How Investors Are Reacting To FactSet (FDS) AI Data Push and Expanded Share Repurchase Plan

- In recent days, FactSet Research Systems Inc. reported first-quarter fiscal 2026 results, reaffirmed full-year guidance, expanded its share repurchase authorization to US$1.00 billion, and completed a buyback of 478,100 shares for US$139.9 million, while stockholders approved updates to the company’s certificate of incorporation at the 2025 Annual Meeting.

- At the same time, FactSet launched what it calls the industry’s first production-grade Model Context Protocol server, giving AI systems governed, real-time access to nine core financial datasets and signaling a push to embed its data more deeply into clients’ AI workflows.

- We’ll now examine how FactSet’s new AI-focused MCP server could reshape the company’s investment narrative and future growth drivers.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

FactSet Research Systems Investment Narrative Recap

To own FactSet, you have to believe in its role as core infrastructure for financial workflows and its ability to keep monetizing high quality data, even as clients scrutinize budgets and technology costs rise. The latest quarter’s results and reaffirmed fiscal 2026 guidance support that narrative near term, while the biggest current risk still looks tied to pressure on asset managers and banks, which these announcements do not materially change.

Among the recent updates, the launch of FactSet’s production grade Model Context Protocol server looks most relevant for the story, because it directly addresses a key catalyst: turning GenAI interest into deeper data feed adoption and stickier enterprise integrations. By giving AI systems governed, real time access to nine core datasets, this move clearly ties into the thesis that new AI products can expand usage and support revenue growth over time.

Yet even with AI tools rolling out, investors should be aware that ongoing cost rationalization in asset management and banking could still...

Read the full narrative on FactSet Research Systems (it's free!)

FactSet Research Systems' narrative projects $2.7 billion revenue and $730.7 million earnings by 2028. This requires 5.7% yearly revenue growth and an earnings increase of about $197.8 million from $532.9 million.

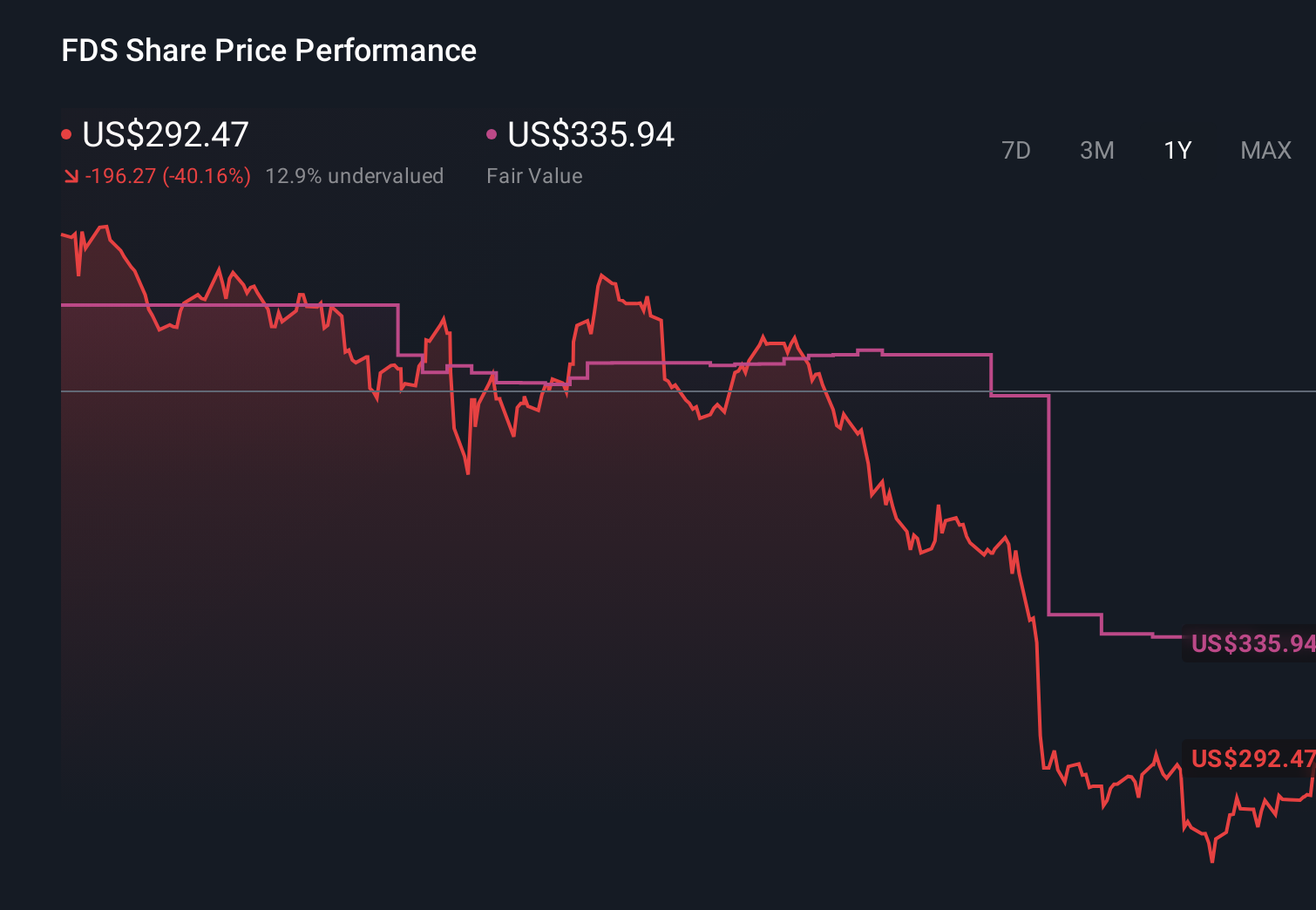

Uncover how FactSet Research Systems' forecasts yield a $333.19 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community currently see FactSet’s fair value between US$276.99 and US$333.19, reflecting a wide spread of expectations. Against that backdrop, the tension between AI driven product catalysts and budget tightening at key clients becomes an important lens for thinking about FactSet’s future performance.

Explore 4 other fair value estimates on FactSet Research Systems - why the stock might be worth as much as 15% more than the current price!

Build Your Own FactSet Research Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FactSet Research Systems research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free FactSet Research Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FactSet Research Systems' overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal