European Penny Stocks To Watch In December 2025

As European markets continue to show signs of steady economic growth, with the STOXX Europe 600 Index rising by 1.60%, investors are exploring diverse opportunities across the continent. Penny stocks, often representing smaller or newer companies, remain a compelling area for those seeking affordability and potential growth. Despite their historical connotations, these stocks can still offer significant value when they exhibit strong financials and promising business models.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.518 | €1.56B | ✅ 4 ⚠️ 3 View Analysis > |

| Orthex Oyj (HLSE:ORTHEX) | €4.75 | €84.35M | ✅ 4 ⚠️ 1 View Analysis > |

| Mistral Iberia Real Estate SOCIMI (BME:YMIB) | €1.05 | €22.87M | ✅ 2 ⚠️ 4 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €221.21M | ✅ 3 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.10 | €65.75M | ✅ 3 ⚠️ 3 View Analysis > |

| Hultstrom Group (OM:HULT B) | SEK3.00 | SEK182.52M | ✅ 2 ⚠️ 2 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.37 | €386.24M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.265 | €313.07M | ✅ 3 ⚠️ 1 View Analysis > |

| Dovre Group (HLSE:DOV1V) | €0.0718 | €7.72M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 296 stocks from our European Penny Stocks screener.

Let's uncover some gems from our specialized screener.

High (ENXTPA:HCO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: High Co. SA offers consumer engagement chain solutions in France, Belgium, and Spain with a market cap of €76.64 million.

Operations: The company's revenue segment consists of €143.31 million from Advertising.

Market Cap: €76.64M

High Co. SA, with a market cap of €76.64 million, offers consumer engagement chain solutions and generates €143.31 million from advertising revenue across France, Belgium, and Spain. The company's financial health is supported by more cash than total debt and strong coverage of interest payments by EBIT (29.1x). However, it faces challenges with declining earnings growth (-41.5% over the past year) and lower current profit margins (4%) compared to last year (8.3%). Despite trading at 75.4% below estimated fair value, its unstable dividend track record may concern potential investors in penny stocks.

- Unlock comprehensive insights into our analysis of High stock in this financial health report.

- Evaluate High's prospects by accessing our earnings growth report.

Hub.Tech (WSE:HUB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hub.Tech SA operates in the chemical industry in Poland and has a market capitalization of PLN162.87 million.

Operations: The company generates revenue primarily from its Specialty Chemicals segment, amounting to PLN213.35 million.

Market Cap: PLN162.87M

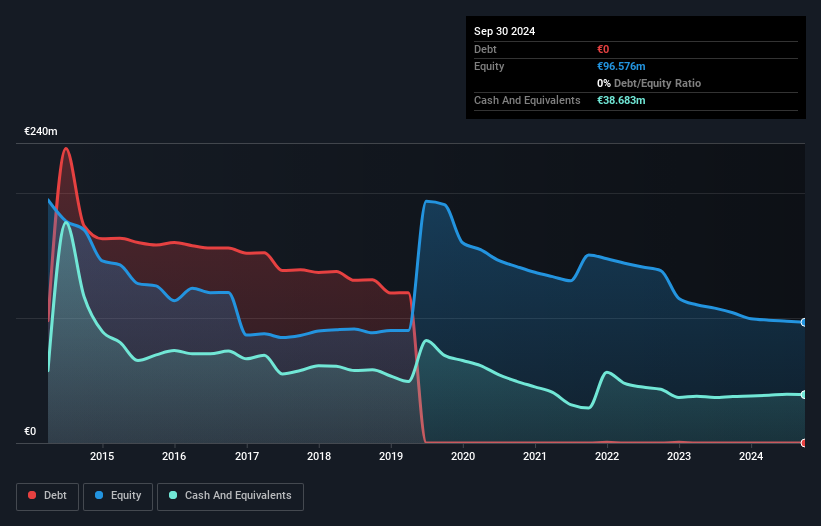

Hub.Tech SA, with a market cap of PLN162.87 million, operates in Poland's chemical industry and primarily generates revenue from its Specialty Chemicals segment, totaling PLN213.35 million. Despite no debt burden and stable short-term financial health, the company's recent earnings report showed a decline in net income to PLN4.31 million for Q3 2025 from PLN9.1 million the previous year, alongside slightly reduced revenue figures. While HUB's earnings have grown significantly over five years and shareholders haven't faced dilution recently, negative earnings growth this past year presents challenges amidst low return on equity and declining profit margins.

- Click to explore a detailed breakdown of our findings in Hub.Tech's financial health report.

- Gain insights into Hub.Tech's historical outcomes by reviewing our past performance report.

q.beyond (XTRA:QBY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: q.beyond AG operates in the cloud, applications, artificial intelligence (AI), and security sectors both in Germany and internationally, with a market cap of €87.21 million.

Operations: The company's revenue is derived from two main segments: Consulting, which generated €60.67 million, and Managed Services, contributing €124.94 million.

Market Cap: €87.21M

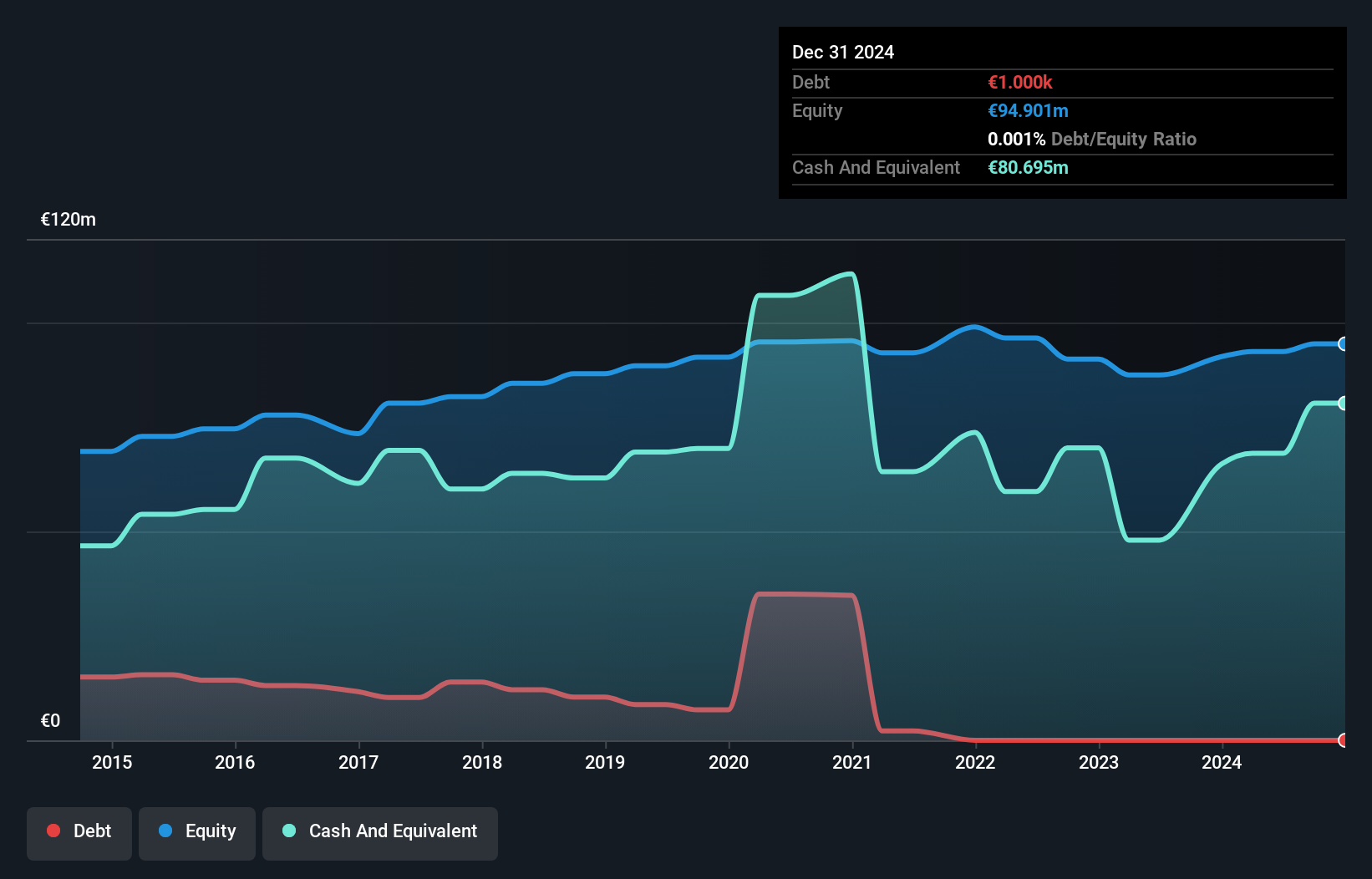

q.beyond AG, with a market cap of €87.21 million, operates in the cloud and AI sectors, reporting Q3 2025 sales of €43.63 million. Despite being unprofitable, it has reduced losses over five years by 10.4% annually and maintains a stable financial position with short-term assets exceeding liabilities significantly. The company is debt-free and possesses a cash runway exceeding three years due to positive free cash flow growth of 54.3% per year. While trading below estimated fair value and analyst targets suggest potential upside, recent guidance revised expected revenues to the lower end due to weak German growth.

- Dive into the specifics of q.beyond here with our thorough balance sheet health report.

- Assess q.beyond's future earnings estimates with our detailed growth reports.

Summing It All Up

- Reveal the 296 hidden gems among our European Penny Stocks screener with a single click here.

- Ready For A Different Approach? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal