CME Group (CME) Valuation Check After FanDuel Predicts Nationwide Rollout Plan

CME Group (CME) just flipped the switch on a strategic bet with FanDuel, rolling out the FanDuel Predicts platform in five states and targeting a nationwide footprint by early 2026.

See our latest analysis for CME Group.

The FanDuel Predicts rollout follows a busy stretch for CME Group, including fresh crypto linked products, and the market seems to approve, with the share price at $276.38 and a strong year to date share price return alongside robust multi year total shareholder returns suggesting momentum is quietly building rather than fading.

If this kind of platform expansion has your attention, it might be a good moment to see what else is evolving across fast growing stocks with high insider ownership.

With CME already trading just below analysts’ targets after a strong multi year run, the real question now is whether FanDuel Predicts can unlock upside from here or if the market has already priced in that growth.

Most Popular Narrative Narrative: 3.4% Undervalued

With CME Group closing at $276.38 against a narrative fair value of about $286, the story centers on whether modest growth can still command a premium.

New product innovations (e.g., Micro contracts, expansion into crypto, FX Spot+), ongoing tech driven operating efficiencies (cloud migration and tokenization initiatives), and strengthening of strategic partnerships (such as the long term NASDAQ index license extension and Google Cloud collaboration) are enhancing operating leverage and EBITDA/net margin performance. The ongoing global shift toward electronic trading, greater regulatory demands for transparency and standardized clearing, and a proven ability to grow non transactional revenue (e.g., record market data revenue) position CME to capture a larger share of trading activity and support durable long term earnings growth.

Want to see why steady single digit growth, rising margins, and a richer future earnings multiple still point to upside? This narrative spells out the playbook.

Result: Fair Value of $286.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, periods of subdued volatility or tighter regulation on derivatives trading could quickly sap volumes, pressuring CME’s fee based moat and growth narrative.

Find out about the key risks to this CME Group narrative.

Another Way to Look at Value

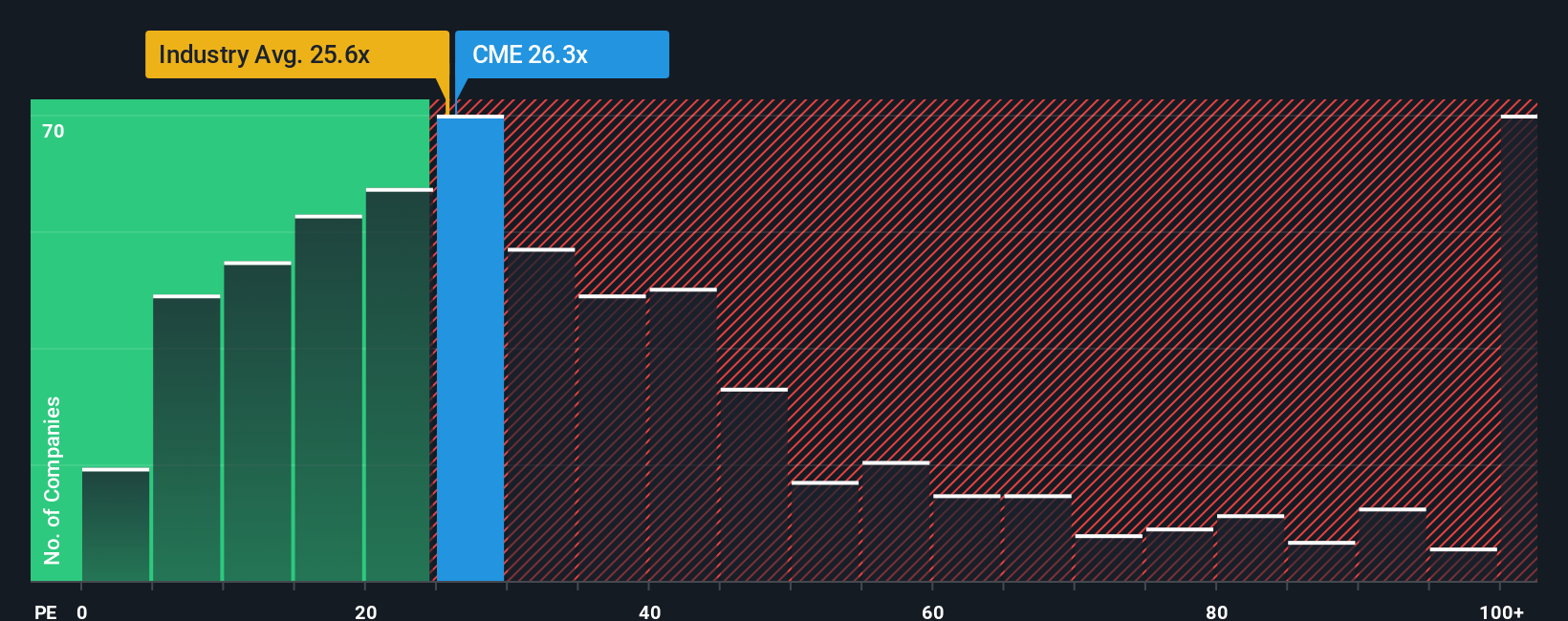

While the narrative fair value implies CME Group is about 3 to 4 percent undervalued, a simple price to earnings lens tells a tougher story. CME trades at 26.8 times earnings, notably above its 15.1 times fair ratio, and even a premium to the 25.6 times industry average. That kind of gap can close either through faster earnings growth or share price drift. Which do you think is more likely from here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CME Group Narrative

If you see the story differently or simply prefer hands on research, you can quickly build your own tailored view in minutes: Do it your way.

A great starting point for your CME Group research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for more investing angles?

If CME has sharpened your focus, do not stop here. Your next winning idea could be hiding in these focused screens before everyone else notices.

- Capitalize on mispriced opportunities by targeting companies our system flags as attractively valued through these 902 undervalued stocks based on cash flows.

- Ride structural shifts in medicine by zeroing in on innovators transforming patient care with these 29 healthcare AI stocks.

- Amplify your income potential by hunting for reliable yield and payout strength using these 10 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal