High Growth Tech Stocks To Watch In December 2025

As global markets navigate mixed signals, with the U.S. experiencing a blend of economic indicators and Japan's interest rate hike marking a significant shift, investors are closely watching how these dynamics impact high-growth technology stocks. In such an environment, selecting promising tech stocks involves considering factors like innovation potential and resilience to economic fluctuations, as these attributes can help companies thrive amid changing market conditions.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.94% | 32.84% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Knowmerce | 35.50% | 33.23% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| KebNi | 25.19% | 61.24% | ★★★★★★ |

| CD Projekt | 37.82% | 51.75% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

Zhejiang ZUCH Technology (SZSE:301280)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zhejiang ZUCH Technology Co., Ltd. focuses on the research, development, production, and sale of electronic connectors in China with a market capitalization of CN¥6.89 billion.

Operations: ZUCH Technology specializes in the electronic connectors sector, emphasizing R&D, production, and sales within China. The company's financial performance is highlighted by its market capitalization of CN¥6.89 billion.

Zhejiang ZUCH Technology, amidst a robust tech landscape, has demonstrated significant financial growth with a 26.9% annual increase in revenue and a 24.6% rise in earnings. Recent amendments to the company's bylaws underscore proactive governance, aligning with its strategic goals. Notably, R&D investments are pivotal; the firm allocated substantial resources to innovation, which is evident from its recent earnings report showing enhanced product offerings and market competitiveness. This focus on R&D not only fuels ZUCH's technological advancements but also positions it well against industry norms where continuous innovation is key to sustaining growth.

- Unlock comprehensive insights into our analysis of Zhejiang ZUCH Technology stock in this health report.

Understand Zhejiang ZUCH Technology's track record by examining our Past report.

Ugreen Group (SZSE:301606)

Simply Wall St Growth Rating: ★★★★★★

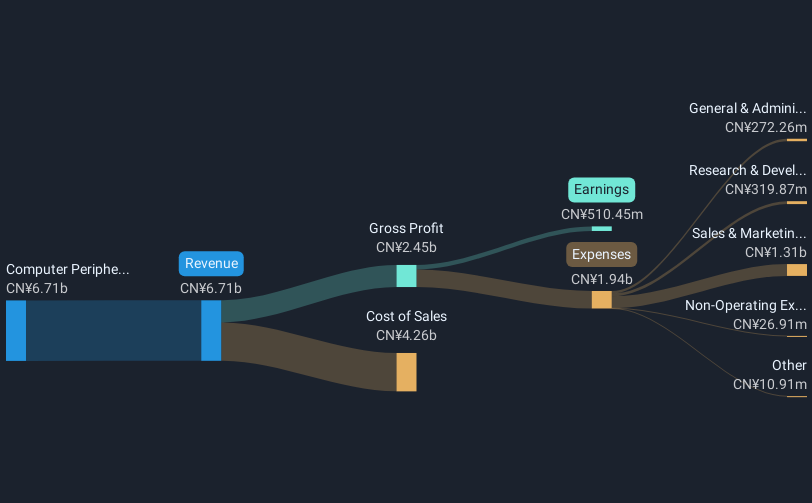

Overview: Ugreen Group Limited is involved in the research, development, design, production, and sale of 3C consumer electronic products both in China and internationally with a market capitalization of CN¥24.89 billion.

Operations: Ugreen Group focuses on the 3C consumer electronics sector, primarily generating revenue from computer peripherals, which account for CN¥8.23 billion.

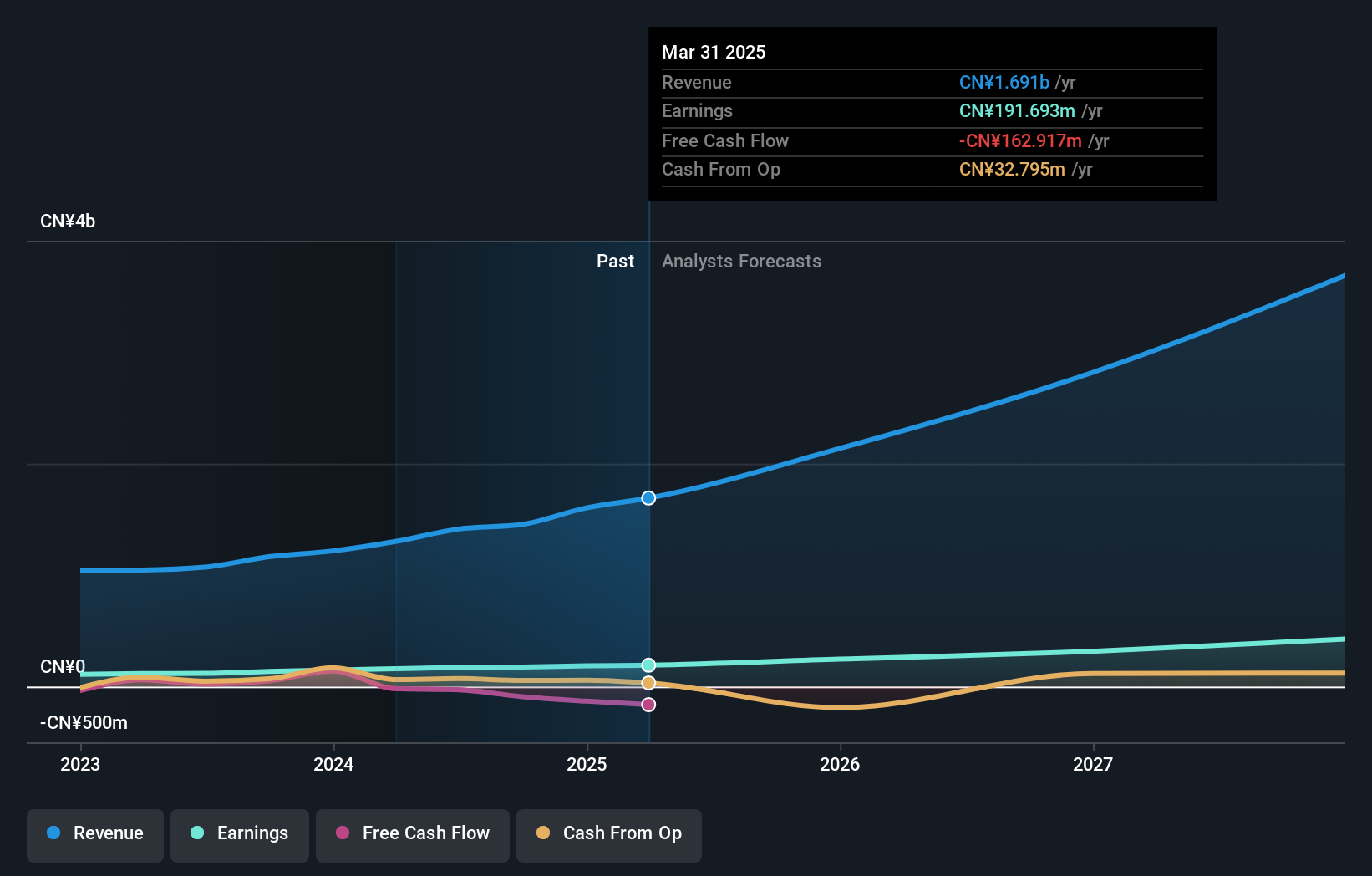

Ugreen Group has shown a robust uptick in its financial metrics, with revenue soaring to CNY 6.36 billion, up from CNY 4.31 billion year-over-year, and net income climbing to CNY 466.83 million from CNY 321.77 million. This performance is underscored by significant R&D investments that bolster its competitive edge in the tech sector; specifically, the company's focus on enhancing product offerings through innovation is evident in these results. With an impressive annual revenue growth rate of 27.9% and earnings growth of 33.4%, Ugreen is well-positioned within a rapidly evolving industry landscape where technological advancements are paramount for sustained success.

- Dive into the specifics of Ugreen Group here with our thorough health report.

Review our historical performance report to gain insights into Ugreen Group's's past performance.

Chunghwa Precision Test Tech (TPEX:6510)

Simply Wall St Growth Rating: ★★★★★☆

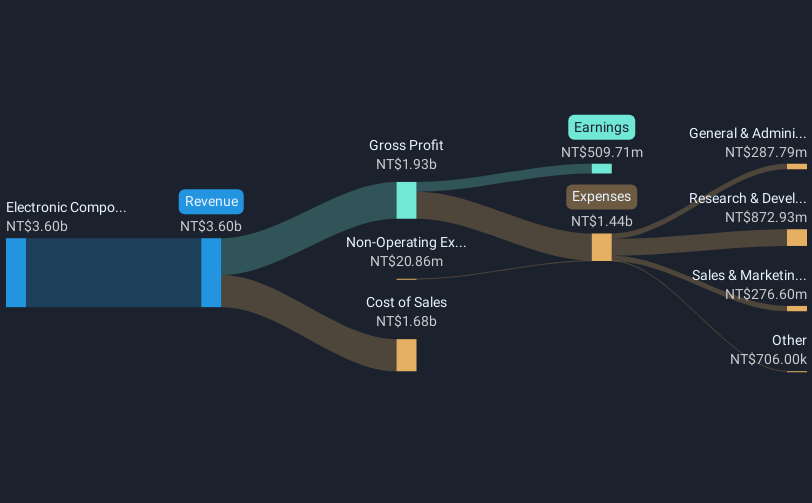

Overview: Chunghwa Precision Test Tech. Co., Ltd. operates in the semiconductor testing industry with a market capitalization of NT$74.27 billion, serving both domestic and international markets.

Operations: Chunghwa Precision Test Tech specializes in the testing of semiconductor components, generating revenue primarily from electronic components and parts, amounting to NT$4.90 billion. The company's operations span both Taiwan and international markets.

Chunghwa Precision Test Tech has demonstrated substantial growth, with a notable increase in sales to TWD 3.61 billion and net income surging to TWD 712.39 million over nine months, reflecting year-over-year growth rates of 55.9% and 279.7%, respectively. These figures are underpinned by strategic alliances, such as the recent partnership with Yokowo, aimed at enhancing technological capabilities and market penetration in semiconductor testing—a sector where innovation drives competitiveness. This collaboration is poised to bolster Chunghwa's product development and competitive stance in a rapidly advancing industry, despite the current non-material impact on financials.

Summing It All Up

- Click here to access our complete index of 243 Global High Growth Tech and AI Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal