Xcel Energy (XEL) Valuation Check After Texas Wildfire Negligence Lawsuit and Market Repricing

The latest move in Xcel Energy (XEL) stock was sparked by a high stakes lawsuit from the Texas Attorney General over the deadly Smokehouse Creek wildfire, which has pushed legal and financial risk firmly into focus.

See our latest analysis for Xcel Energy.

Despite the legal overhang, Xcel Energy’s 1 month share price return of negative 7.7 percent comes after a solid year to date share price return of roughly 10.8 percent, and a 1 year total shareholder return of about 12.2 percent. This suggests the recent weakness is more about adjusting for higher perceived risk than a collapse in the long term story.

If this kind of risk reward trade off has you reassessing utilities, it could be a good moment to broaden your search and discover fast growing stocks with high insider ownership.

With the shares now trading at a discount to analyst targets despite steady earnings and dividend momentum, is Xcel Energy an undervalued defensive compounder, or is the market wisely pricing in wildfire liabilities and slower future growth?

Most Popular Narrative: 15.4% Undervalued

With Xcel Energy closing at $74.09 against a narrative fair value near the high $80s, the valuation case leans firmly toward upside potential despite current uncertainty.

Policy driven decarbonization and climate measures are accelerating demand for wind, solar, and storage projects, with Xcel's aggressive clean energy buildout (aiming for over 80% carbon free generation by 2030) supporting long term regulated asset base expansion and sustained earnings growth.

Curious how steady, mid single digit growth assumptions and rising margins can still justify a richer earnings multiple for a regulated utility, not a tech stock? Dive in to see which revenue trajectory, profit expansion path, and future valuation multiple this narrative is quietly baking into that bullish fair value.

Result: Fair Value of $87.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sizable wildfire liabilities and potential regulatory pushback on Xcel’s ambitious grid and renewables investments could still derail the premium valuation narrative.

Find out about the key risks to this Xcel Energy narrative.

Another Take: DCF Says the Stock Is Richly Priced

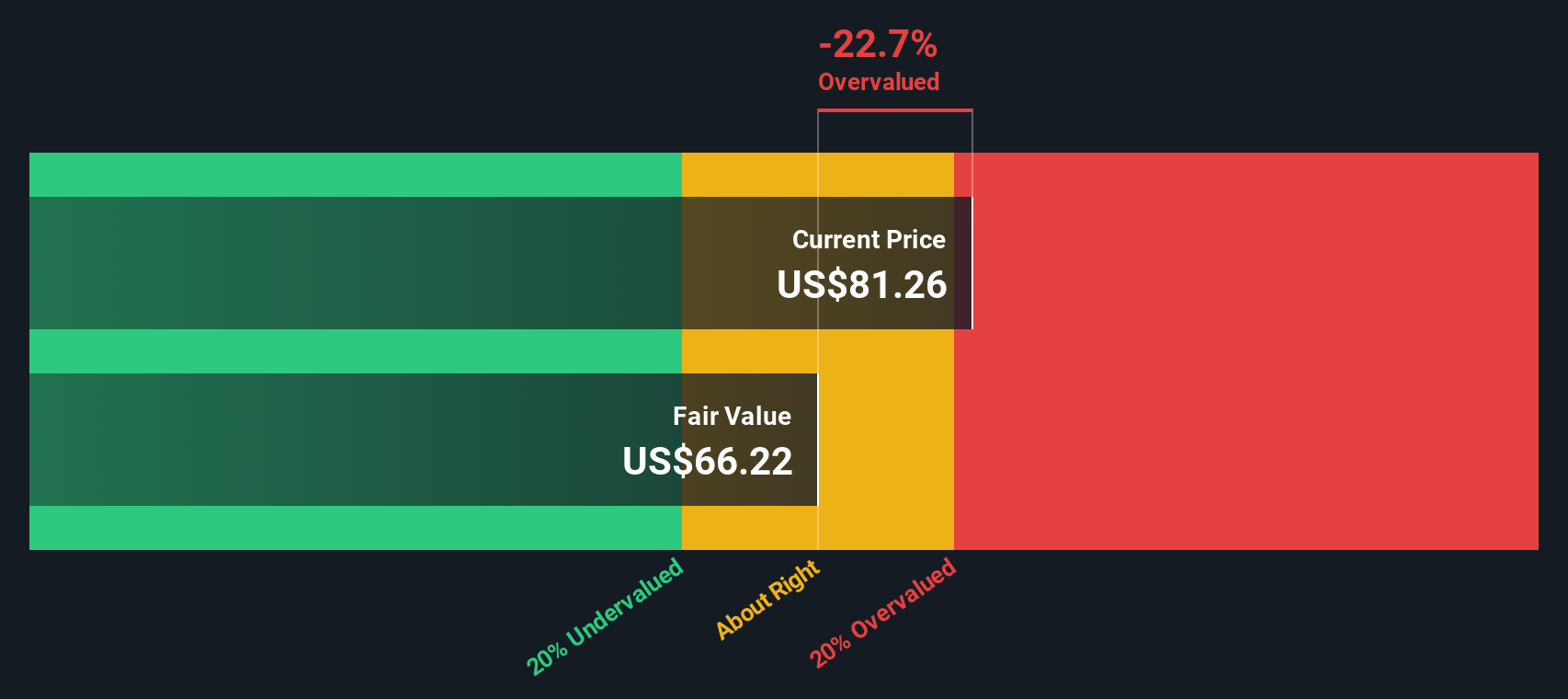

While the narrative fair value points to upside, our DCF model paints a cooler picture. It indicates Xcel’s fair value is closer to $65.67 versus a $74.09 share price, suggesting the stock is slightly overvalued. Is the market overpaying for growth and legal clarity, or is the model too cautious?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Xcel Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 904 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Xcel Energy Narrative

If this framework does not resonate, or you would rather dig into the numbers yourself, you can craft a complete view in minutes: Do it your way.

A great starting point for your Xcel Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunities with targeted stock ideas built around growth, income, and innovation, all filtered through the Simply Wall St Screener.

- Capture resilient cash generators with reliable payouts by scanning these 10 dividend stocks with yields > 3% that can anchor your portfolio through shifting interest rate cycles.

- Ride the next wave of innovation by zeroing in on these 24 AI penny stocks positioned at the heart of automation, data intelligence, and productivity transformation.

- Position yourself ahead of the crowd by hunting for mispriced opportunities across these 904 undervalued stocks based on cash flows that the market has not fully recognized yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal