Evaluating CAE (TSX:CAE)’s Valuation After Its Major Australian Defense Training Contract Win

CAE (TSX:CAE) just landed a CAD 270 million, 10 year contract with Australia to deliver its Future Air Mission Training System. This deal strengthens both its defense backlog and its long running RAAF relationship.

See our latest analysis for CAE.

The contract news lands at a time when sentiment is already improving. The share price is at CA$42.99 and a strong 1 month share price return of 17.43 percent builds on a 3 year total shareholder return of 68.13 percent, suggesting momentum is picking up rather than fading.

If this kind of defense win has your attention, it could be worth seeing what else is taking off in aerospace and defense stocks right now.

Yet even with this contract win and a 34 percent implied discount to intrinsic value, CAE trades only slightly below consensus targets. This raises a key question: is this still a buying opportunity, or is future growth already priced in?Most Popular Narrative Narrative: 2.1% Undervalued

With the fair value estimate sitting just above CAE's last close, the most followed narrative argues the stock still has room to climb.

Strategic program execution and operational discipline highlighted by focus on optimizing recently built capacity, driving cost efficiencies, and replacing lower margin legacy defense contracts with accretive ones should translate into stronger margin performance, improved cash conversion, and higher returns on invested capital over time.

Want to see the math behind that confidence? The narrative leans on steady revenue expansion, rising margins, and a richer earnings multiple than the sector usually commands. Curious how those assumptions stack up?

Result: Fair Value of $43.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated debt and potential delays in civil aviation training demand mean that slower margin expansion could quickly undermine this undervaluation story.

Find out about the key risks to this CAE narrative.

Another Angle on Valuation

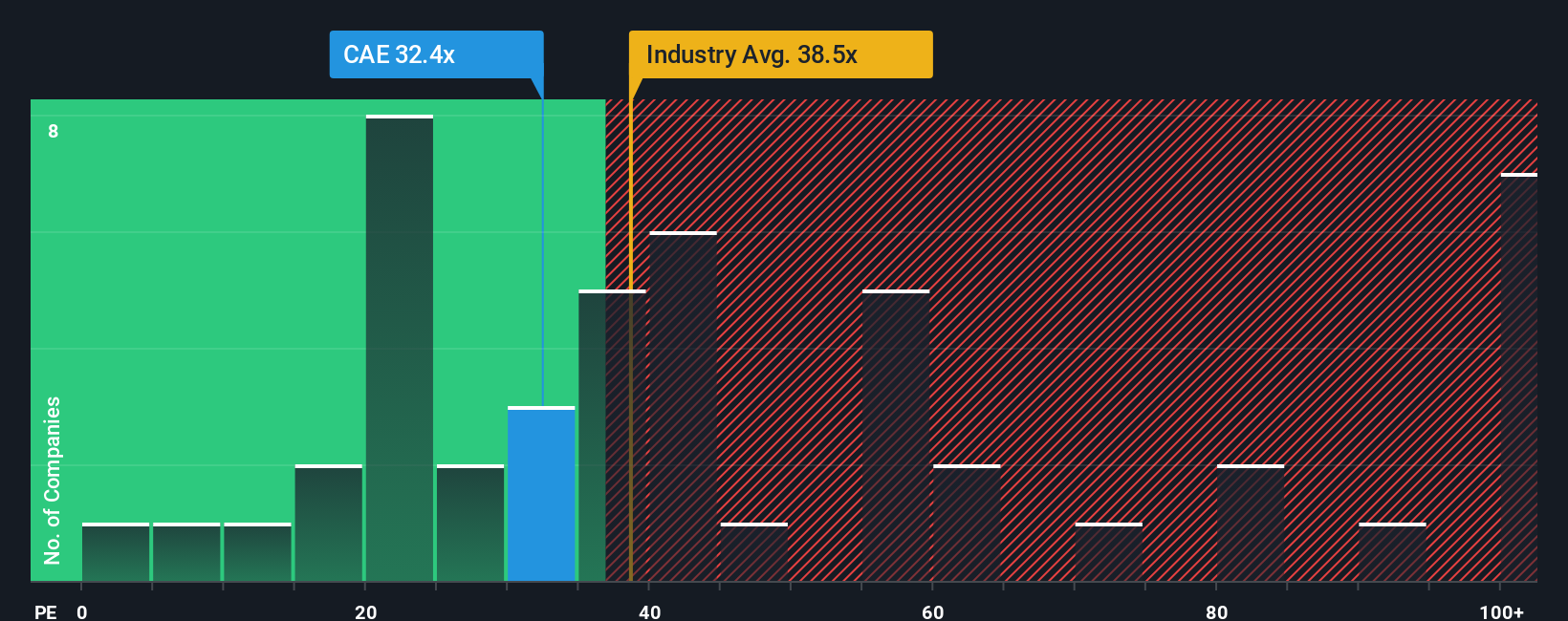

Looked at through earnings, CAE trades on a 31.7x price to earnings ratio, above its 23.2x fair ratio, even if it still sits below the 37x industry average. That premium suggests less margin for error, so is this really a bargain or just fairly full?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CAE Narrative

If you see the story differently or would rather dig into the numbers yourself, you can build a personalized thesis in just a few minutes: Do it your way.

A great starting point for your CAE research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with CAE. Use Simply Wall Street's powerful Screener to uncover fresh opportunities tailored to your strategy before the market fully catches on.

- Capture potential rebound stories by targeting underappreciated businesses with strong cash flow support using these 904 undervalued stocks based on cash flows.

- Tap into cutting edge innovation by focusing on next generation automation and intelligent platforms through these 24 AI penny stocks.

- Lock in reliable income streams by filtering companies that consistently distribute attractive yields via these 10 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal