Riot Platforms (RIOT): Valuation Check After Record Results, Bitcoin’s Surge and Rising Institutional Interest

Riot Platforms (RIOT) has been in the spotlight after Bitcoin’s surge above $100,000 coincided with the company’s record revenue growth and ambitious data center expansion, drawing fresh institutional money and keeping analyst sentiment broadly constructive.

See our latest analysis for Riot Platforms.

At a share price of $13.92, Riot’s recent 7 day share price return of 7.41 percent and 33.08 percent year to date gain suggest momentum is rebuilding after a volatile stretch. Its 3 year total shareholder return of 323.10 percent shows how powerful sentiment can be when Bitcoin, fundamentals, and institutional interest all move in the same direction.

If Riot’s rebound has your attention, this could be a smart moment to explore high growth tech and AI stocks for other high growth, infrastructure heavy plays harnessing the same digital transformation tailwinds.

Yet with the stock still trading at a steep discount to analyst targets despite surging revenues and institutional inflows, investors now face a pivotal question: Is Riot undervalued, or is the market already pricing in its future growth?

Most Popular Narrative Narrative: 49.4% Undervalued

With Riot last closing at $13.92 against a narrative fair value of $27.50, the story frames today’s price as a deep discount to long term potential.

Riot's aggressive build out of a scalable data center business leverages its extensive, readily available power capacity in high demand regions, which positions the company to benefit from surging demand for AI and cloud computing infrastructure. This demand is expected to support higher revenue growth and improved valuation multiples over time.

Want to see what kind of revenue surge, margin shift, and future earnings multiple are baked into that upside call? The narrative’s math might surprise you.

Result: Fair Value of $27.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained Bitcoin price weakness or delays in filling new AI focused data centers could quickly challenge today’s upside assumptions and valuation optimism.

Find out about the key risks to this Riot Platforms narrative.

Another Angle on Valuation

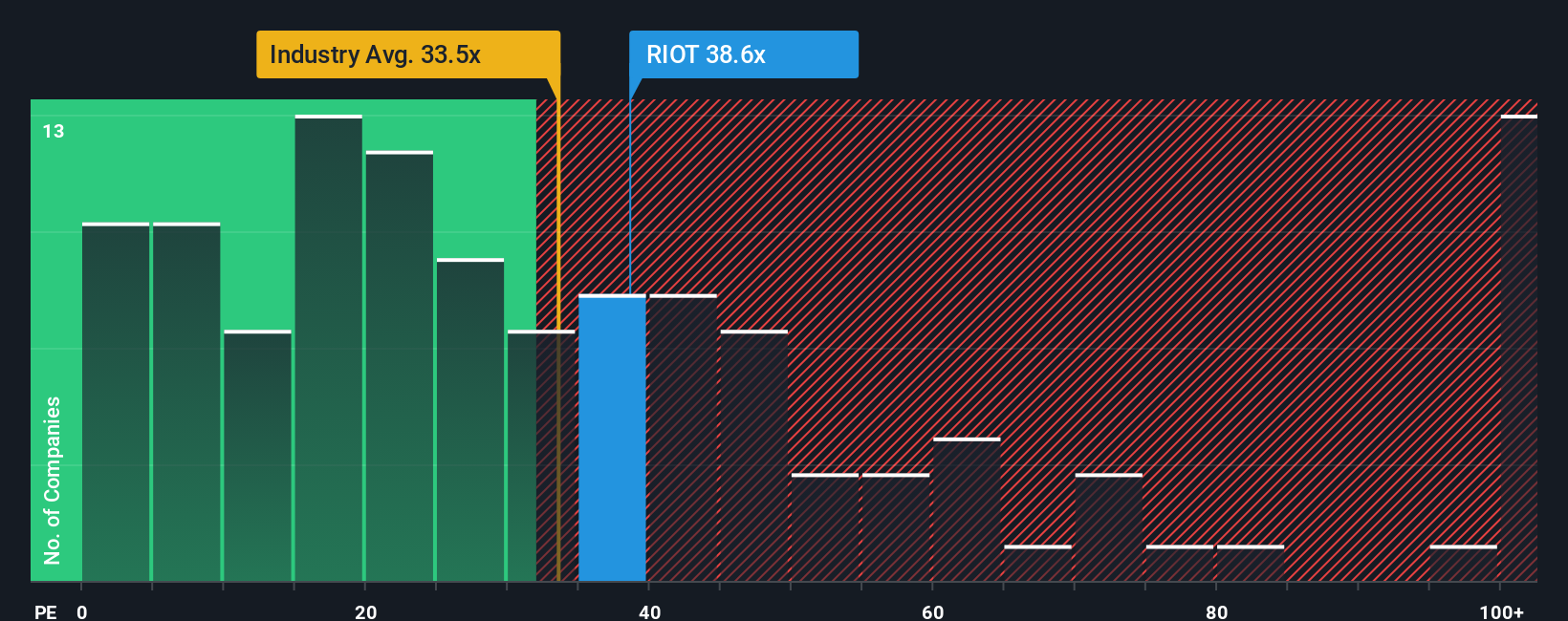

On earnings, the picture looks tougher. Riot trades on a 31.6 times price to earnings ratio, close to the US software average of 31.9 times but far above its 7.5 times fair ratio. This implies far less upside and far more execution risk than the narrative fair value suggests.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Riot Platforms Narrative

If you see Riot’s story differently or want to stress test the assumptions with your own inputs, you can build a custom view in minutes using Do it your way.

A great starting point for your Riot Platforms research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for your next investing edge?

Do not stop with a single idea. Use the Simply Wall St Screener to quickly uncover fresh, data backed opportunities that others will only notice later.

- Capture growth at the smaller end of the market by reviewing these 3630 penny stocks with strong financials with resilient balance sheets and improving fundamentals.

- Ride the compounding power of payouts by targeting these 10 dividend stocks with yields > 3% that can strengthen total returns even when markets churn.

- Position ahead of the next digital infrastructure wave through these 24 AI penny stocks tapping surging demand for real world AI applications.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal