EastGroup Properties (EGP): Rethinking Valuation After a Year of Solid Share Price Gains

EastGroup Properties (EGP) has quietly outperformed many real estate peers, with the stock up roughly 10% in the past 3 months and about 15% over the past year, drawing fresh investor interest.

See our latest analysis for EastGroup Properties.

That steady backdrop of industrial demand has helped the stock build momentum, with the share price return over the past year backed up by a solid multi year total shareholder return that suggests investors still see room for growth.

If EastGroup’s rise has you rethinking your playbook, it could be a smart moment to explore fast growing stocks with high insider ownership as potential next wave opportunities.

With revenue and earnings still growing at a healthy clip, and the share price hovering below analyst targets, the big question now is whether EastGroup remains undervalued or if the market has already priced in its future growth.

Most Popular Narrative: 7.5% Undervalued

With EastGroup closing at $181.36 against a narrative fair value of $196, the valuation case leans positive and hinges on a few powerful growth assumptions.

EastGroup's strategic expansion in high barrier, technology driven Sunbelt metros (like Raleigh, Nashville, and Austin) is leveraging long term regional economic tailwinds, increasing portfolio quality and diversification, and supporting long term asset appreciation and NAV growth. Management's strong balance sheet, ample land bank, and ability to accelerate development starts when demand rebounds ensures the company can capitalize early on secular demand trends, translating to scalable FFO growth and further upside in earnings as market sentiment normalizes.

Want to see what kind of revenue climb, margin lift, and future earnings multiple are baked into that fair value math? The underlying projections are bold, finely tuned, and surprisingly aggressive for an industrial REIT, but you will need to dig into the full narrative to see exactly how those moving parts fit together.

Result: Fair Value of $196 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside case could unravel if industrial demand normalizes faster than expected, or if higher-for-longer rates choke off new development and capital access.

Find out about the key risks to this EastGroup Properties narrative.

Another View: Rich On Earnings Multiples

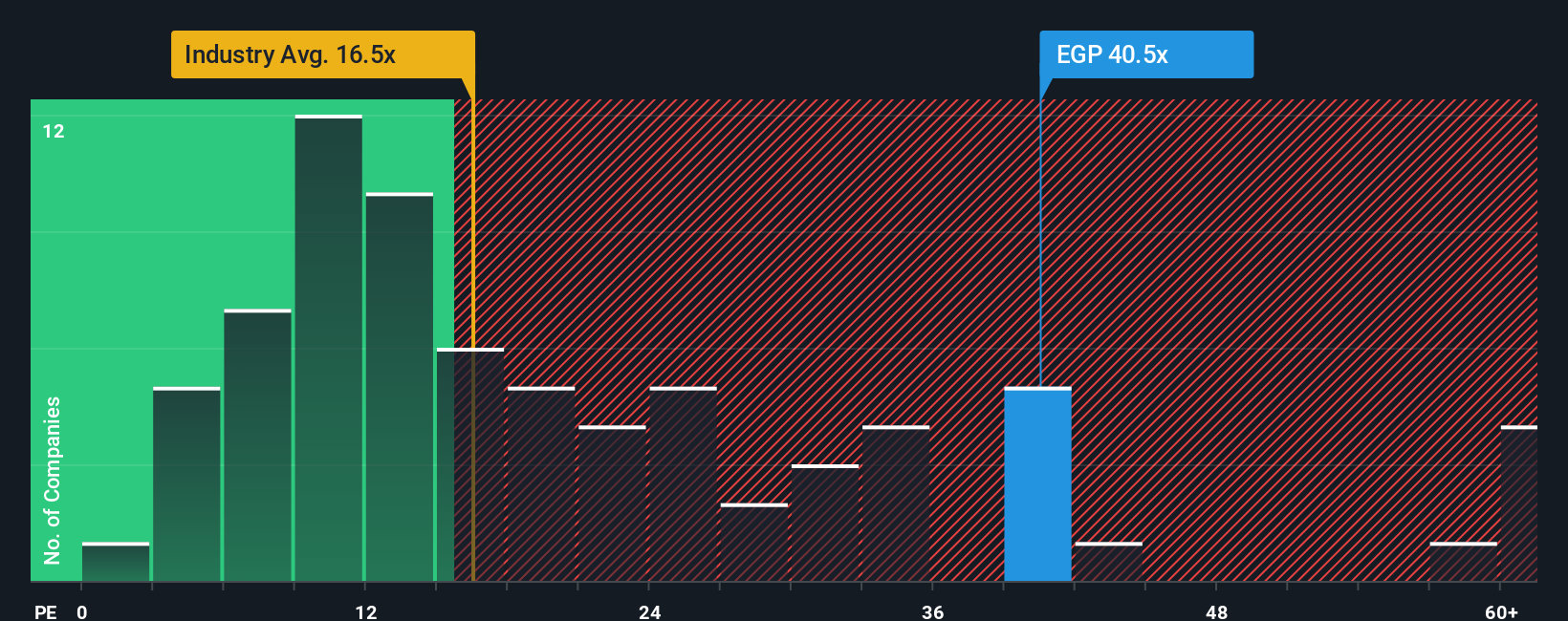

While our narrative fair value suggests EastGroup is 14.6% undervalued, its 38.9x earnings multiple tells a tougher story, trading well above the US Industrial REITs average of 27.3x and a fair ratio of 33.5x. Is the market already paying up for perfection?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own EastGroup Properties Narrative

If this outlook does not quite match your own thinking, or you simply prefer to dive into the numbers yourself, you can build a complete narrative in just a few minutes: Do it your way.

A great starting point for your EastGroup Properties research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Instead of waiting for the next headline, take control now and use the Simply Wall St Screener to uncover fresh, data driven opportunities you do not want to miss.

- Capitalize on mispriced opportunities by targeting companies flagged as undervalued through these 902 undervalued stocks based on cash flows, before the market fully wakes up to their potential.

- Ride powerful technology tailwinds by focusing on innovators at the intersection of medicine and machine learning with these 29 healthcare AI stocks built to capture structural growth.

- Position yourself for the next wave of digital disruption by zeroing in on future facing businesses advancing blockchain and digital assets via these 80 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal