Darling Ingredients (DAR): Valuation Check After Boosting 2025 Renewable Fuel Tax Credit Sales to $235 Million

Darling Ingredients (DAR) just bumped its 2025 tax credit sales to $235 million through its Diamond Green Diesel joint venture, signaling meaningful progress in turning its renewable fuel operations into upfront cash.

See our latest analysis for Darling Ingredients.

The renewed push to monetize renewable fuel tax credits seems to be resonating with investors, with a roughly 13% 90 day share price return off recent lows. However, the three year total shareholder return is still deeply negative, which points to a stock that is rebuilding momentum rather than riding a long term uptrend.

If this kind of transition story interests you, it could be worth scanning other niche players in traditional industries that are reshaping themselves through cleaner technologies and smarter capital allocation using fast growing stocks with high insider ownership.

With earnings recovering, a sizeable discount to analyst targets, and new cash from tax credit sales, investors now face a key question: Is Darling still mispriced, or has the market already baked in the next leg of growth?

Most Popular Narrative: 24.6% Undervalued

With Darling Ingredients closing at $35.45 versus a narrative fair value of $47, the story hinges on whether its earnings reset can truly stick.

Investments in operational efficiency and advanced processing technologies are enhancing rendering yields and product innovation, which, combined with strict capital discipline and deleveraging, are expected to improve net margins, boost free cash flow, and set the stage for renewed capital allocation (debt paydown, buybacks) when near term industry headwinds abate.

Want to see what kind of profit margins and earnings power could justify that gap to fair value? The narrative leans on a powerful combination: rising profitability, accelerating earnings, and a future valuation multiple that looks more like a compounder than a cyclical. Curious how those moving parts stack up over the next few years? Dive in to see the assumptions driving that $47 figure.

Result: Fair Value of $47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering regulatory uncertainty and margin pressure in renewable fuels could quickly undermine the bullish case if policy support or pricing recovery disappoints.

Find out about the key risks to this Darling Ingredients narrative.

Another Angle on Value

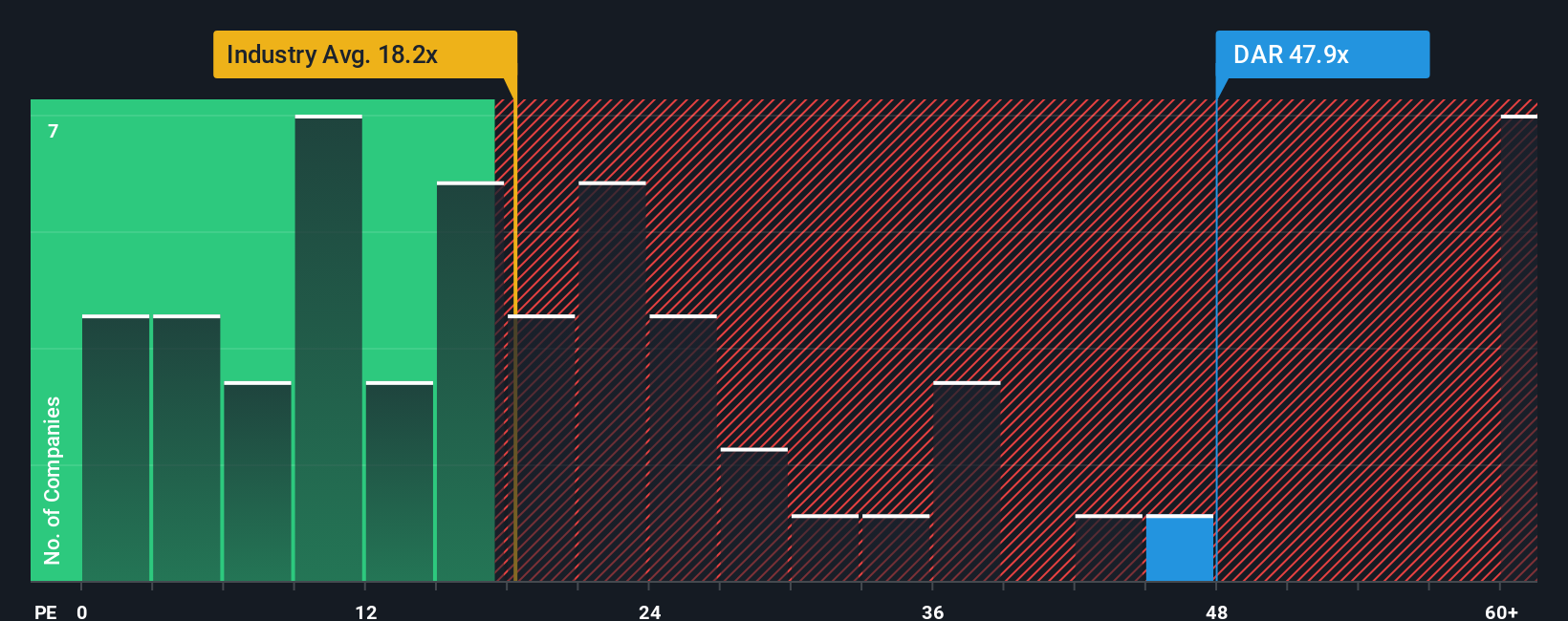

While the narrative fair value points to upside, today’s 52x earnings multiple versus 20.3x for the US Food industry and 17.2x for peers suggests Darling is richly priced on simple comparisons, even if its 59.1x fair ratio hints the market could stretch further. Is that a margin of safety or a valuation trap?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Darling Ingredients Narrative

If you see the story differently or want to stress test the assumptions with your own research, you can build a fresh view in under three minutes: Do it your way.

A great starting point for your Darling Ingredients research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, give yourself an edge by scanning targeted stock ideas built from real fundamentals, momentum, and structural trends across different corners of the market.

- Capitalize on mispriced cash generators by running through these 904 undervalued stocks based on cash flows that the market may be overlooking.

- Ride the next wave of intelligent automation by focusing on these 24 AI penny stocks at the intersection of data, software, and scalable platforms.

- Lock in potential income streams by hunting for these 10 dividend stocks with yields > 3% that can support returns even when markets turn choppy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal