UK Dividend Stocks To Consider In December 2025

As the FTSE 100 and FTSE 250 indices reflect challenges in the global market, particularly due to weak trade data from China, investors are navigating a complex landscape marked by fluctuating commodity prices and economic uncertainty. In such an environment, dividend stocks can offer a measure of stability and income potential, making them an attractive consideration for those looking to balance their portfolios amidst these broader market dynamics.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Treatt (LSE:TET) | 4.16% | ★★★★★☆ |

| Seplat Energy (LSE:SEPL) | 7.16% | ★★★★★☆ |

| RS Group (LSE:RS1) | 3.58% | ★★★★★☆ |

| MONY Group (LSE:MONY) | 6.83% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.10% | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | 7.98% | ★★★★★☆ |

| IG Group Holdings (LSE:IGG) | 3.60% | ★★★★★☆ |

| Hargreaves Services (AIM:HSP) | 5.64% | ★★★★★☆ |

| Begbies Traynor Group (AIM:BEG) | 3.84% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 4.55% | ★★★★★☆ |

Click here to see the full list of 48 stocks from our Top UK Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

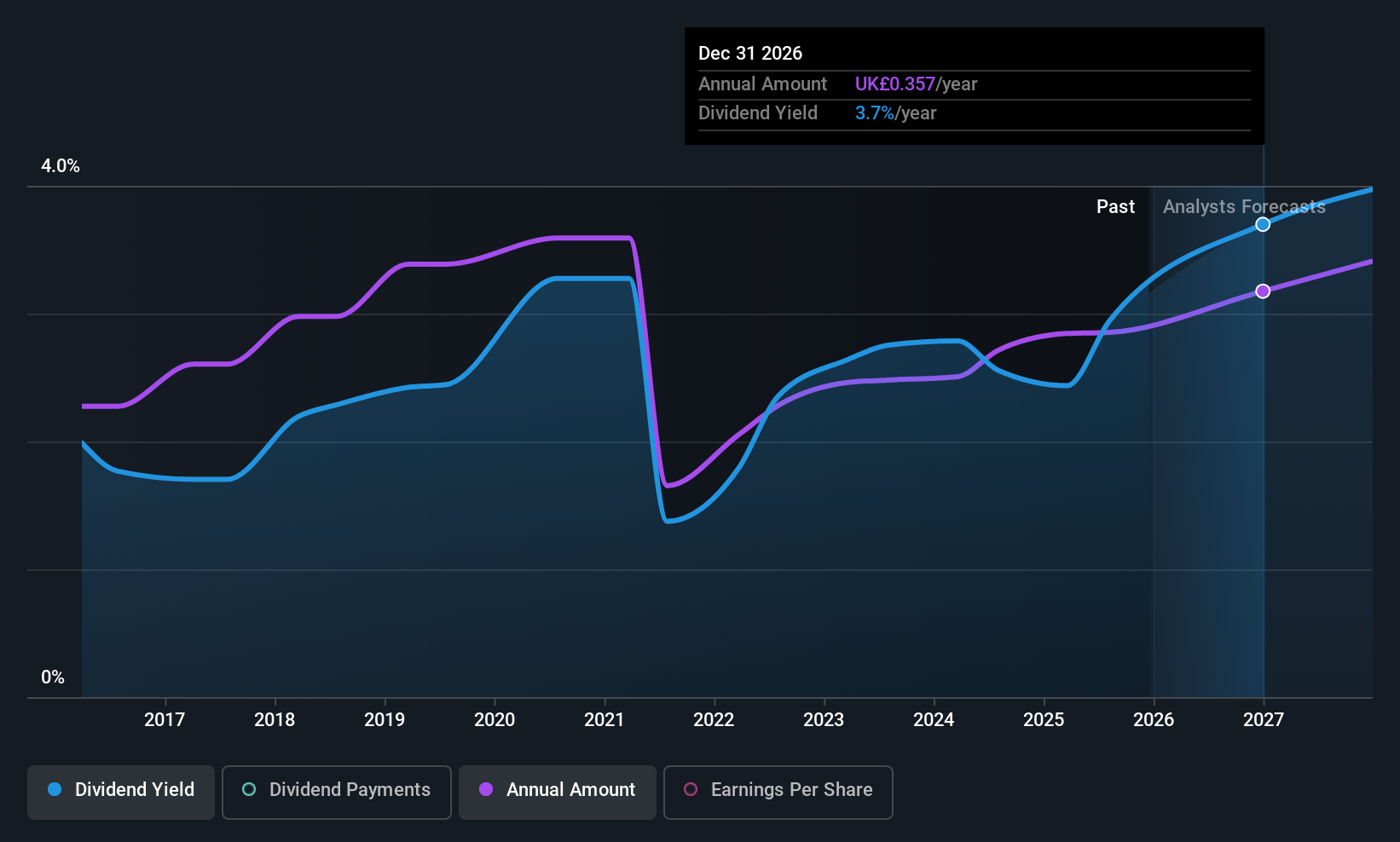

Nichols (AIM:NICL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nichols plc, along with its subsidiaries, supplies soft drinks to various industries including retail and wholesale across the UK, Middle East, Africa, and internationally, with a market cap of £352.53 million.

Operations: Nichols plc generates revenue through its Packaged segment, which accounts for £133.97 million, and its Out of Home segment, contributing £40.35 million.

Dividend Yield: 3.3%

Nichols plc's dividend payments are covered by both earnings and cash flows, with a payout ratio of 67% and a cash payout ratio of 54%. However, its dividend yield of 3.33% is lower than the top UK payers. Despite a history of volatility in dividends over the past decade, payouts have increased. The stock trades below estimated fair value and analyst targets suggest potential price appreciation. Recent leadership changes may influence strategic growth positively.

- Click to explore a detailed breakdown of our findings in Nichols' dividend report.

- Our valuation report unveils the possibility Nichols' shares may be trading at a discount.

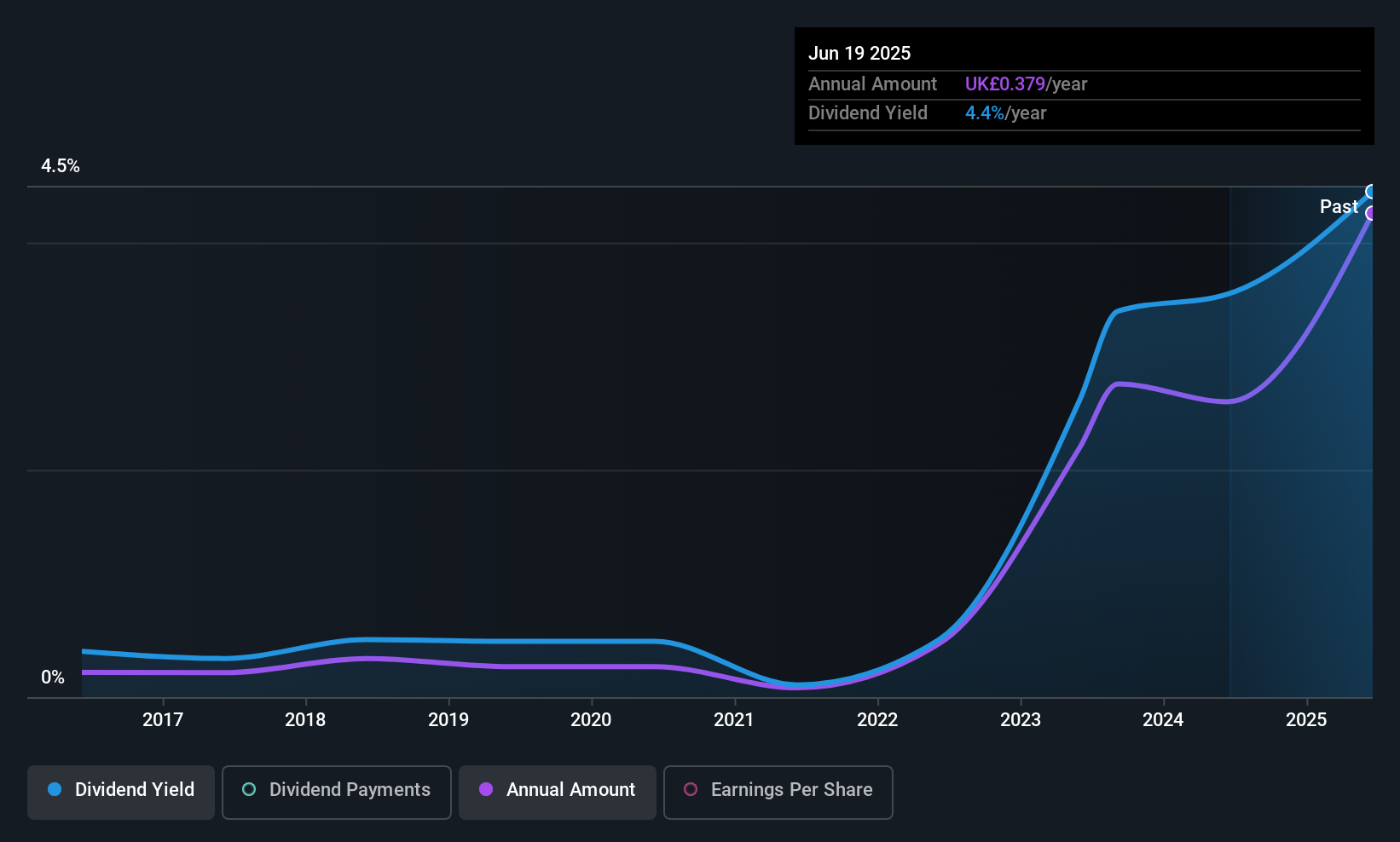

AEP Plantations (LSE:AEP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: AEP Plantations Plc, along with its subsidiaries, engages in the ownership, operation, and development of oil palm plantations in Indonesia and Malaysia, with a market capitalization of approximately £515.79 million.

Operations: AEP Plantations generates revenue from the cultivation of oil palm plantations, amounting to $436.63 million.

Dividend Yield: 4.2%

AEP Plantations, recently renamed from Anglo-Eastern Plantations Plc, declared a dividend of 37.3 cents per share, marking a return to payouts after none in 2024. Despite a lower yield compared to top UK dividend stocks, its dividends are well-covered by earnings and cash flows with payout ratios of 39.5% and 36.8%, respectively. However, the company's historical volatility in dividends raises concerns about stability despite recent growth in production and profits.

- Navigate through the intricacies of AEP Plantations with our comprehensive dividend report here.

- Our valuation report here indicates AEP Plantations may be undervalued.

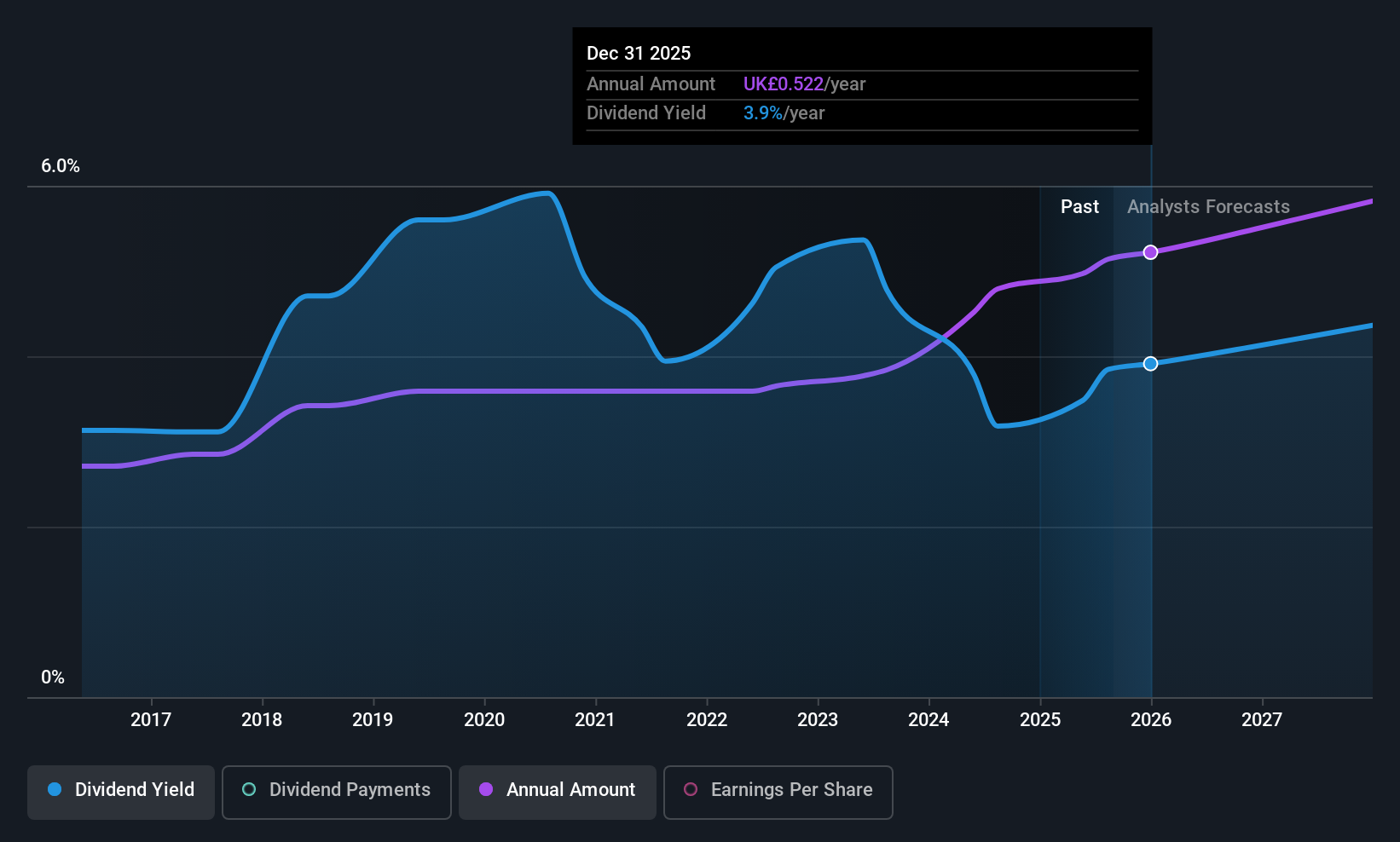

Keller Group (LSE:KLR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Keller Group plc offers specialist geotechnical services across North America, Europe, the Middle East, and the Asia-Pacific, with a market cap of approximately £1.15 billion.

Operations: Keller Group plc generates revenue of £2.95 billion from its specialist geotechnical services provided in various regions globally.

Dividend Yield: 3.1%

Keller Group's dividends have been stable and growing over the past decade, supported by a low payout ratio of 26.4% from earnings and 35.3% from cash flows, ensuring sustainability. Although its yield of 3.1% is below the top UK dividend payers, it trades at a significant discount to its estimated fair value, presenting good relative value compared to peers. Recent earnings growth further supports its reliable dividend payments without volatility concerns.

- Click here to discover the nuances of Keller Group with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Keller Group shares in the market.

Key Takeaways

- Embark on your investment journey to our 48 Top UK Dividend Stocks selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal