How Junior Subordinated Notes Offering And Stronger NII At Customers Bancorp (CUBI) Has Changed Its Investment Story

- In December 2025, Customers Bancorp, Inc. completed a US$100,000,000 fixed-to-floating rate junior subordinated unsecured notes offering due January 15, 2036, issued at 100% with a 1.5% discount per security and callable, variable-rate features.

- This capital raise follows a 38.3% year-on-year revenue increase and stronger-than-expected net interest income, underpinned by higher loan and lease interest and more non-interest-bearing deposits.

- We’ll now examine how this junior subordinated notes issuance, alongside stronger net interest income, may influence Customers Bancorp’s broader investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Customers Bancorp Investment Narrative Recap

To own Customers Bancorp, you need to believe it can keep turning its digital-first, cubiX-driven growth and rising net interest income into durable returns without letting risk concentrations get away from it. The new US$100,000,000 junior subordinated notes add long-dated, flexible funding, but they do not materially change the near term story, where the key catalyst is sustaining net interest margin momentum and the key risk remains concentrated exposure to digital asset related deposits.

The most closely connected recent announcement is the planned redemption of the US$85,000,000 Series F preferred stock in December 2025, which, together with the junior subordinated notes, reshapes the capital stack toward lower ongoing preferred dividend costs. For investors watching catalysts, this combination highlights management’s focus on funding efficiency alongside strong net interest income, even as the bank continues to lean into digital asset, fintech and other high growth verticals that can amplify both earnings potential and risk.

Yet behind these funding moves, investors still need to watch how concentrated cubiX and digital asset deposits could affect liquidity and margins if...

Read the full narrative on Customers Bancorp (it's free!)

Customers Bancorp's narrative projects $977.5 million revenue and $424.9 million earnings by 2028.

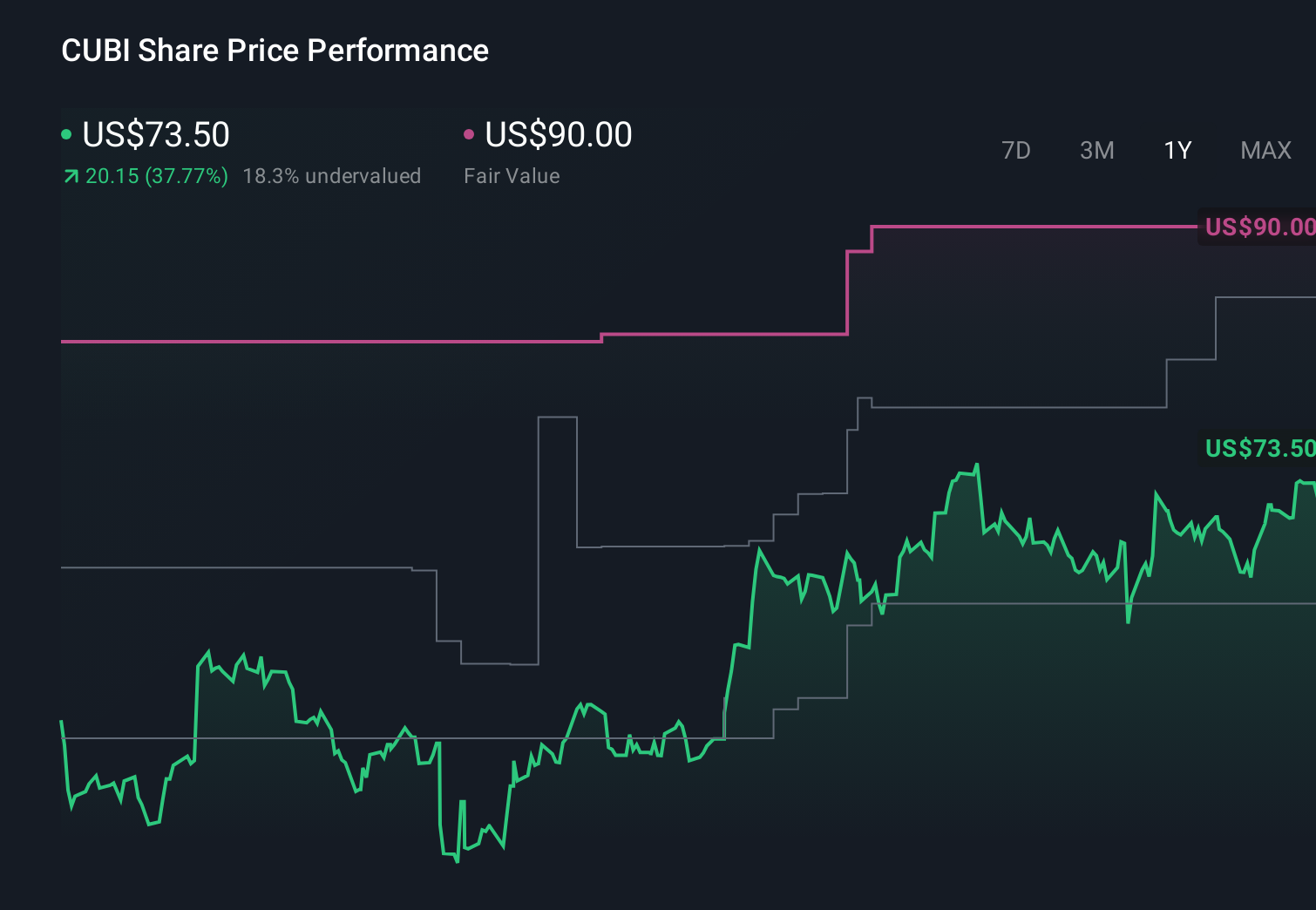

Uncover how Customers Bancorp's forecasts yield a $85.33 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community fair value estimates span roughly US$82 to about US$160 per share, underlining how far apart individual views on Customers Bancorp can be. When you set those against the bank’s growing reliance on digital asset related deposits and cubiX driven income, it becomes clear that understanding both the upside and the concentration risk is essential before forming your own view.

Explore 3 other fair value estimates on Customers Bancorp - why the stock might be worth just $82.00!

Build Your Own Customers Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Customers Bancorp research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Customers Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Customers Bancorp's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal