A Look at Loar Holdings’ Valuation as New Buy Ratings Follow a Strong Third Quarter

Loar Holdings (LOAR) just got a fresh vote of confidence, as Citi and other firms started weighing in after a strong third quarter. The results highlighted how demand in its core aerospace and defense niches is holding up.

See our latest analysis for Loar Holdings.

Even with the latest analyst enthusiasm and a solid third quarter, Loar Holdings’ 1 year total shareholder return of negative 8.94 percent and year to date share price return of negative 7.25 percent at a 68.62 dollar share price suggest momentum is still rebuilding rather than in full swing.

If you want to see how other names in the same space are trading, this is a good moment to explore aerospace and defense stocks as potential alternatives or complements to Loar.

With revenue and earnings still growing solidly and Wall Street targets sitting well above today’s share price, investors now face the key question: is Loar quietly undervalued, or is the market already pricing in its next leg of growth?

Most Popular Narrative Narrative: 26.4% Undervalued

With the most followed narrative putting fair value near 93.30 dollars versus a 68.62 dollar close, the implied upside depends on some punchy earnings assumptions.

Ongoing productivity initiatives, adoption of advanced value based pricing, and continuous improvement in manufacturing processes including the integration of advanced digital technologies are facilitating annual margin expansion, a trend that should enhance both operating leverage and net margins as topline scales.

Curious what kind of revenue trajectory and margin jump are embedded in this story? And which lofty profit multiple keeps that fair value in reach? The full narrative joins these moving parts into one aggressive earnings arc.

Result: Fair Value of $93.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, integration stumbles on niche acquisitions, or a sharper than expected slowdown in key platforms like the A320 and 737, could quickly challenge that bullish setup.

Find out about the key risks to this Loar Holdings narrative.

Another Angle on Valuation

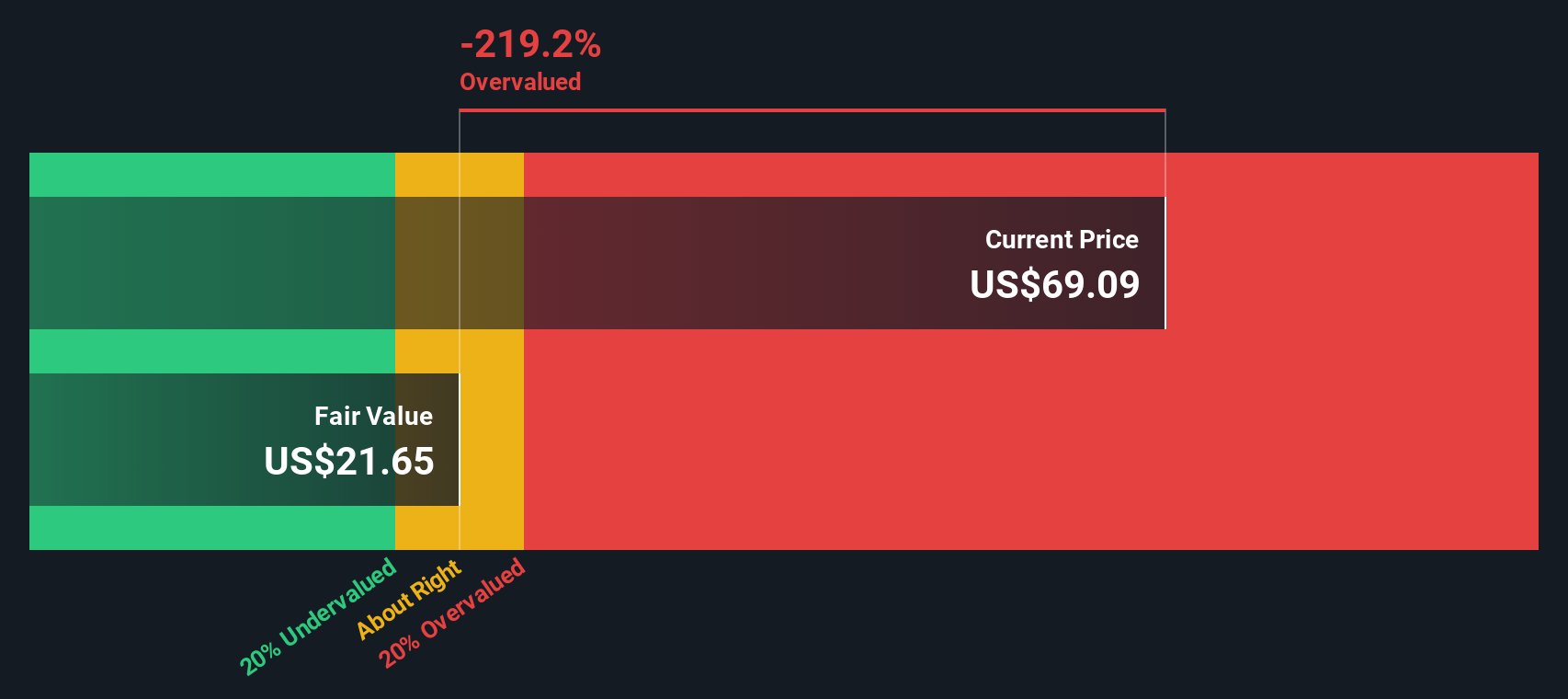

While the narrative based fair value paints Loar as 26.4 percent undervalued, our DCF model is far more conservative and puts fair value closer to 29.12 dollars. This makes the current 68.62 dollar price look rich. Which story do you think is closer to reality?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Loar Holdings Narrative

If you lean toward your own view of the numbers and want to test it against the market, you can build a custom narrative in just a few minutes, Do it your way.

A great starting point for your Loar Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Put your research edge to work now by scanning fresh opportunities on Simply Wall Street’s Screener so you do not miss the next standout setup.

- Target steady income by reviewing these 10 dividend stocks with yields > 3% that can potentially strengthen your portfolio’s cash flow while rates and market sentiment shift around you.

- Capture high potential growth stories early by focusing on these 24 AI penny stocks positioned at the intersection of innovation, productivity gains, and accelerating enterprise adoption.

- Position yourself for a valuation rebound by filtering through these 902 undervalued stocks based on cash flows that the market may be overlooking despite solid underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal