Synchrony Financial (SYF): Assessing Valuation After Partnership Expansions and Strengthening Credit Performance

Synchrony Financial (SYF) has been quietly stacking catalysts, from extending its CareCredit partnership with the American Med Spa Association to renewing deals like Mitsubishi Electric Trane and rolling out products with Walmart and Amazon.

See our latest analysis for Synchrony Financial.

That steady stream of partnership wins seems to be showing up in the numbers, with a roughly 15% 1 month share price return and a powerful multi year total shareholder return suggesting momentum is still building rather than fading.

If Synchrony’s run has caught your attention, this could be a good moment to broaden your watchlist and explore fast growing stocks with high insider ownership.

But with the stock hovering near analyst targets after a sharp rerating and intrinsic value estimates implying upside, is Synchrony still trading below its true worth, or are markets already baking in years of growth ahead?

Most Popular Narrative Narrative: 0.6% Overvalued

With the narrative fair value sitting just below Synchrony Financial’s last close near $86, the story hinges on how durable its growth engine really is.

The company's proactive investment in advanced data analytics, AI, and end to end digital platforms including deeper digital integration of new cards with PayPal and Walmart enhances risk management and operational efficiency, thereby supporting improved net interest margins and lower charge offs as these technologies mature.

Want to see exactly how much revenue acceleration, margin compression, and future earnings power this narrative is baking in? The cash flow math might surprise you.

Result: Fair Value of $85.57 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated payment rates, cautious consumers, and heavy tech spending requirements could quickly undermine growth assumptions if credit or demand weakens from here.

Find out about the key risks to this Synchrony Financial narrative.

Another Angle On Valuation

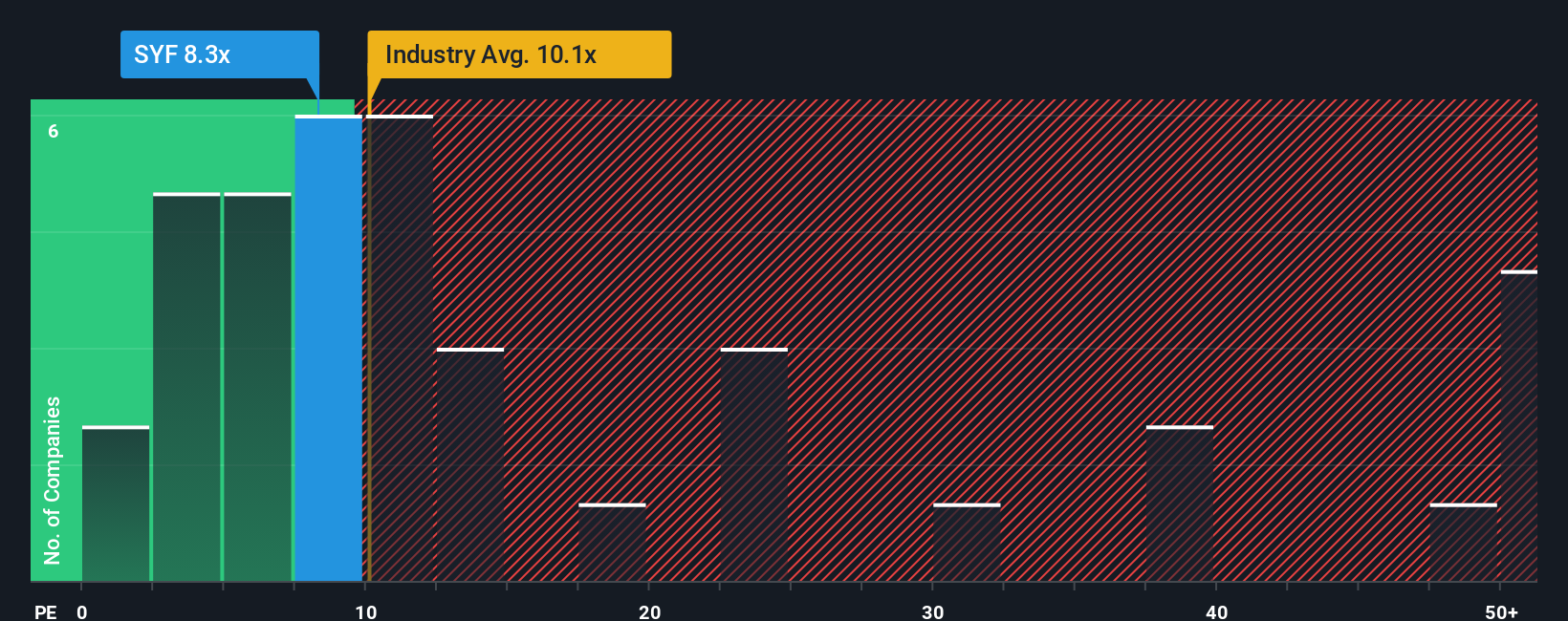

Analysts see Synchrony as roughly fairly priced to slightly overvalued, but the SWS fair ratio tells a different story. At 8.9x earnings versus an industry 10x and a 15.1x fair ratio, the gap hints at meaningful upside if sentiment shifts. Which signal would you trust?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Synchrony Financial Narrative

If you see the story differently or want to dive into the numbers yourself, you can build a custom view in just a few minutes: Do it your way.

A great starting point for your Synchrony Financial research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for your next smart move?

Do not stop at one opportunity. Use the Simply Wall St Screener to uncover fresh ideas that match your strategy before the market fully wakes up.

- Capture early stage potential by reviewing these 3629 penny stocks with strong financials that pair tiny market caps with surprisingly robust balance sheets and growing revenues.

- Target structural tailwinds by scanning these 29 healthcare AI stocks harnessing data driven treatments and automation across hospitals, diagnostics, and medical devices.

- Lock in income focused opportunities through these 10 dividend stocks with yields > 3% offering yields above 3 percent without sacrificing fundamental quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal