Core Scientific (CORZ): Valuation Check After Citizens’ Upgrades and Growing High-Performance Computing Contract Optimism

Core Scientific (CORZ) is back in the spotlight after a fresh wave of upgrades from Citizens, with analysts highlighting its high performance computing power pipeline story and upcoming earnings as key catalysts.

See our latest analysis for Core Scientific.

Those bullish calls come after a volatile stretch, with the share price sitting at $15.57 and showing a 7 day share price return of 14.74 percent but a softer 90 day share price return of minus 7.54 percent. At the same time, the 1 year total shareholder return of 4.08 percent suggests momentum is starting to rebuild as investors refocus on Core Scientific’s high performance computing story.

If you are weighing Core Scientific alongside other AI infrastructure names, this could be a good moment to explore high growth tech and AI stocks as a way to spot what else is gaining traction.

With the stock still trading at a steep discount to Wall Street’s targets despite rapid top line and earnings momentum, investors now face a key question: is this a mispriced AI infrastructure play, or is future growth already in the price?

Most Popular Narrative Narrative: 41.9% Undervalued

Against the last close at $15.57, the most widely followed fair value estimate sits far higher at $26.82, framing Core Scientific as a deep value AI infrastructure play in the making.

The analysts have a consensus price target of $19.045 for Core Scientific based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $23.0, and the most bearish reporting a price target of just $15.0.

Want to see how an unprofitable miner transforms into a high margin compute platform story? This narrative leans on aggressive revenue compounding, a sharp swing into profitability, and a future earnings multiple usually reserved for established software leaders. Curious which specific growth, margin, and valuation assumptions have to line up to justify that upside gap? Dive in to see the full playbook behind that $26.82 figure.

Result: Fair Value of $26.82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained net losses and heavy reliance on CoreWeave contracts mean that any execution stumble or demand slowdown could quickly puncture this bullish valuation case.

Find out about the key risks to this Core Scientific narrative.

Another Way to Look at Valuation

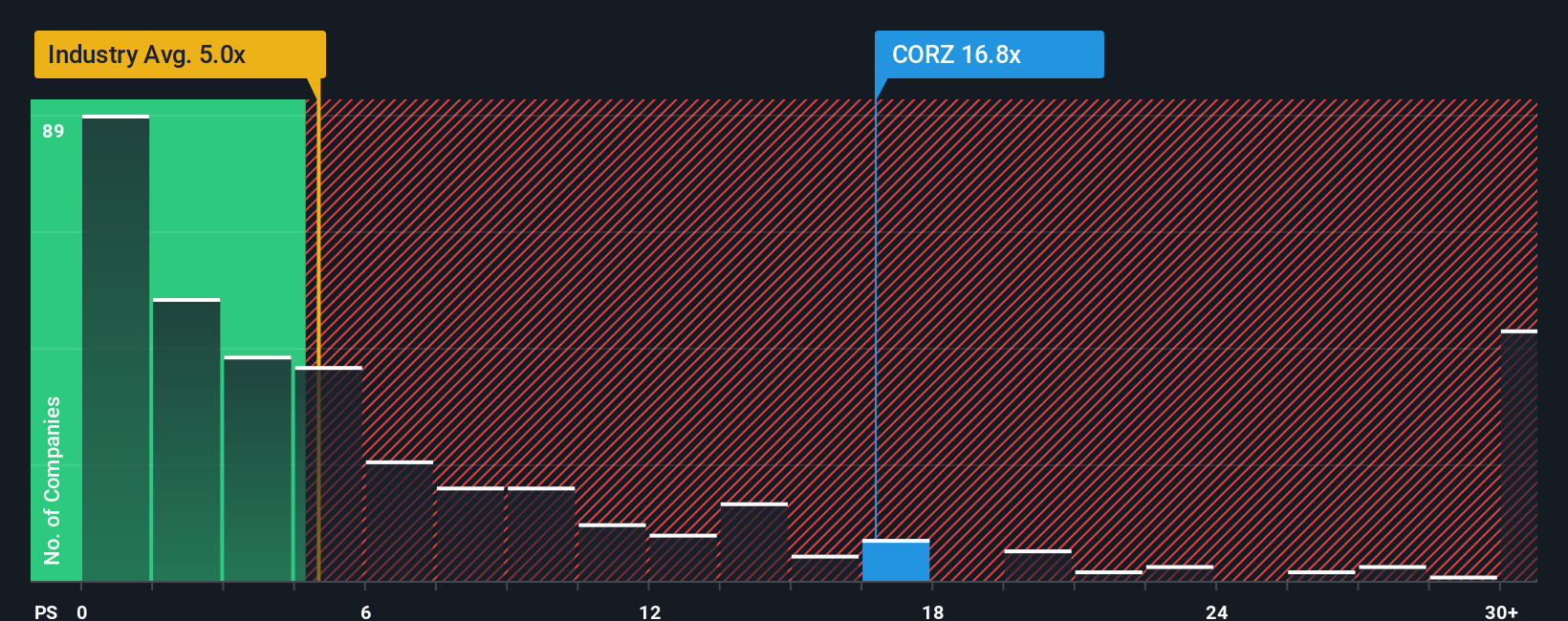

There is a catch to the upside story. On a sales basis, Core Scientific trades on a rich 14.4 times price to sales, versus about 4.8 times for the US software sector and 4.4 times for close peers. Our fair ratio sits nearer 4.1 times. That gap signals meaningful downside risk if sentiment cools or growth underdelivers, even if the AI pipeline plays out.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Core Scientific Narrative

If this angle does not quite fit your view, or you would rather dig into the numbers yourself, you can build a custom take in minutes: Do it your way.

A great starting point for your Core Scientific research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas beyond Core Scientific?

Do not stop at one opportunity when you can quickly scan smarter ideas; use the Simply Wall Street Screener to target themes that match your strategy.

- Capture potential rebound stories by targeting discounted names using these 904 undervalued stocks based on cash flows that still show solid fundamentals and room for sentiment to turn.

- Position yourself at the heart of the AI build out by scanning these 24 AI penny stocks that could benefit from accelerating demand for data, chips, and compute.

- Strengthen your long term income stream by reviewing these 10 dividend stocks with yields > 3% that combine dependable payouts with sustainable balance sheets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal