Undiscovered Gems in Global Markets for December 2025

As global markets navigate a complex landscape of mixed economic signals and shifting monetary policies, small-cap stocks have faced unique challenges and opportunities. With the Russell 2000 Index recently declining, investors may be on the lookout for undervalued or overlooked companies that can thrive amid these conditions. Identifying such undiscovered gems often involves assessing a company's fundamentals, growth potential, and resilience in an evolving market environment.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Shindaeyang Paper | 10.96% | 0.53% | -8.77% | ★★★★★★ |

| Thai Steel Cable | NA | 3.35% | 17.89% | ★★★★★★ |

| Saha-Union | 0.70% | 0.67% | 18.29% | ★★★★★★ |

| Creative & Innovative System | 0.72% | 37.76% | 64.55% | ★★★★★★ |

| Wan Hwa Enterprise | NA | 9.74% | 13.35% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| Kinpo Electronics | 102.23% | 5.04% | 44.47% | ★★★★★☆ |

| ILSEUNG | 35.04% | 0.33% | 32.17% | ★★★★★☆ |

| Iljin DiamondLtd | 2.08% | -4.09% | 13.10% | ★★★★☆☆ |

| Fengyinhe Holdings | 9.39% | 53.36% | 74.10% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

SUFA Technology Industry CNNC (SZSE:000777)

Simply Wall St Value Rating: ★★★★★★

Overview: SUFA Technology Industry Co., Ltd., CNNC specializes in the research, development, production, sales, and service of industrial valves both in China and internationally with a market cap of CN¥8.18 billion.

Operations: The company generates revenue primarily through the production and sale of industrial valves. Its financial performance is influenced by various cost components, including manufacturing and operational expenses. The net profit margin has shown variability, reflecting changes in these costs and market conditions.

SUFA Technology Industry, a notable player in the machinery sector, showcases robust financial health with high-quality earnings and a satisfactory net debt to equity ratio of 7.4%. Over the past year, its earnings grew by 8.5%, outpacing the industry's 6.1% growth rate, while its price-to-earnings ratio stands at an attractive 39.9x compared to the CN market's 44.5x. Despite a slight dip in net income from CNY 115.71 million to CNY 111.57 million for nine months ending September 2025, SUFA remains profitable with positive free cash flow and promising future growth prospects of approximately 17.69% annually.

New Huadu Technology (SZSE:002264)

Simply Wall St Value Rating: ★★★★★★

Overview: New Huadu Technology Co., Ltd. operates in the Internet marketing sector within China and has a market capitalization of approximately CN¥6.66 billion.

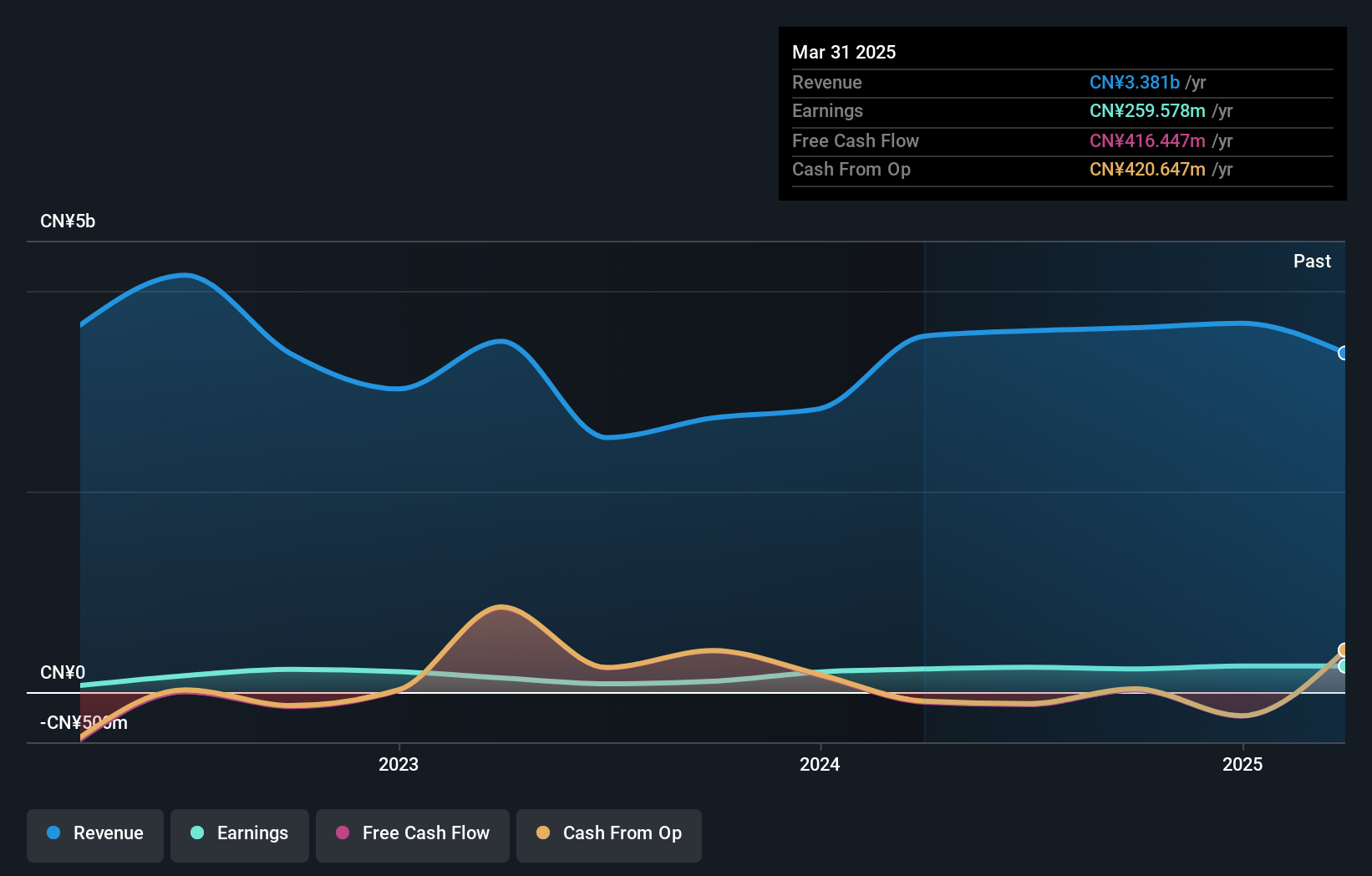

Operations: New Huadu Technology generates revenue primarily from its Internet marketing business, totaling approximately CN¥3.35 billion. The company's financial performance is influenced by its net profit margin, which has shown variability over recent periods.

New Huadu Technology, a small yet promising player, has shown resilience with earnings growth of 6.9% over the past year, outpacing the Consumer Retailing industry's -11.9%. Its price-to-earnings ratio of 29.6x is attractive compared to the CN market's 44.5x, suggesting potential value for investors. The company boasts high-quality earnings and has managed to reduce its debt-to-equity ratio from 23.4% to just 4% in five years, indicating improved financial health. Despite recent volatility in share prices and a slight drop in revenue and net income for nine months ending September 2025 compared to last year, New Huadu remains profitable with free cash flow positivity likely supporting future growth prospects within its sector.

- Click here and access our complete health analysis report to understand the dynamics of New Huadu Technology.

Explore historical data to track New Huadu Technology's performance over time in our Past section.

Shenzhen Bromake New Material (SZSE:301387)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Bromake New Material Co., Ltd. specializes in the research, development, production, and sale of protective and functional products for consumer electronics with a market capitalization of CN¥5.33 billion.

Operations: Bromake generates revenue primarily from its Electronic Components & Parts segment, amounting to CN¥1.54 billion.

Shenzhen Bromake New Material, a relatively small player in the materials sector, has shown impressive financial progress. Over the past year, its earnings surged by 18.7%, outpacing the broader electronic industry growth of 9.4%. The company’s debt-to-equity ratio has improved from 20.3% to 15.2% over five years, indicating better financial health and stability with interest payments well covered by EBIT at a robust 12 times coverage. Recent reports highlight sales reaching CNY1.16 billion for nine months ending September 2025, up from CNY841 million last year, while net income jumped to CNY28 million from CNY7 million previously, reflecting strong operational performance and potential for future growth in this dynamic market space.

Turning Ideas Into Actions

- Take a closer look at our Global Undiscovered Gems With Strong Fundamentals list of 2995 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal