Casella Waste Systems (CWST) Valuation After Its Inclusion in the S&P 1000 Index

Casella Waste Systems (CWST) has just been added to the S&P 1000, a move that can quietly reshape its shareholder base as index trackers and benchmarked funds adjust their portfolios.

See our latest analysis for Casella Waste Systems.

The inclusion in the S&P 1000 comes just as momentum has been quietly improving, with a roughly mid teens 90 day share price return and a solid multi year total shareholder return, even though this year’s performance has been softer.

If Casella’s move into the index has you thinking about what else might be gaining institutional attention, it could be a good moment to explore fast growing stocks with high insider ownership.

Yet with earnings growing faster than revenue and the share price already near analyst targets, the key question is whether Casella still trades below its true potential or if the market is already pricing in its future growth.

Most Popular Narrative Narrative: 10.5% Undervalued

With Casella Waste Systems last closing at $100.82 against a narrative fair value of about $112.70, the current setup leans toward underappreciated upside.

Infrastructure investments such as automation in fleet (with 55 new and mostly automated trucks coming in late 2025), upgraded ERP systems, and route optimization are expected to unlock significant operational efficiencies, capturing previously delayed cost synergies in the Mid Atlantic region, which should materially boost net margins and EBITDA starting in 2026.

Want to see how steady double digit style growth, rising margins, and a rich future earnings multiple all fit together? The full narrative reveals the blueprint behind that upside case.

Result: Fair Value of $112.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained acquisition integration problems or higher than expected labor and capital costs could erode margins and undermine the longer term upside narrative.

Find out about the key risks to this Casella Waste Systems narrative.

Another Lens on Valuation

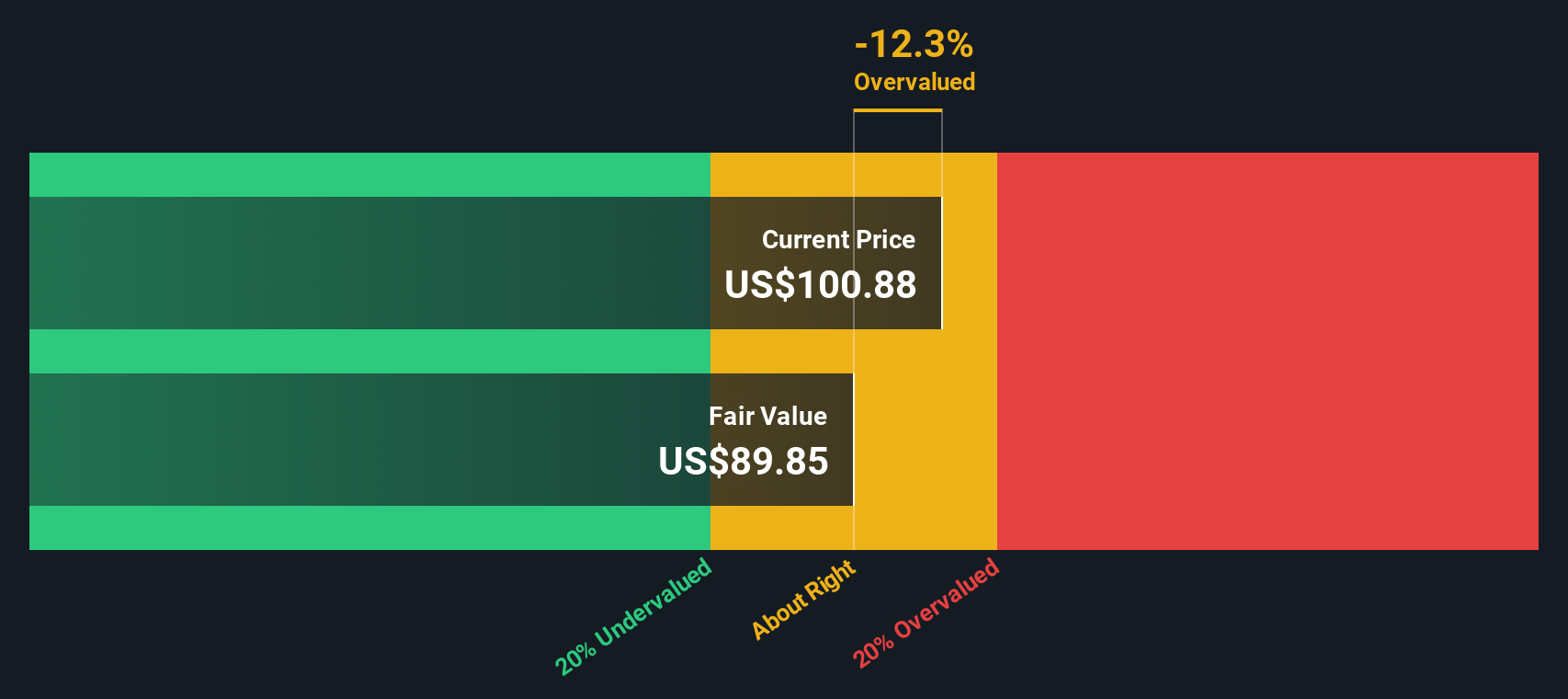

Our SWS DCF model paints a cooler picture, putting fair value closer to $85.15 per share. This implies Casella is trading at a premium rather than a discount. If the cash flows do not ramp as quickly as the narrative assumes, today’s price could leave little margin for error. Which story do you trust more: the cash flows or the compounding narrative?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Casella Waste Systems Narrative

If you want to dig into the numbers yourself or challenge this view, you can build a tailored narrative in just a few minutes: Do it your way.

A great starting point for your Casella Waste Systems research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Casella might be compelling, but you may want to quickly scan focused shortlists of other opportunities that match very different strategies.

- Target potential income by reviewing these 10 dividend stocks with yields > 3% that could help diversify your portfolio with regular cash distributions.

- Explore long term innovation by assessing these 29 healthcare AI stocks in medical diagnostics and treatment.

- Review high growth potential by analyzing these 80 cryptocurrency and blockchain stocks at the intersection of digital assets, payments, and blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal