Guardant Health (GH): Reassessing Valuation After New Trial Library Partnership and Strong Share Price Gains

Guardant Health (GH) just teamed up with Trial Library in a data heavy, AI driven push to make cancer clinical trial enrollment easier, especially in community clinics that usually sit on the sidelines.

See our latest analysis for Guardant Health.

The collaboration lands after a powerful run for the stock, with a roughly 70 percent 3 month share price return and a year to date share price return above 220 percent, which hints that investors see momentum and growth potential building.

If this kind of precision oncology story is on your radar, it could be worth scanning other innovative names across healthcare by exploring healthcare stocks.

Yet with shares up more than 200 percent this year, trading only modestly below analyst targets but still at a steep intrinsic discount, is Guardant Health quietly undervalued, or is the market already pricing in its next leg of growth?

Most Popular Narrative Narrative: 8.4% Undervalued

With Guardant Health last closing at $102.38 against a narrative fair value near $111.82, the story frames the stock as carrying further upside potential.

Substantial regulatory, reimbursement, and clinical validation milestones (including Shield's breakthrough device status, NCCN guideline inclusion, and ongoing pilot studies) are paving the way for further guideline adoption, expanded payer coverage, and commercial inflections in Shield/MCED and Reveal volumes, significantly increasing future revenue and earnings visibility.

Want to see what kind of growth curve could justify this richer valuation, and how future margins might transform today’s heavy losses into sustained earnings power?

Result: Fair Value of $111.82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained cash burn and any stumble in payer adoption for Shield could quickly challenge both the growth trajectory and today’s optimistic valuation.

Find out about the key risks to this Guardant Health narrative.

Another Angle on Valuation

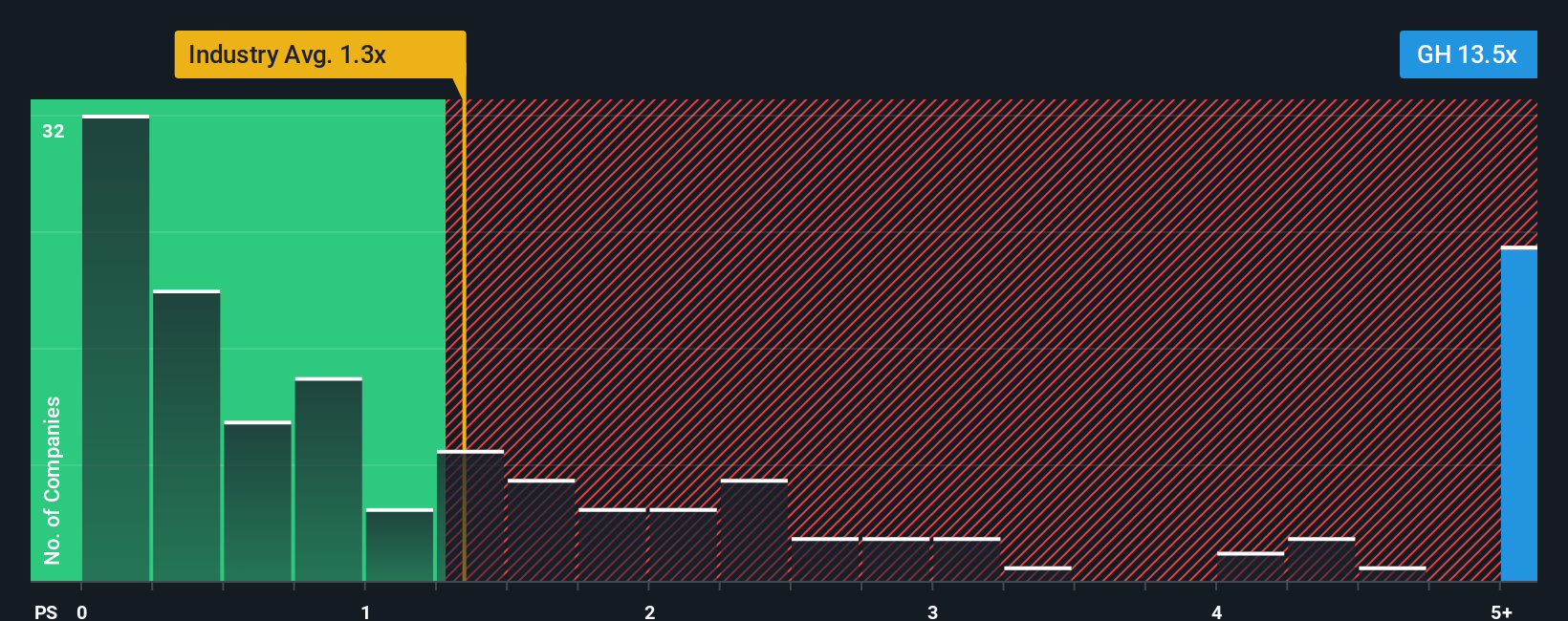

While the narrative fair value suggests upside, the sales based view looks far tougher. Guardant trades on a 14.6 times sales multiple versus about 1.3 times for the wider US healthcare space and 1.1 times for peers, well above a 7.1 times fair ratio that the market could eventually lean toward.

That gap implies today’s price bakes in years of strong execution, leaving less room for error if growth or margins wobble. This raises a key question: is this still a mispriced opportunity, or already a richly valued success story in the making?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Guardant Health Narrative

If you see the numbers differently, or want to test your own thesis against the data, build a custom narrative in minutes, Do it your way.

A great starting point for your Guardant Health research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with a single stock. Use the Simply Wall Street Screener to uncover focused opportunities and keep your watchlist loaded with potential winners.

- Capture powerful price swings early by hunting through these 3626 penny stocks with strong financials that already show real financial strength instead of pure speculation.

- Ride the next wave of intelligent automation by zeroing in on these 24 AI penny stocks positioned to benefit most from rapid adoption of AI technologies.

- Lock in potential bargains before the crowd notices with these 901 undervalued stocks based on cash flows that score well on cash flow based valuation checks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal