Iridium Communications (IRDM): Valuation Check After S&P 600 Index Inclusion Drives Fresh Buying Interest

Iridium Communications (IRDM) just caught a lift after being added to the S&P 600, a technical shift that sparked fresh buying from index-tracking funds and pushed the stock meaningfully higher.

See our latest analysis for Iridium Communications.

That index bump arrives after a tough stretch, with the share price sitting at $17.40 and a year-to-date share price return of minus 41.16%. The one-year total shareholder return of minus 37.92% shows longer term holders are still deep in the red, even as short term momentum has perked up with a 7-day share price return of 4.88% and a 30-day share price return of 6.62%. This suggests sentiment is stabilising rather than surging.

If Iridium’s move on index news has you wondering what else might be setting up for a turn, this is a good moment to explore fast growing stocks with high insider ownership.

With shares still down sharply over one and three years but trading at roughly a 30% discount to analyst targets, is Iridium an undervalued turnaround story, or is the market already pricing in all the future growth?

Most Popular Narrative: 41.5% Undervalued

With Iridium Communications last closing at $17.40 against a narrative fair value of $29.75, the story points to meaningful upside if assumptions hold.

The company's fully deployed next-gen constellation and declining capex profile are freeing up significant cash flow for buybacks and steady dividend increases, directly boosting per-share earnings potential and making Iridium's free cash flow yield structurally attractive.

Want to see what is powering this gap between price and narrative value? The core story leans heavily on rising margins, steady growth, and a richer future earnings multiple. Curious which specific profit, revenue, and valuation assumptions have to land perfectly for that upside to materialise? Read on to unpack the full blueprint behind this fair value call.

Result: Fair Value of $29.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, several narrative risks linger, including slower IoT adoption and intensifying spectrum competition, which could limit revenue growth and pressure margins if they worsen.

Find out about the key risks to this Iridium Communications narrative.

Another Angle on Value

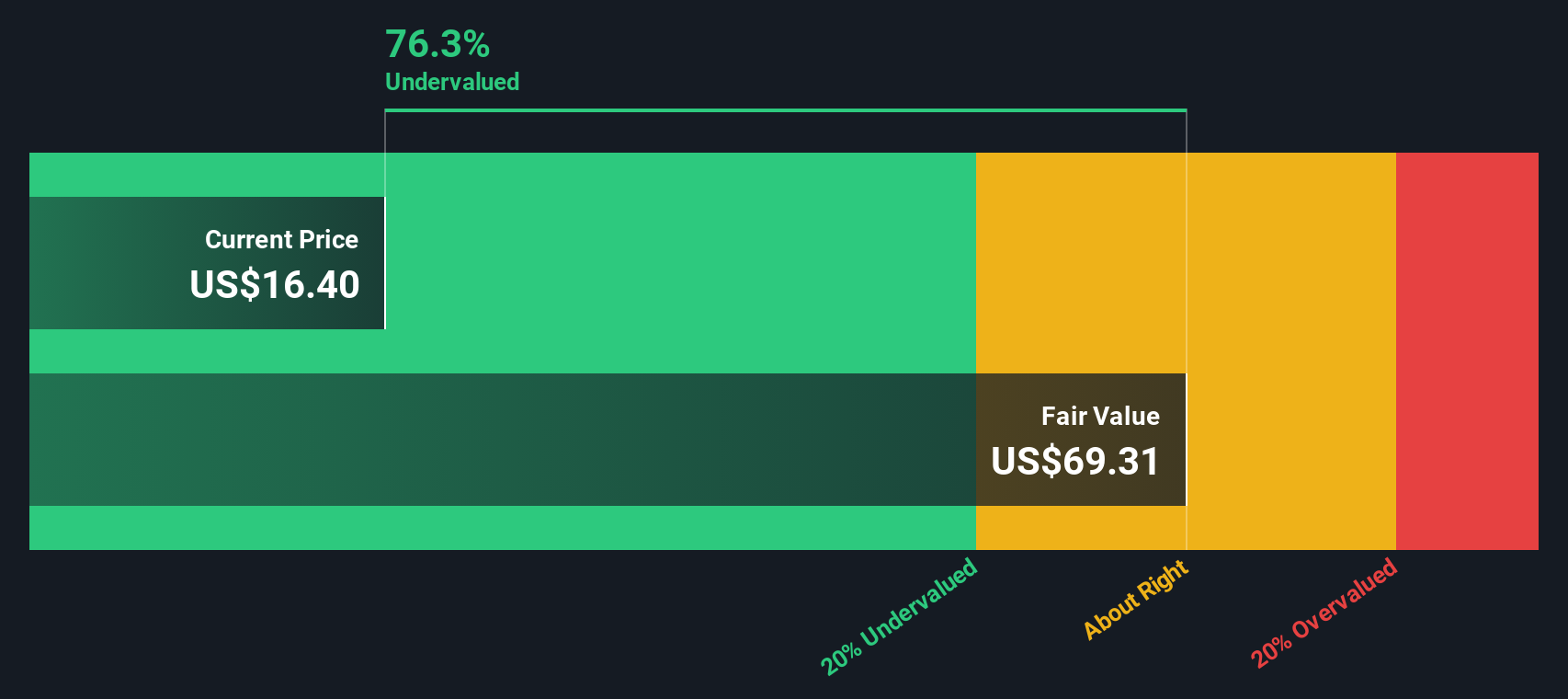

Our SWS DCF model paints an even more optimistic picture than the narrative fair value, suggesting Iridium is trading at a deep discount to its long term cash flow potential. If both the DCF and narrative are right, is the risk now more about execution than price?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Iridium Communications Narrative

If you are not fully convinced by this view, or would rather interrogate the numbers yourself, you can build a custom take in minutes: Do it your way.

A great starting point for your Iridium Communications research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunity by scanning pre-built stock ideas on Simply Wall Street, so you are not relying on Iridium alone.

- Capture potential mispricings by targeting companies trading below intrinsic value through these 902 undervalued stocks based on cash flows, and position yourself ahead of a sentiment shift.

- Evaluate opportunities in machine learning and automation with these 24 AI penny stocks, focusing on businesses turning AI innovation into real, recurring revenue.

- Strengthen your portfolio income stream by reviewing these 10 dividend stocks with yields > 3%, spotlighting companies combining current yields with payout profiles that appear sustainable.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal