Baytex Energy (TSX:BTE) Valuation After Eagle Ford Sale, 2026 Capital Plan, and Leadership Changes

Baytex Energy (TSX:BTE) just wrapped up the sale of its U.S. Eagle Ford assets and laid out a 2026 capital plan, redirecting cash toward debt reduction, Canadian growth projects, and stepped up shareholder returns.

See our latest analysis for Baytex Energy.

Those moves, along with the 2026 growth plan and new leadership, help explain why Baytex’s 90 day share price return of 26.45 percent and 1 year total shareholder return of 28.56 percent point to momentum rebuilding from a still depressed three year total shareholder return.

If this kind of repositioning has you thinking more broadly about opportunities in energy and beyond, it could be worth exploring fast growing stocks with high insider ownership as a way to surface other compelling candidates.

With analysts calling Baytex a value play and the stock still trading below target and intrinsic estimates, is the market overlooking its reshaped balance sheet and Canadian growth runway, or is it already baking in the next leg of upside?

Most Popular Narrative Narrative: 13.6% Undervalued

With the narrative placing Baytex’s fair value above its CA$4.35 last close, the implied upside leans on some striking long range assumptions.

The analysts have a consensus price target of CA$3.95 for Baytex Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$5.0, and the most bearish reporting a price target of just CA$2.5.

Want to see what kind of shrinking margins, falling earnings, and bold future multiples still add up to upside in this story? The full narrative spells it out.

Result: Fair Value of $5.03 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained oil price weakness or tougher tariffs on Canadian exports could quickly erode free cash flow assumptions and challenge today’s undervaluation thesis.

Find out about the key risks to this Baytex Energy narrative.

Another Take On Value

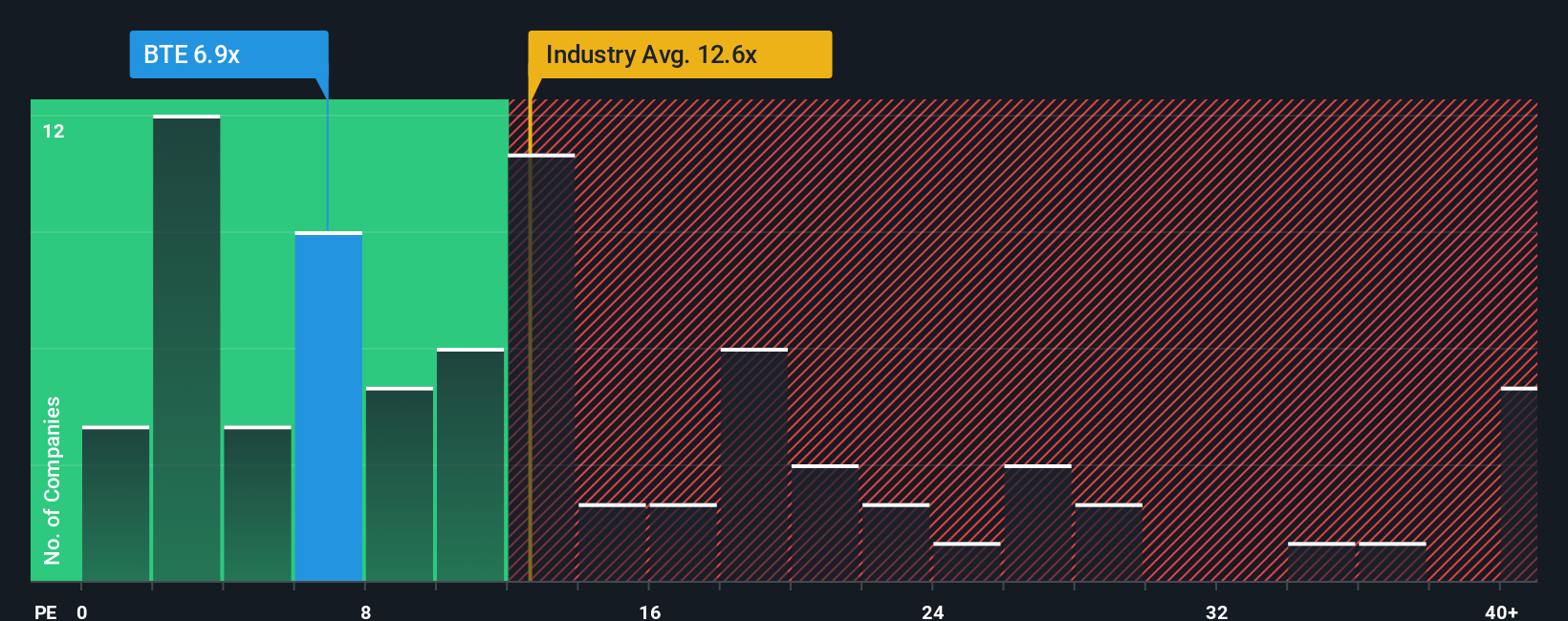

On earnings, Baytex looks pricey, trading on a 15.6x price to earnings ratio versus a 5.6x fair ratio and 14.1x for the wider Canadian oil and gas group. That richer multiple suggests less margin for error if forecasts of falling revenue and profits play out, or it may indicate that the market is already betting on a more resilient earnings path than the consensus.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Baytex Energy Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A great starting point for your Baytex Energy research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Put your research momentum to work now, or risk missing out on other mispriced opportunities quietly emerging across sectors, themes, and overlooked corners of the market.

- Target reliable income first by reviewing these 10 dividend stocks with yields > 3% that can help anchor your portfolio with steadier cash returns.

- Capitalize on powerful growth themes by scanning these 24 AI penny stocks riding structural demand for intelligent automation and data driven decision making.

- Act on potential mispricings by focusing on these 902 undervalued stocks based on cash flows where market pessimism may have gone too far.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal