanning these 901 undervalued stocks based on cash flows that strong cash flow analysis suggests the market may still be overlooking.

- Ride structural technology shifts by targeting these 24 AI penny stocks positioned to benefit from accelerating real world adoption of artificial intelligence.

- Lock in income potential by reviewing these 10 dividend stocks with yields > 3% that offer attractive yields above 3 percent with the backing of listed businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal