Schrödinger (SDGR): Revisiting Valuation After Analyst Upgrades and a Strategic Shift Toward Software

BofA Securities’ recent upgrade of Schrödinger (SDGR), alongside KeyBanc’s reiterated positive stance, centers on one big shift: the company is leaning harder into its higher margin software business and away from cash hungry drug programs.

See our latest analysis for Schrödinger.

The market seems to be cautiously warming to that story, with a 7 day share price return of 5.63% and a 30 day share price return of 7.42%. However, the year to date share price return remains negative and long term total shareholder returns are still underwhelming, suggesting early momentum rather than a full rerating.

If Schrödinger’s shift toward software has caught your attention, it is worth exploring other innovation driven healthcare names using healthcare stocks as a starting point for fresh ideas.

With the stock still trading at a steep discount to analyst targets despite improving growth metrics, investors face a key question: is Schrödinger quietly undervalued, or is the market already baking in the software pivot’s upside?

Most Popular Narrative Narrative: 32.7% Undervalued

With Schrödinger’s last close at $18.38 versus a narrative fair value in the high twenties, the implied upside leans heavily on ambitious growth and margin shifts.

Analysts are assuming Schrödinger's revenue will grow by 18.6% annually over the next 3 years.

If Schrödinger's profit margin were to converge on the industry average, you could expect earnings to reach $34.8 million (and earnings per share of $0.46) by about September 2028, up from $-181.3 million today.

Want to see how a loss making platform business jumps to meaningful profits and a premium earnings multiple in just a few years? The full narrative unpacks an aggressive revenue glidepath, a sharp margin turnaround, and a valuation framework that leans on future healthcare style profitability. Curious which assumptions do the real heavy lifting in that fair value math and how sensitive the upside is if they slip even slightly? Read on to see what the narrative is really pricing in.

Result: Fair Value of $27.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shrinking software margins and growing reliance on volatile milestone revenues could easily derail the aggressive earnings and valuation path implied today.

Find out about the key risks to this Schrödinger narrative.

Another Lens on Valuation

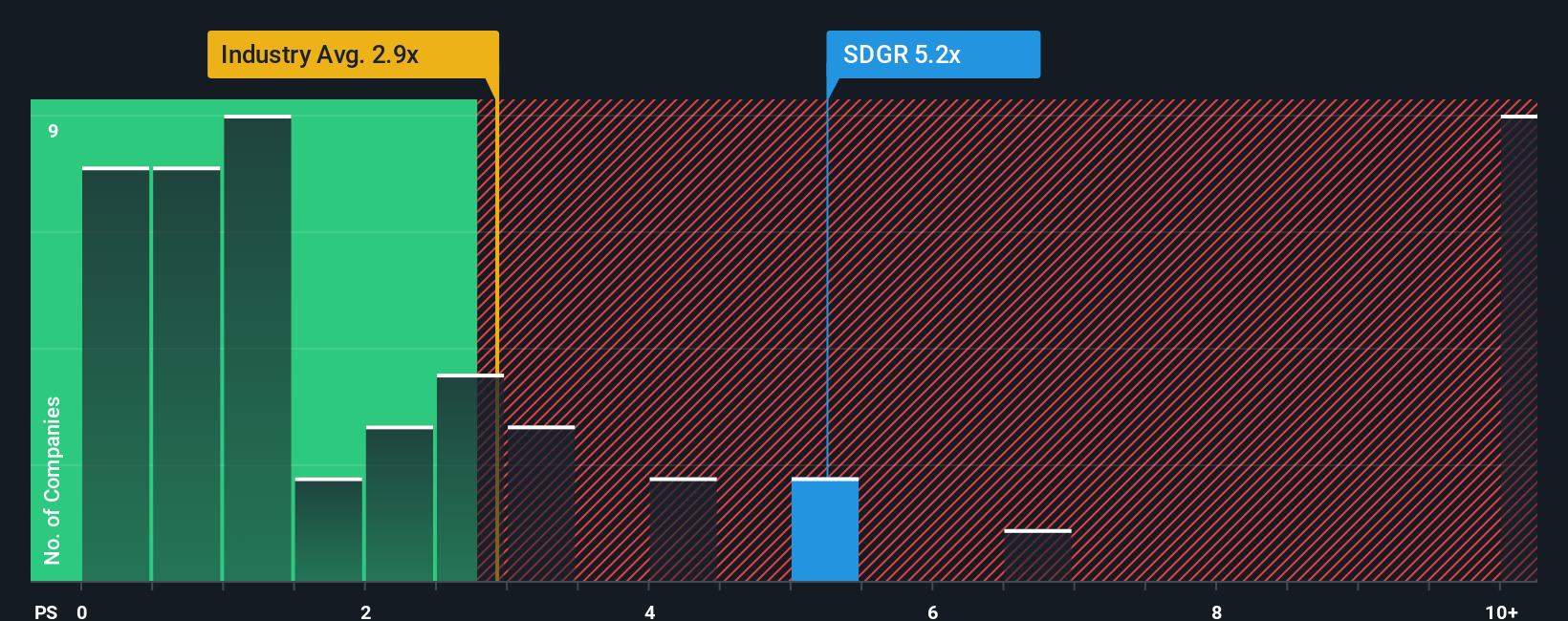

On simple price to sales, Schrödinger looks demanding at 5.3 times revenue versus 2.4 times for the US healthcare services sector and 1.8 times for peers, and even above a 2.7 times fair ratio that the market could eventually gravitate toward. This raises the risk that sentiment rather than fundamentals is doing more of the work here. If growth or margins disappoint, how far could that gap realistically compress?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Schrödinger Narrative

If you see the numbers differently or want to stress test your own assumptions against the market narrative, you can build a personalized view in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Schrödinger.

Looking for your next investment move?

Do not stop at one compelling story. Turn today’s momentum into a full watchlist of opportunities tailored to your style with the Simply Wall St Screener.

- Capitalize on market mispricing by targeting these 901 undervalued stocks based on cash flows that combine strong fundamentals with attractive entry points before sentiment fully catches up.

- Ride structural growth trends by focusing on these 24 AI penny stocks positioned at the center of automation, data intelligence, and next generation software adoption.

- Lock in potential income streams by zeroing in on these 10 dividend stocks with yields > 3% that balance yield, payout sustainability, and long term capital preservation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal