Reassessing Roivant Sciences (ROIV) Valuation After Pipeline Progress, NDA Timelines and Genevant Litigation Updates

Pipeline momentum and what it could mean for the stock

Roivant Sciences (ROIV) just tightened the timeline on several key programs, from Brepocitinib NDA plans to mosliciguat trials and Genevant litigation milestones. This gives investors clearer visibility into how the pipeline might translate into value.

See our latest analysis for Roivant Sciences.

The latest pipeline clarity seems to be feeding into solid momentum, with an 86.26% year to date share price return and a 194.89% three year total shareholder return suggesting investors are steadily re-rating Roivant’s prospects.

If Roivant’s recent run has you thinking about what else could re-rate on execution, it might be worth exploring healthcare stocks as your next hunting ground.

With shares already up sharply and trading only modestly below the average analyst target, the core question now is simple: Is Roivant still undervalued on its deep pipeline, or is the market already pricing in that growth?

Most Popular Narrative Narrative: 12.2% Undervalued

With Roivant closing at $22.50 against a narrative fair value of about $25.64, the valuation case hinges heavily on future earnings power and legal upside.

Roivant's late stage pipeline, with potential approvals expected in the next couple of years, could lead to a projected $10 billion+ peak sales portfolio, significantly impacting earnings as these therapies are commercialized. Business development activities with negotiations for potential in licensing of new programs are ongoing, representing opportunities for revenue growth through the expansion of their development stage clinical pipeline.

Curious how one set of growth assumptions, margin shifts, and a premium future earnings multiple can justify a richer fair value than today’s price? Read on.

Result: Fair Value of $25.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, pivotal trial setbacks or an unfavorable outcome in the LNP litigation could quickly erode confidence in those optimistic valuation assumptions.

Find out about the key risks to this Roivant Sciences narrative.

Another Lens on Valuation

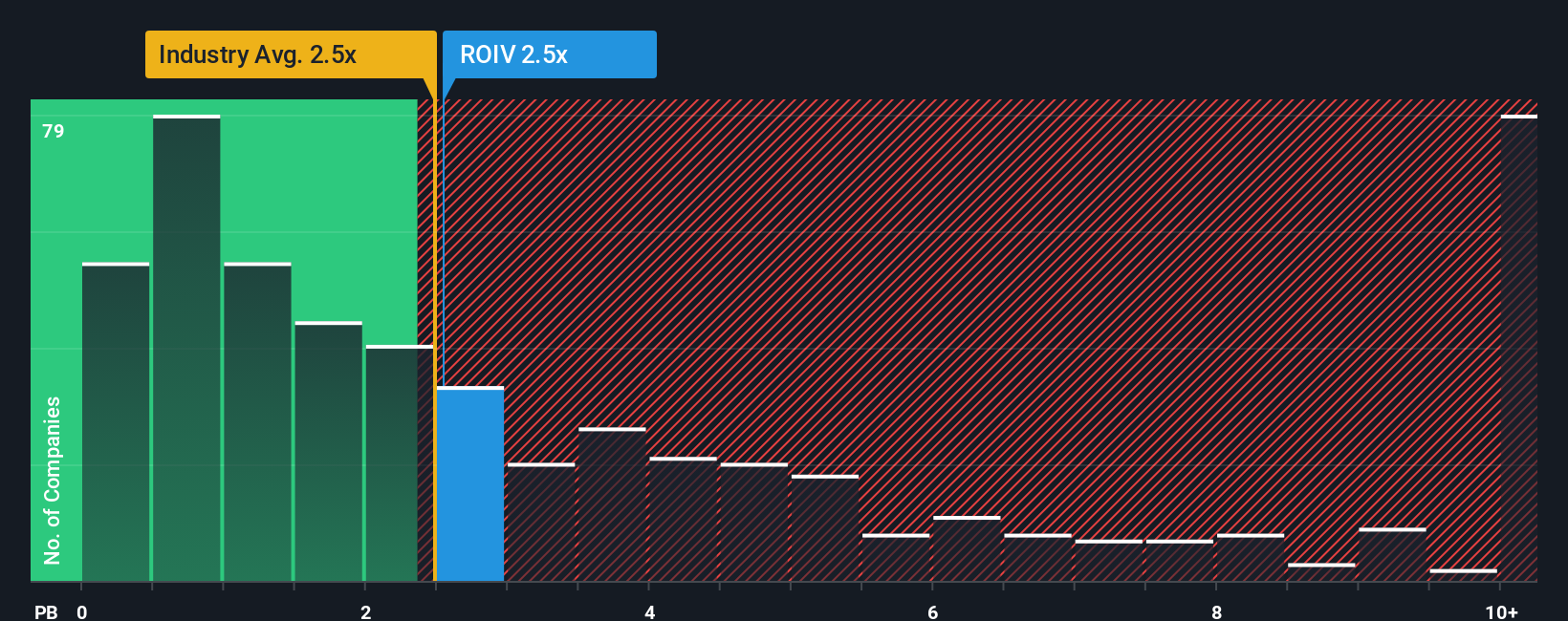

Price to book paints a less generous picture. Roivant trades at about 3.6 times book value versus 2.7 times for the US biotech industry, even if it still looks cheaper than peer averages near 8.6 times. That premium multiple raises a simple question: how much execution risk are investors really being paid for?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Roivant Sciences Narrative

If you would rather stress test these assumptions yourself and reach an independent view, you can build a complete Roivant thesis in minutes: Do it your way.

A great starting point for your Roivant Sciences research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, explore your next set of opportunities with targeted screens on Simply Wall Street, so you do not miss the market’s next leaders.

- Identify potential value plays by scanning these 903 undervalued stocks based on cash flows that pair strong cash flows with attractive entry prices.

- Strengthen your watchlist with these 24 AI penny stocks that may benefit from the adoption of artificial intelligence across industries.

- Find income-focused ideas with these 10 dividend stocks with yields > 3% that offer yields above 3 percent from established businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal