3 Stocks Estimated To Be Trading At Discounts Of 21.2% To 35.3% Below Intrinsic Value

As the U.S. stock market continues to reach new heights with the Dow Jones and S&P 500 setting all-time records, investors are keenly observing opportunities amid this bullish trend. In such a thriving environment, identifying stocks that are trading below their intrinsic value can offer potential for growth and diversification within a portfolio.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zymeworks (ZYME) | $26.86 | $52.58 | 48.9% |

| UMB Financial (UMBF) | $118.90 | $233.12 | 49% |

| Sportradar Group (SRAD) | $23.11 | $45.55 | 49.3% |

| SmartStop Self Storage REIT (SMA) | $31.57 | $61.46 | 48.6% |

| Perfect (PERF) | $1.75 | $3.42 | 48.9% |

| Nicolet Bankshares (NIC) | $124.56 | $242.21 | 48.6% |

| Community West Bancshares (CWBC) | $22.74 | $44.11 | 48.4% |

| Columbia Banking System (COLB) | $28.62 | $56.93 | 49.7% |

| Clearfield (CLFD) | $29.43 | $58.37 | 49.6% |

| BioLife Solutions (BLFS) | $25.41 | $49.94 | 49.1% |

We'll examine a selection from our screener results.

Carrier Global (CARR)

Overview: Carrier Global Corporation offers intelligent climate and energy solutions across various regions, including the United States, Europe, and the Asia Pacific, with a market cap of approximately $45.06 billion.

Operations: Carrier Global's revenue is derived from its intelligent climate and energy solutions provided across the United States, Europe, the Asia Pacific, and other international markets.

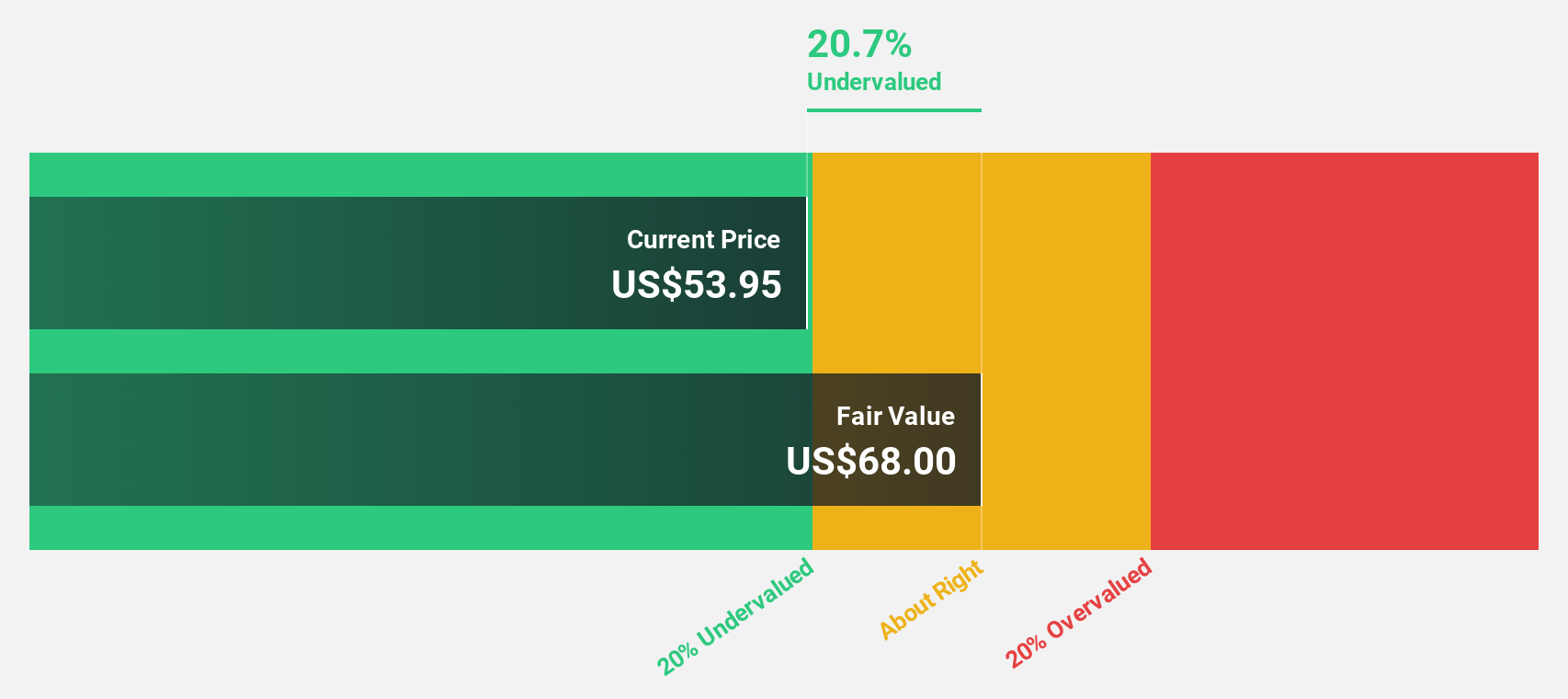

Estimated Discount To Fair Value: 21.2%

Carrier Global is trading at US$53.5, approximately 21% below its estimated fair value of US$67.88, suggesting it might be undervalued based on cash flow analysis. Despite a slower revenue growth forecast of 3.7% annually compared to the market's 10.7%, earnings are expected to grow significantly at 21.9% per year, outpacing the broader US market's growth rate of 16.2%. However, debt coverage by operating cash flow remains a concern for potential investors.

- Insights from our recent growth report point to a promising forecast for Carrier Global's business outlook.

- Click to explore a detailed breakdown of our findings in Carrier Global's balance sheet health report.

Comfort Systems USA (FIX)

Overview: Comfort Systems USA, Inc. offers mechanical and electrical installation, renovation, maintenance, repair, and replacement services across the United States with a market cap of $33.72 billion.

Operations: The company's revenue is comprised of $2.02 billion from electrical services and $6.30 billion from mechanical services.

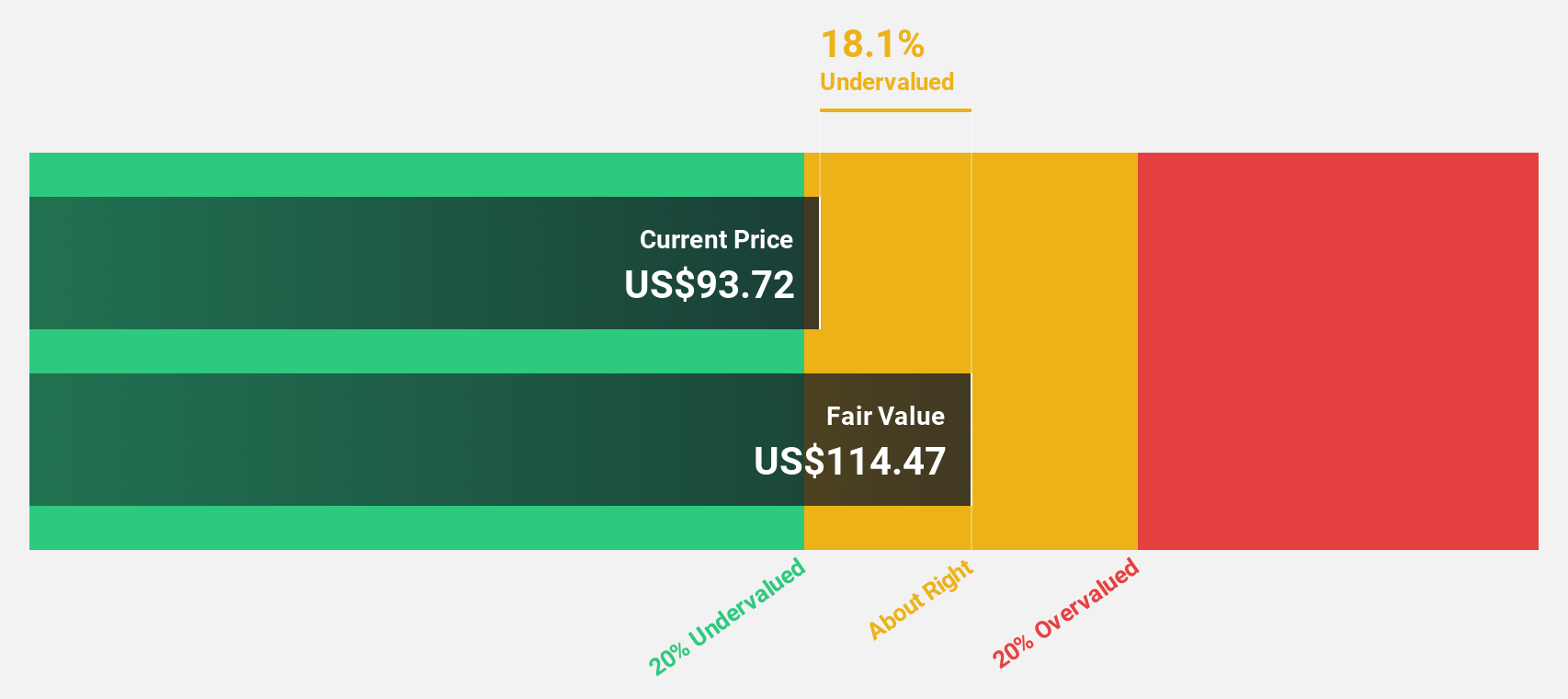

Estimated Discount To Fair Value: 35.3%

Comfort Systems USA, trading at US$958.07, is considered undervalued with a fair value estimate of US$1,481.69. The company has been added to the S&P 500 and other indices, enhancing its market visibility despite recent index removals. Earnings grew by 78.9% last year and are forecast to continue growing at 18.7% annually, surpassing the broader market's growth rate of 16.2%. However, significant insider selling may raise caution among investors.

- Upon reviewing our latest growth report, Comfort Systems USA's projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of Comfort Systems USA.

Modine Manufacturing (MOD)

Overview: Modine Manufacturing Company designs, engineers, tests, manufactures, and sells mission-critical thermal solutions globally, with a market cap of $7.24 billion.

Operations: Modine's revenue is primarily derived from its Climate Solutions segment, which generated $1.57 billion, and its Performance Technologies segment, contributing $1.13 billion.

Estimated Discount To Fair Value: 34.7%

Modine Manufacturing, trading at US$137.59, is significantly undervalued with a fair value estimate of US$210.69. The company's earnings are projected to grow substantially at 33.9% annually over the next three years, outpacing the broader U.S. market growth rate of 16.2%. Despite carrying a high level of debt, Modine's recent expansion in data center cooling capacity and raised sales guidance underscore its commitment to capitalizing on digital infrastructure growth opportunities in the U.S.

- Our growth report here indicates Modine Manufacturing may be poised for an improving outlook.

- Dive into the specifics of Modine Manufacturing here with our thorough financial health report.

Where To Now?

- Navigate through the entire inventory of 208 Undervalued US Stocks Based On Cash Flows here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal