The GEM IPO of Ink Bank Co., Ltd. has accepted the R&D, production and sales of digital inkjet inks

Zhitong Finance App learned that on December 25, Shenzhen Moku New Materials Group Co., Ltd. (abbreviation: Moku Co., Ltd.) Shenzhen Stock Exchange GEM IPO was accepted. Huatai United Securities is its sponsor and plans to raise 720 million yuan.

According to the prospectus, Ink Bank Co., Ltd. is mainly engaged in R&D, production and sales of digital inkjet inks. Its main products include dispersion ink, paint ink, UV ink, water-based dye ink, etc.

The company's products are used in emerging digital printing technology. This technology integrates high-tech technologies such as computers, mechatronics, precision machinery manufacturing, and fine chemicals. It mainly uses digital equipment and inkjet printing technology to print digital inkjet ink according to set procedures to form a pattern on the printing material through a control system.

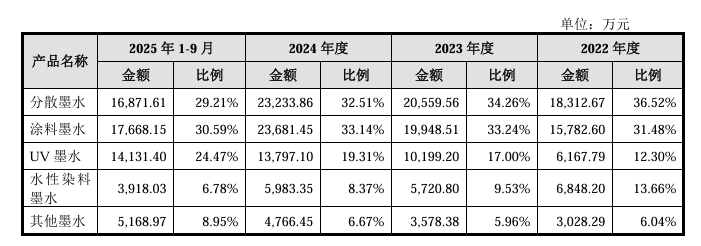

The composition of the company's main business revenue during the reporting period was as follows:

The digital inkjet ink produced by the company is used as a key consumable. It is used in digital printing equipment with core components such as digital nozzles, system boards, and other accessory products. It is mainly used in digital textile printing, advertising images, desktop office printing, packaging and publications, electronic circuits, architectural decoration, and craft decorations.

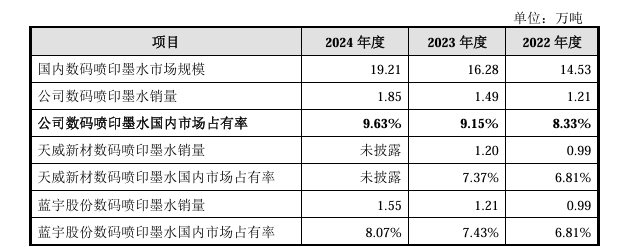

According to statistics from the China Printing and Equipment Industry Association, China's digital inkjet ink market size is 145,300 tons in 2022, China's digital inkjet ink market size forecast is 162,800 tons in 2023, and China's digital inkjet ink market size is predicted to be 192,100 tons in 2024.

Based on the above data, the domestic digital inkjet ink market share is as follows:

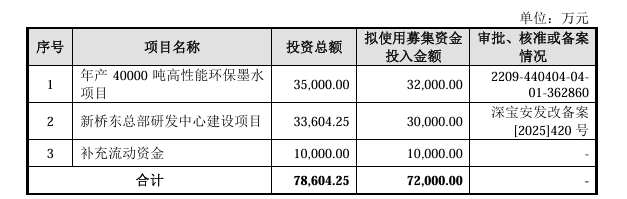

After deducting the issuance fee, all of the funds raised in this offering are to be used for the following projects:

The prospectus suggests that raw materials account for a high proportion of the company's operating costs and may face the risk of supply shortages and price fluctuations. During the reporting period, the company's direct materials accounted for 79.70%, 79.76%, 80.46% and 81.66% of the company's main business costs, respectively.

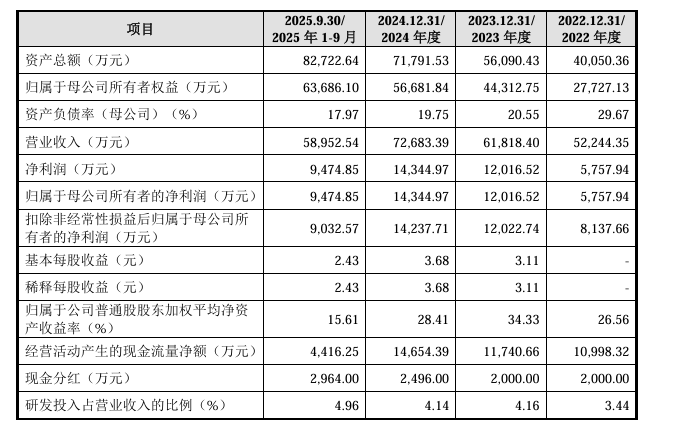

On the financial side, in 2022, 2023, 2024, and January-September 2025, Moku shares achieved operating income of approximately $522 million, 618 million yuan, 727 million yuan, and 590 million yuan, respectively.

For the same period, net profit was 57.5794 million yuan, 120 million yuan, 143 million yuan, and 94.7485 million yuan, respectively.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal