Philip Morris International (NYSE:PM): Valuation Check as Dividend Confirmed and ZYN FDA Review Nears

Philip Morris International (NYSE:PM) just put income investors back in the spotlight, reaffirming its quarterly dividend at 1.47 dollars per share ahead of the December 26 ex dividend date and a closely watched FDA review for ZYN.

See our latest analysis for Philip Morris International.

The reaffirmed dividend, new credit facilities and looming FDA decision on ZYN are all feeding into sentiment, with Philip Morris International’s 34.3% year to date share price return pointing to building momentum supported by robust multi year total shareholder returns.

If the mix of income and regulatory catalysts has your attention, this could be a good moment to see how Philip Morris stacks up against other income focused names in pharma stocks with solid dividends.

With the stock up more than 34% year to date but still trading below analyst targets and some estimates of intrinsic value, investors now face a key question: is Philip Morris undervalued, or is the market already pricing in its next leg of smoke free growth?

Most Popular Narrative Narrative: 11.1% Undervalued

With Philip Morris International last closing at 162.64 dollars, the most popular narrative argues that intrinsic value still sits meaningfully higher, underpinned by long term smoke free transformation and earnings growth.

The accelerating global adoption of smoke-free alternatives, driven by increasing health awareness and regulatory moves away from combustibles, is fueling strong double-digit volume and margin growth in PMI's IQOS, ZYN, and VEEV platforms. This secular shift enables the company to capture new consumer segments, expand its addressable market, and structurally boost net revenues and operating margins over time.

Curious how this shift translates into that higher valuation line? The narrative leans on rising sales, fatter margins and a richer future earnings multiple. Want to see the exact roadmap behind those assumptions?

Result: Fair Value of $182.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside case could be derailed by tougher nicotine regulation around ZYN and IQOS, or by a sharper than expected decline in traditional cigarettes.

Find out about the key risks to this Philip Morris International narrative.

Another Angle on Valuation

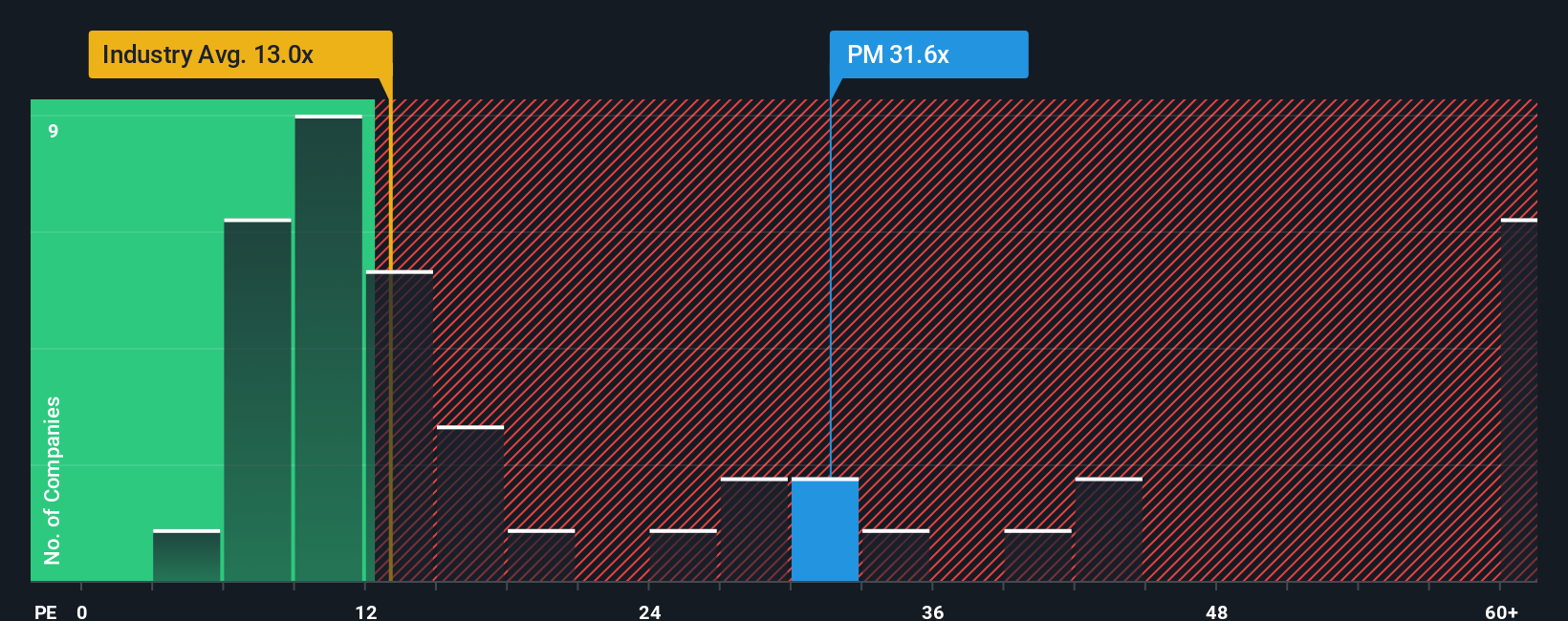

On a plain price to earnings view, the story looks less generous. Philip Morris trades on about 29.4 times earnings versus 24.1 times for peers and 13.1 times for the wider global tobacco group, and even above its own 27.4 times fair ratio, suggesting less margin for error if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Philip Morris International Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a personalised Philip Morris view in minutes: Do it your way.

A great starting point for your Philip Morris International research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you only stick with one stock, you will miss other powerful setups, so use the Simply Wall St Screener to uncover your next conviction opportunity today.

- Turn small allocations into potential game changers by targeting calculated high risk, high reward opportunities through these 3626 penny stocks with strong financials.

- Ride structural growth in automation, data and productivity by focusing on companies at the forefront of intelligent innovation with these 24 AI penny stocks.

- Seek stronger risk reward profiles by filtering for quality companies trading below estimated cash flow value using these 901 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal