Range Resources (RRC): Valuation Check as Institutions Boost Stakes and Cash Returns Grow

Institutional buyers are quietly leaning into Range Resources (RRC), with firms like Requisite Capital Management lifting their stakes as the company converts steady gas output into cash, buybacks, and dividends despite choppy commodity prices.

See our latest analysis for Range Resources.

That quiet buying spree is coming after a choppy stretch, with the share price at $35.25 and a roughly 8 percent one month share price pullback contrasting with a robust five year total shareholder return above 400 percent. This pattern suggests long term momentum is intact even as near term sentiment cools a bit.

If Range’s mix of cash generation and cyclicality has your attention, this could be a good moment to broaden your search and explore fast growing stocks with high insider ownership.

With profits rising faster than revenue, a double digit discount to analyst targets, and a hefty gap to some intrinsic estimates, investors have to ask: is Range still mispriced, or is Wall Street already baking in the next leg of growth?

Most Popular Narrative Narrative: 15.9% Undervalued

With Range Resources last closing at $35.25 against a narrative fair value near $41.91, the story hinges on durable gas demand and expanding margins.

Ongoing efficiency gains in drilling and completions and sustained reductions in per unit well costs are enabling Range to increase production guidance and lower capital spending. This directly expands margins and delivers stronger free cash flow even in a flatter commodity environment.

Want to see what kind of earnings runway justifies that higher value, even with only modest price assumptions, and how disciplined buybacks reshape the per share math?

Result: Fair Value of $41.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside case still hinges on smooth execution, with Appalachian infrastructure bottlenecks and softer than expected LNG linked demand both capable of derailing estimates.

Find out about the key risks to this Range Resources narrative.

Another Angle on Valuation

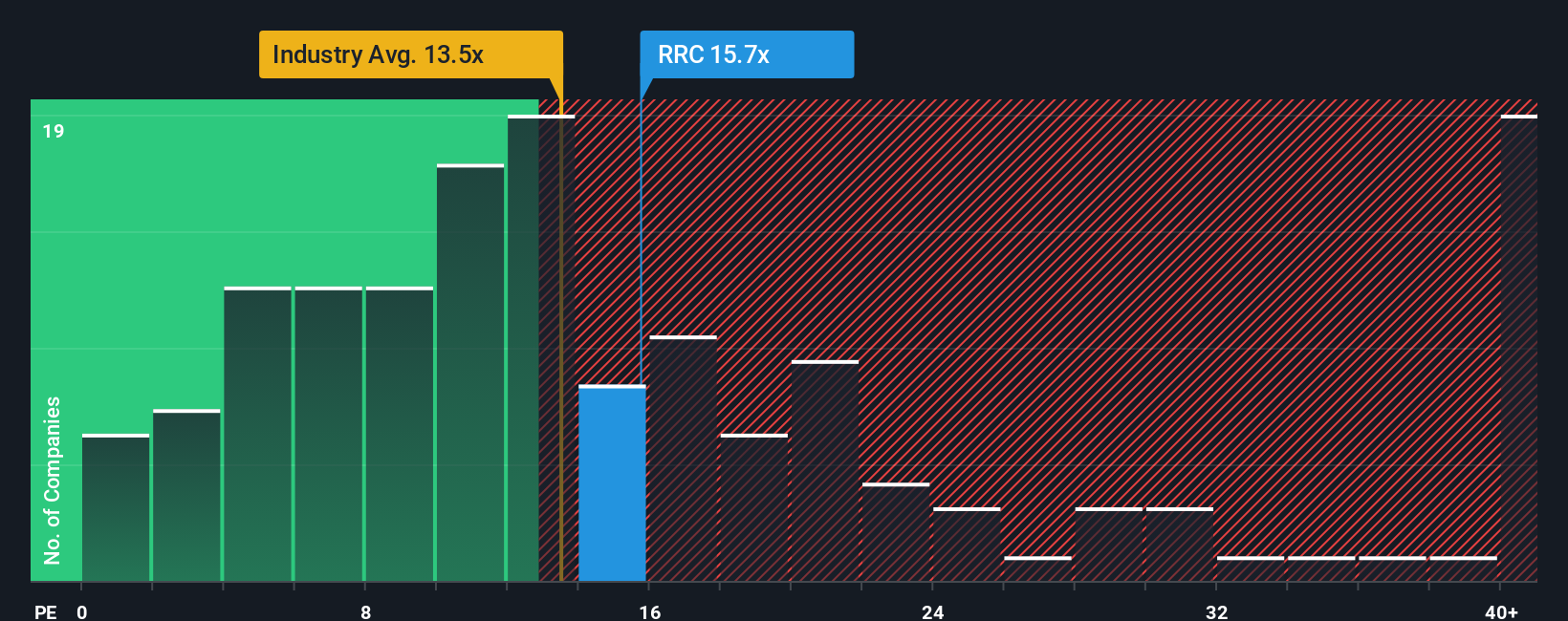

On earnings, the story looks different. Range trades on a 14.6x price to earnings ratio, richer than the US oil and gas industry at 12.9x but far below peers at 44x and under a 20.5x fair ratio implied by our work. This leaves a wedge between perceived safety and upside. Where do you think that gap closes?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Range Resources Narrative

If you see the numbers differently or want to stress test your own assumptions with the same toolkit, you can build a full narrative in just minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Range Resources.

Ready for your next investing move?

Do not stop at a single opportunity. Use the Simply Wall Street Screener to spot your next edge before the crowd locks in the best ideas.

- Capture growth potential early with these 24 AI penny stocks that are harnessing artificial intelligence to reshape entire industries and earnings trajectories.

- Strengthen your portfolio’s income stream through these 10 dividend stocks with yields > 3% that can help support returns even when markets turn volatile.

- Position yourself ahead of the market by targeting these 904 undervalued stocks based on cash flows that may be trading at meaningful discounts to their long term cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal