Kinetic Development Group (SEHK:1277) Valuation Revisited After Scrutinized Related Party Loans and Property Deals

Kinetic Development Group (SEHK:1277) is back in focus after a fresh batch of related party moves, including extending loans to Guizhou Liliang and aggregating property acquisitions tied to its major shareholder, drawing closer regulatory and investor attention.

See our latest analysis for Kinetic Development Group.

These governance heavy moves are landing against a choppy backdrop, with the share price now at HK$1.32 after a weak 1 month share price return. However, the still impressive multi year total shareholder return suggests long term momentum is intact rather than fading.

If this kind of corporate reshuffling has you reassessing your options, it might be a good moment to broaden your search and explore fast growing stocks with high insider ownership.

With governance questions swirling around connected deals but a headline intrinsic discount suggesting upside, the real puzzle is whether Kinetic Development is genuinely undervalued or whether the market is already pricing in its future growth.

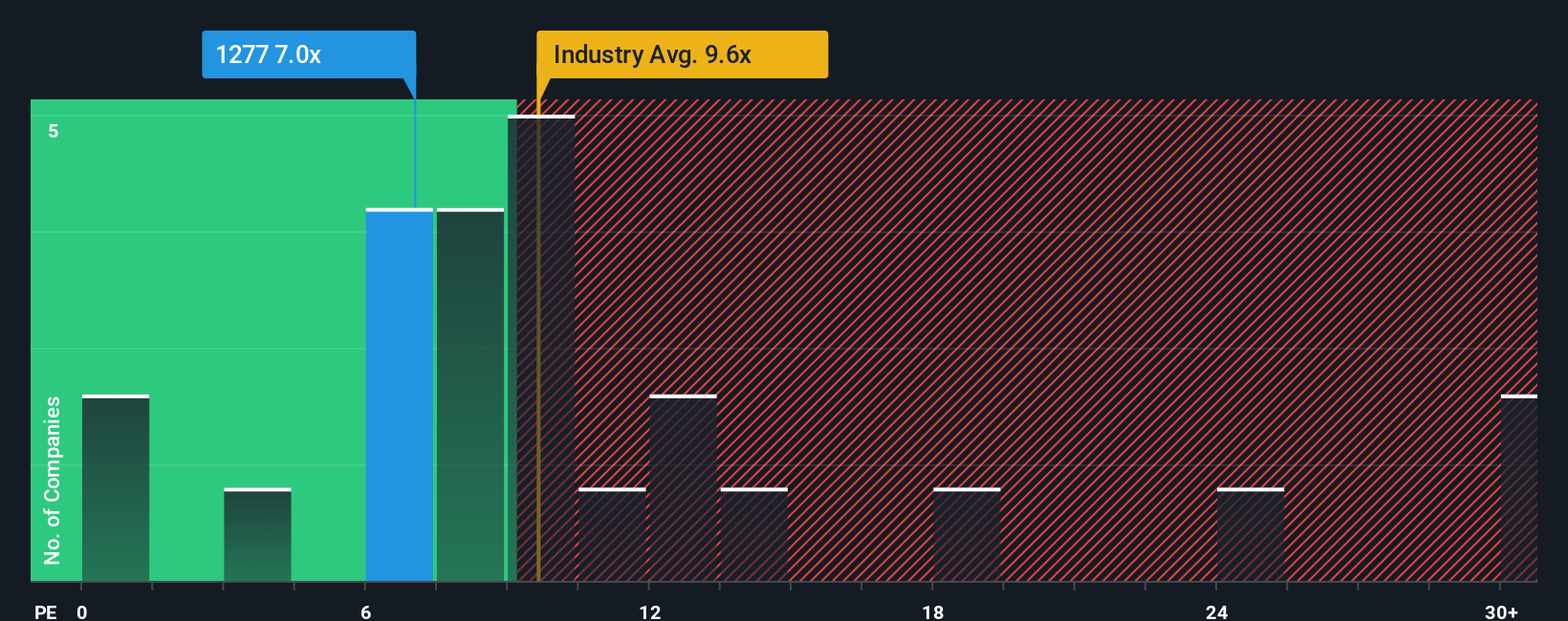

Price-to-Earnings of 6.4x: Is it justified?

Kinetic Development Group appears undervalued on our SWS DCF model, with a fair value of HK$6.42 versus the last close at HK$1.32.

Our DCF model estimates the present value of the company by projecting future cash flows and discounting them back to today using an appropriate required return. This approach focuses on the cash the business can generate over time rather than short term market swings.

For Kinetic Development, that framework is particularly important, as it operates a single key coal asset and related operations where earnings can be volatile year to year. Despite recent profit margin compression and a weak year of earnings, the longer term record of profit growth and high quality earnings supports a materially higher intrinsic value than the current share price implies.

Look into how the SWS DCF model arrives at its fair value.

Result: DCF fair value of $6.42 (UNDERVALUED)

However, ongoing related party transactions and earnings volatility from a single core coal asset could quickly erode any perceived valuation discount.

Find out about the key risks to this Kinetic Development Group narrative.

Another View: Earnings Multiple Signals Cheaper Pricing

While our SWS DCF model points to a big upside, the earnings multiple also hints at value. Kinetic trades at 6.4 times earnings, well below the Hong Kong Oil and Gas average of 9.3 times and a peer average of 25.5 times. This raises the question of whether the discount reflects risk or mispricing.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kinetic Development Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 902 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kinetic Development Group Narrative

If this take does not quite align with your own view, dive into the numbers yourself and build a tailored narrative in minutes: Do it your way.

A great starting point for your Kinetic Development Group research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, you can explore your next potential opportunity by running fresh screens on Simply Wall St and identifying strong candidates for your watchlist.

- Search for potential mispricing by scanning these 902 undervalued stocks based on cash flows that the market has not fully recognized yet.

- Explore major structural themes by checking out these 24 AI penny stocks related to developments in artificial intelligence.

- Review these 10 dividend stocks with yields > 3% that target dividend yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal