Reassessing Floor & Decor Holdings (FND) Valuation After Sector Index Removal and Earnings Slowdown

Floor & Decor Holdings (FND) was just removed from the S&P Homebuilders Select Industry Index, a shift that may push some passive money away and sharpen focus on the company’s underlying slowdown.

See our latest analysis for Floor & Decor Holdings.

That backdrop helps explain why, even with a 7 day share price return of 4.44 percent and a 30 day share price return of 4.19 percent, the 1 year total shareholder return sits at a steep negative 38.23 percent. This signals that momentum has been fading rather than building.

If this kind of reset has you rethinking where growth could come from next, it might be worth scanning fast growing stocks with high insider ownership as a way to spot the next potential winners.

So with shares still well below their highs despite ongoing revenue growth and a sizable gap to analyst targets, is Floor & Decor now a misunderstood value story, or is the market correctly pricing in a slower growth runway?

Most Popular Narrative: 19.2% Undervalued

With Floor & Decor last closing at $63.21 versus a narrative fair value near the high 70s, the story leans toward a recovery thesis built on improving demand and operating leverage.

The analysts have a consensus price target of $83.864 for Floor & Decor Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $100.0, and the most bearish reporting a price target of just $60.0.

Curious how mid single digit margins, high growth expectations and a premium earnings multiple can still justify upside from here? The narrative unpacks bold assumptions about revenue momentum, profitability gains and what multiple investors might accept several years from now. Want to see the exact profit path and valuation bridge that leads to that target price? Dive in to decode the full playbook behind this fair value call.

Result: Fair Value of $78.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weak housing turnover and slower ramping new stores could delay the anticipated sales recovery and pressure margins more than the current narrative assumes.

Find out about the key risks to this Floor & Decor Holdings narrative.

Another Lens On Valuation

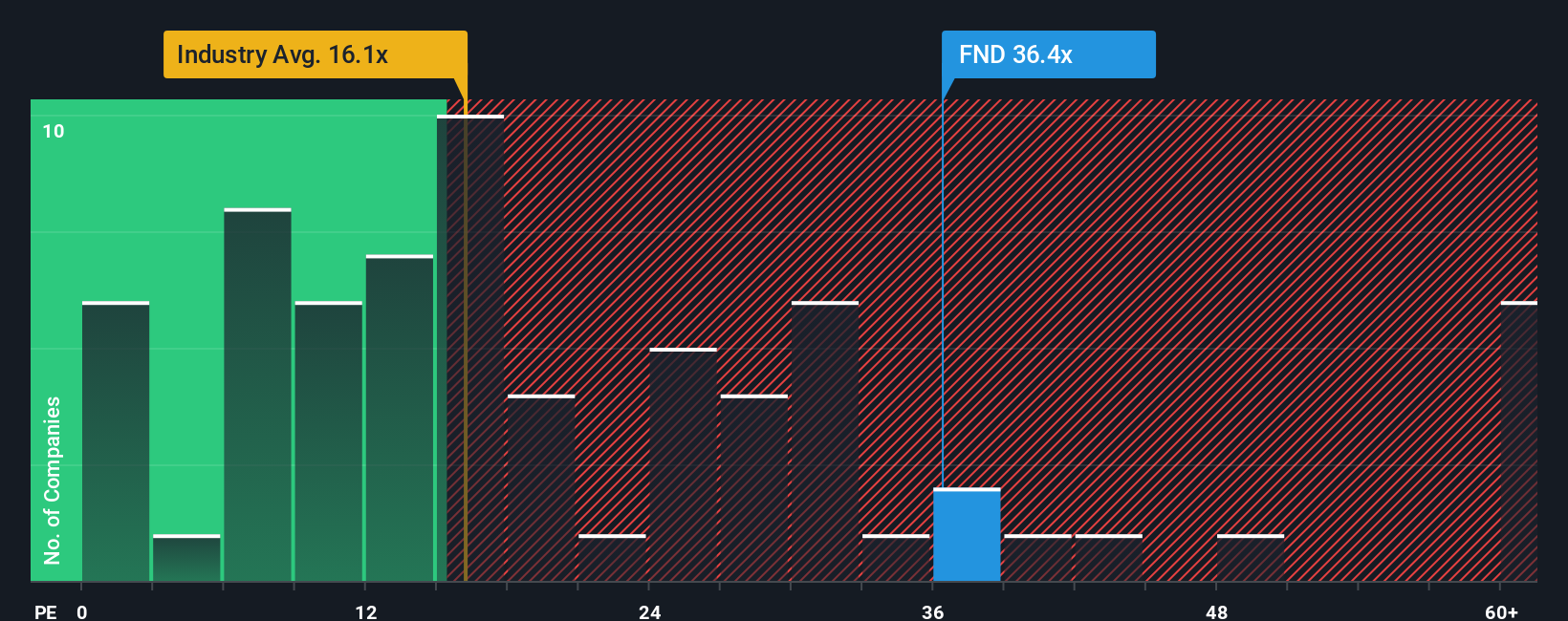

Analysts see roughly 19 percent upside to $78.27, yet on earnings the stock already looks stretched. Floor & Decor trades on about 31.4 times earnings versus 19.9 times for the US Specialty Retail group and a fair ratio near 17.4 times, suggesting limited margin for error if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Floor & Decor Holdings Narrative

If this framework does not quite match your view, or you prefer digging into the numbers yourself, you can shape a custom narrative in under three minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Floor & Decor Holdings.

Looking for more investment ideas?

Before you move on, consider your next smart move by using the Simply Wall Street Screener to uncover focused opportunities that many investors are still overlooking.

- Capitalize on mispriced potential by reviewing these 902 undervalued stocks based on cash flows that may offer different characteristics than today’s well known names.

- Explore the next wave of innovation by targeting these 24 AI penny stocks positioned to benefit from rapid advances in machine learning and automation.

- Strengthen your income stream by zeroing in on these 10 dividend stocks with yields > 3% that can support a long term, compounding approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal