Arhaus (ARHS): Assessing Valuation After a 25% One-Month Share Price Rally

Arhaus (ARHS) has quietly delivered a strong past month, with the stock climbing about 25% as investors warm to its premium home furnishings model and steady double digit revenue and profit growth.

See our latest analysis for Arhaus.

That 24.8% 1 month share price return builds on a solid trend, with the year to date share price return of 24.1% and a 1 year total shareholder return of 22.2% pointing to gradually improving sentiment around Arhaus profitable growth story.

If Arhaus momentum has you thinking about where else the market might be re-rating quality stories, it could be worth exploring fast growing stocks with high insider ownership as a way to spot the next wave of potential winners.

But with shares now trading slightly above analyst targets and well ahead of the market over the past year, is Arhaus still flying under the radar, or is the recent rally already pricing in its future growth?

Most Popular Narrative: 4.1% Overvalued

With Arhaus last closing at $11.69 against a narrative fair value of about $11.23, the story frames a moderately full valuation built on steady growth assumptions and resilient margins.

The successful execution of showroom expansion in both mature and underpenetrated markets, paired with high contribution margin design studio concepts and a growing national footprint, creates a significant runway for revenue growth and EBITDA margin improvement as Arhaus gains market share in a fragmented industry.

Curious how mid single digit growth, stable margins, and a richer future earnings multiple can still justify today premium price tag? The narrative unpacks the delicate balance between long term expansion, margin resilience, and a valuation usually reserved for faster growing names. Want to see which specific revenue and earnings milestones have to line up for this story to work?

Result: Fair Value of $11.23 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering macro uncertainty and heavy U.S. centric expansion mean that any sustained demand slowdown or weaker showroom productivity could quickly challenge these optimistic assumptions.

Find out about the key risks to this Arhaus narrative.

Another Angle on Valuation

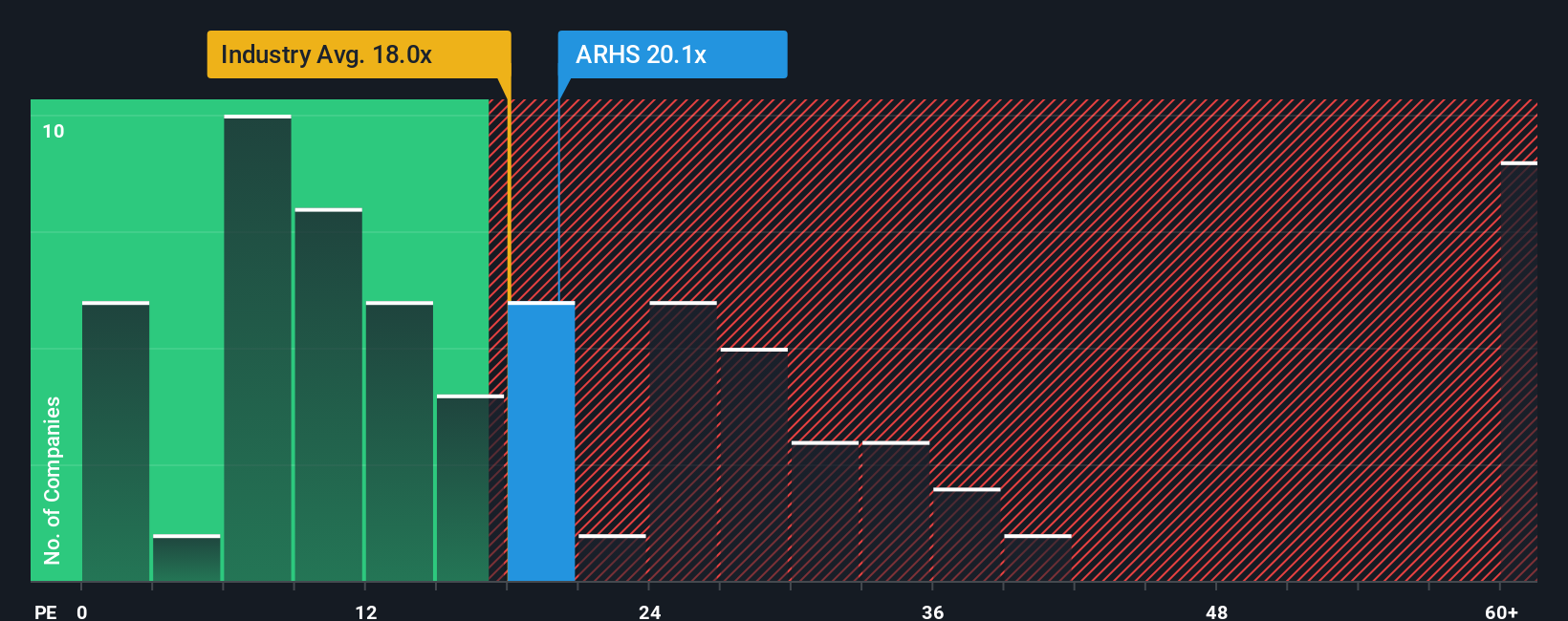

While the narrative fair value suggests Arhaus is only modestly overvalued, its 22.4x earnings multiple paints a starker picture, sitting above the US Specialty Retail average of 19.9x and well ahead of a 14.6x fair ratio that the market could eventually gravitate toward.

That gap implies limited room for error if growth underwhelms, raising the risk of de rating rather than further upside from here. Is the recent share price strength a sign of durable confidence, or a point where expectations have quietly crept too high?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Arhaus Narrative

If this perspective does not quite match your own, or you prefer to dig through the numbers yourself, you can shape a full narrative in just a few minutes, Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Arhaus.

Ready for more investing ideas?

Do not stop with a single stock. Use the Simply Wall Street Screener now to identify clear opportunities before the broader market focuses on the same ideas.

- Capture potential multi baggers early by tracking these 3630 penny stocks with strong financials that already have robust financial underpinnings instead of fragile hype.

- Explore opportunities in automation, medical imaging, and predictive analytics through these 29 healthcare AI stocks that combine innovation with current healthcare needs.

- Position your income portfolio for stronger cash flow by focusing on these 10 dividend stocks with yields > 3% that aim to balance attractive yields with sustainable payout ratios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal