Undiscovered Gems in Europe for December 2025

As European markets show signs of steady economic growth, buoyed by looser monetary policies and a rise in major stock indexes like the STOXX Europe 600, investors are increasingly looking for opportunities in lesser-known stocks that may offer unique potential. In this environment, identifying a good stock often involves seeking companies with strong fundamentals and innovative offerings that can thrive amid shifting economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| FRoSTA | 5.37% | 4.80% | 13.56% | ★★★★★★ |

| Dekpol | 61.42% | 9.03% | 14.54% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Mangold Fondkommission | NA | -6.00% | -42.55% | ★★★★★☆ |

| VNV Global | 15.38% | -18.33% | -18.19% | ★★★★★☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

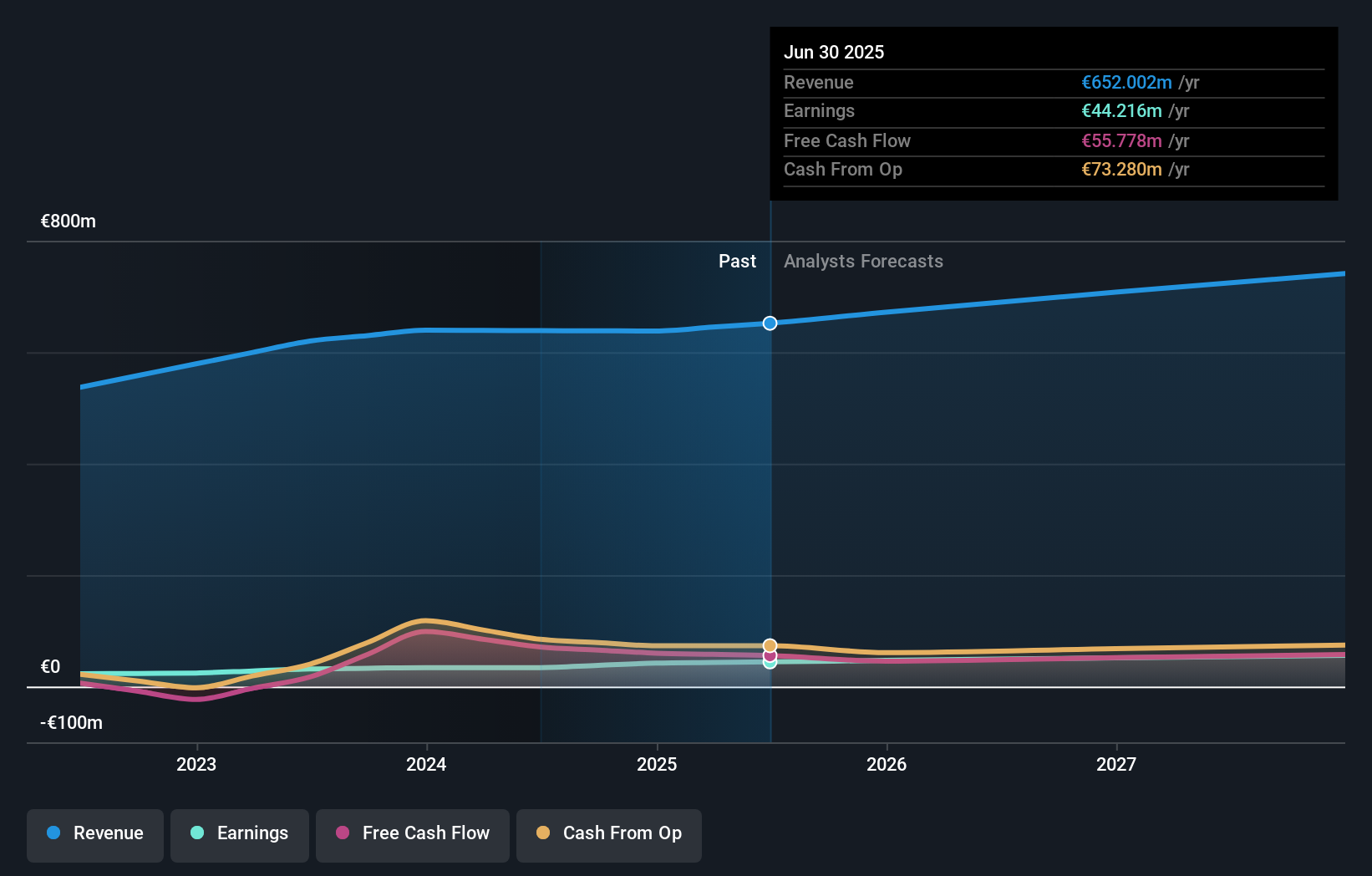

FRoSTA (DB:NLM)

Simply Wall St Value Rating: ★★★★★★

Overview: FRoSTA Aktiengesellschaft, along with its subsidiaries, is involved in the development, production, and marketing of frozen food products across Germany, Poland, Austria, Italy, and Eastern Europe with a market capitalization of €629.48 million.

Operations: FRoSTA generates revenue primarily from its frozen food products sold across multiple European countries. The company's financials reveal a focus on maintaining efficient production and marketing operations to support its market presence.

FRoSTA, a notable player in the frozen food sector, is trading at 41.7% below its estimated fair value, suggesting potential undervaluation. Over the past year, its earnings surged by 29.8%, outpacing the broader food industry which saw a -5% growth rate. The company has effectively reduced its debt to equity ratio from 20.8% to 5.4% over five years, highlighting improved financial health and stability. With high-quality earnings and positive free cash flow, FRoSTA appears well-positioned within its niche market despite broader industry challenges and may offer promising opportunities for investors seeking value in European markets.

- Click here and access our complete health analysis report to understand the dynamics of FRoSTA.

Evaluate FRoSTA's historical performance by accessing our past performance report.

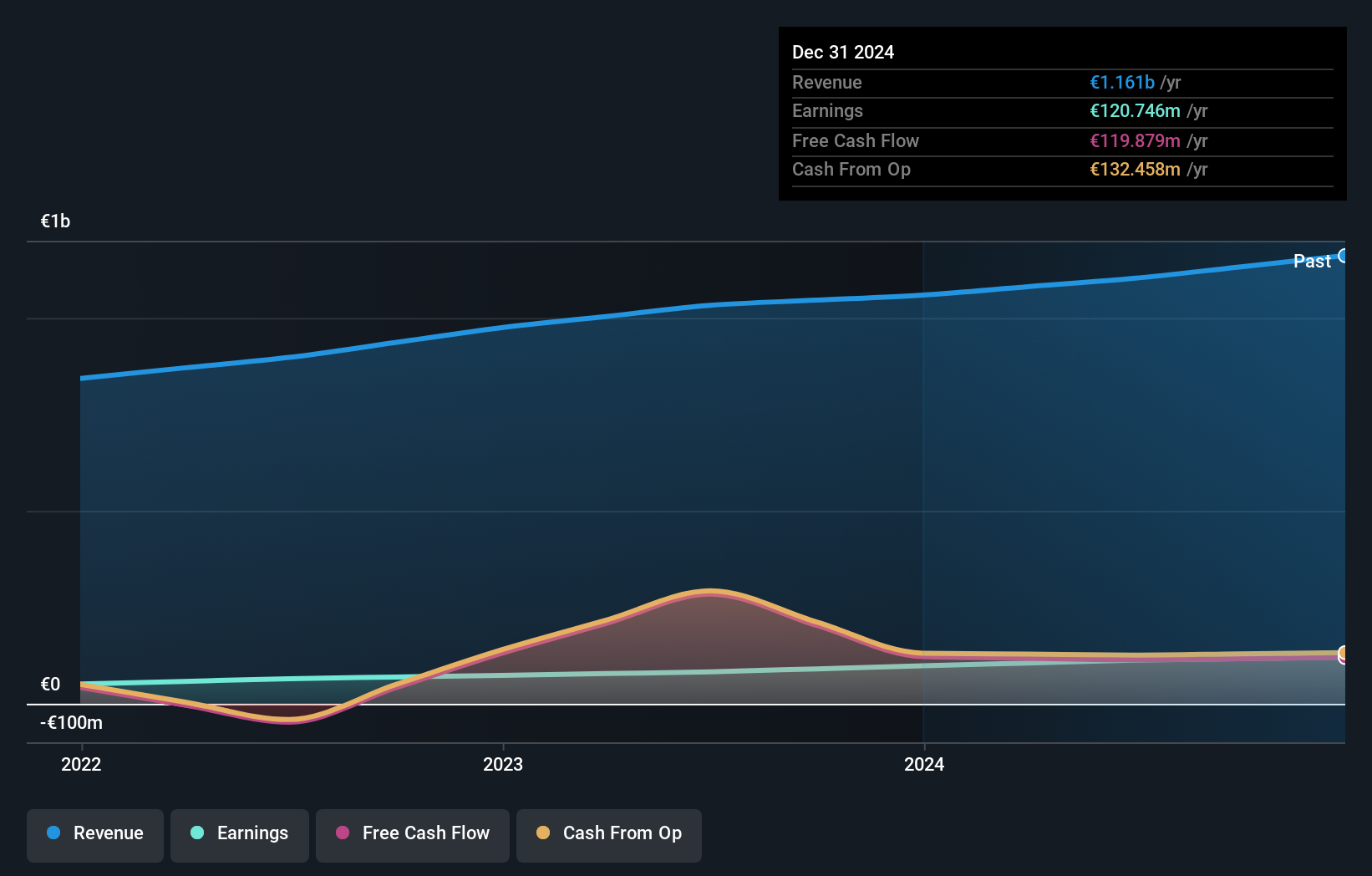

VIEL & Cie société anonyme (ENXTPA:VIL)

Simply Wall St Value Rating: ★★★★★☆

Overview: VIEL & Cie, société anonyme is an investment company offering interdealer broking, online trading, and private banking services across multiple regions including France, Europe, the Middle East, Africa, the Americas, and the Asia-Pacific with a market capitalization of approximately €1.07 billion.

Operations: VIEL & Cie generates revenue primarily from professional intermediation (€1.16 billion) and stock exchange online services (€72.80 million). The company's financial performance is characterized by its ability to derive significant income from its core segments, with professional intermediation being the largest contributor.

VIEL & Cie, a small player in the financial sector, showcases promising attributes with its earnings growing by 10.6% over the past year, outpacing the industry's 8.7%. The company's debt to equity ratio has improved from 89.9% to 79.4% over five years, indicating prudent financial management. Trading at approximately 20% below estimated fair value suggests potential upside for investors seeking undervalued opportunities. With high-quality earnings and more cash than total debt, VIEL seems well-positioned in its market niche despite some uncertainty around interest coverage by EBIT due to insufficient data provided on this aspect.

- Click here to discover the nuances of VIEL & Cie société anonyme with our detailed analytical health report.

Gain insights into VIEL & Cie société anonyme's past trends and performance with our Past report.

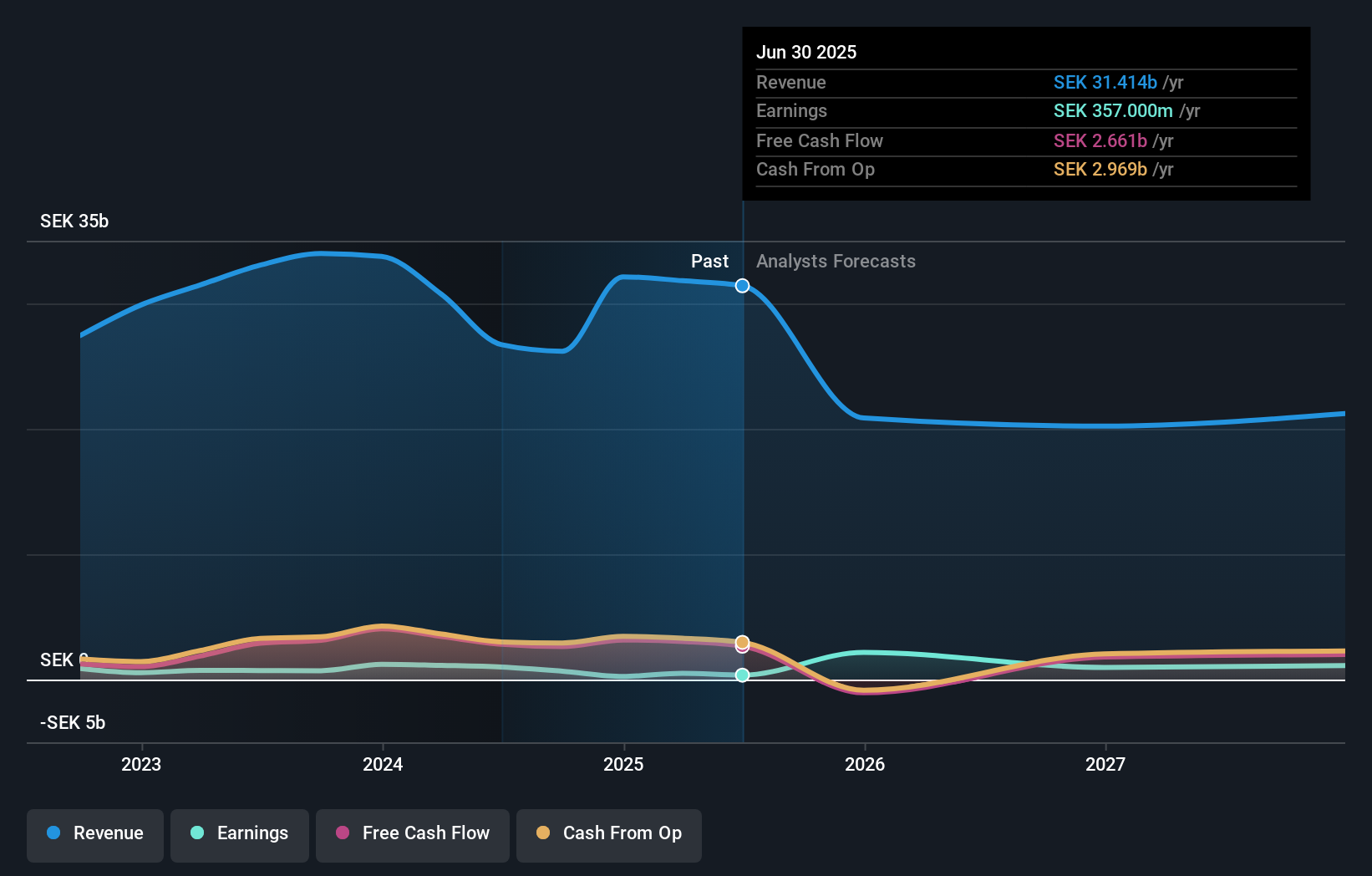

Ratos (OM:RATO B)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ratos AB (publ) is a private equity firm focused on buyouts, turnarounds, add-on acquisitions, and middle market transactions with a market cap of SEK12.20 billion.

Operations: Ratos generates revenue primarily from its Consumer segment, amounting to SEK4.65 billion. The company also reports a Segment Adjustment of SEK26.33 billion, impacting overall financial results.

Ratos, a smaller player in the European market, has shown impressive earnings growth of 110.7% over the past year, outpacing its industry peers. The company's net income for the recent quarter was SEK 395 million, a significant turnaround from last year's loss of SEK 146 million. Its debt to equity ratio has improved from 39.1% to 25.8% over five years, indicating better financial health and reduced leverage concerns with a satisfactory net debt to equity ratio of 20.6%. Despite these positives, Ratos is trading at an attractive value—28.2% below estimated fair value—but faces challenges like currency volatility and restructuring risks under new leadership with Gustaf Salford as CEO starting December.

Where To Now?

- Reveal the 304 hidden gems among our European Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal