The Bull Case For OceanaGold (TSX:OGC) Could Change Following Waihi North Mine Approval - Learn Why

- OceanaGold has received final approval from New Zealand’s Expert Panel to develop and operate the Waihi North Project, including the high-grade Wharekirauponga Underground mine, associated surface infrastructure, plant expansions, and a new tailings storage facility.

- This green light, alongside contractor appointments and early works already under way, effectively locks in a long-dated growth path for the Waihi district and OceanaGold’s New Zealand footprint.

- We’ll now examine how formal approval of Waihi North, especially the Wharekirauponga Underground development timeline, influences OceanaGold’s broader investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

OceanaGold Investment Narrative Recap

To own OceanaGold, you need to believe in its ability to convert a multi-asset gold portfolio into durable cash flow while managing operational and environmental complexity. The Waihi North approval reinforces the long-term New Zealand story but does little to change the more immediate focus on execution risks at Haile and Didipio, which still look like the key near term swing factors for margins and sentiment.

Against this backdrop, I think the recent uplift in 2025 production guidance to 450,000–520,000 ounces of gold, with 2026 guided higher again, is the most relevant context for Waihi North. The formal green light for Wharekirauponga does not feed into those numbers yet, but it underpins why some investors might see the current growth profile as extending well beyond the existing guidance window and why operational delivery at today’s mines remains so critical.

Yet the same severe weather and water related challenges that forced a redesign at Didipio remain an issue investors should be aware of...

Read the full narrative on OceanaGold (it's free!)

OceanaGold's narrative projects $2.2 billion revenue and $764.2 million earnings by 2028. This requires 12.7% yearly revenue growth and a $388.4 million earnings increase from $375.8 million today.

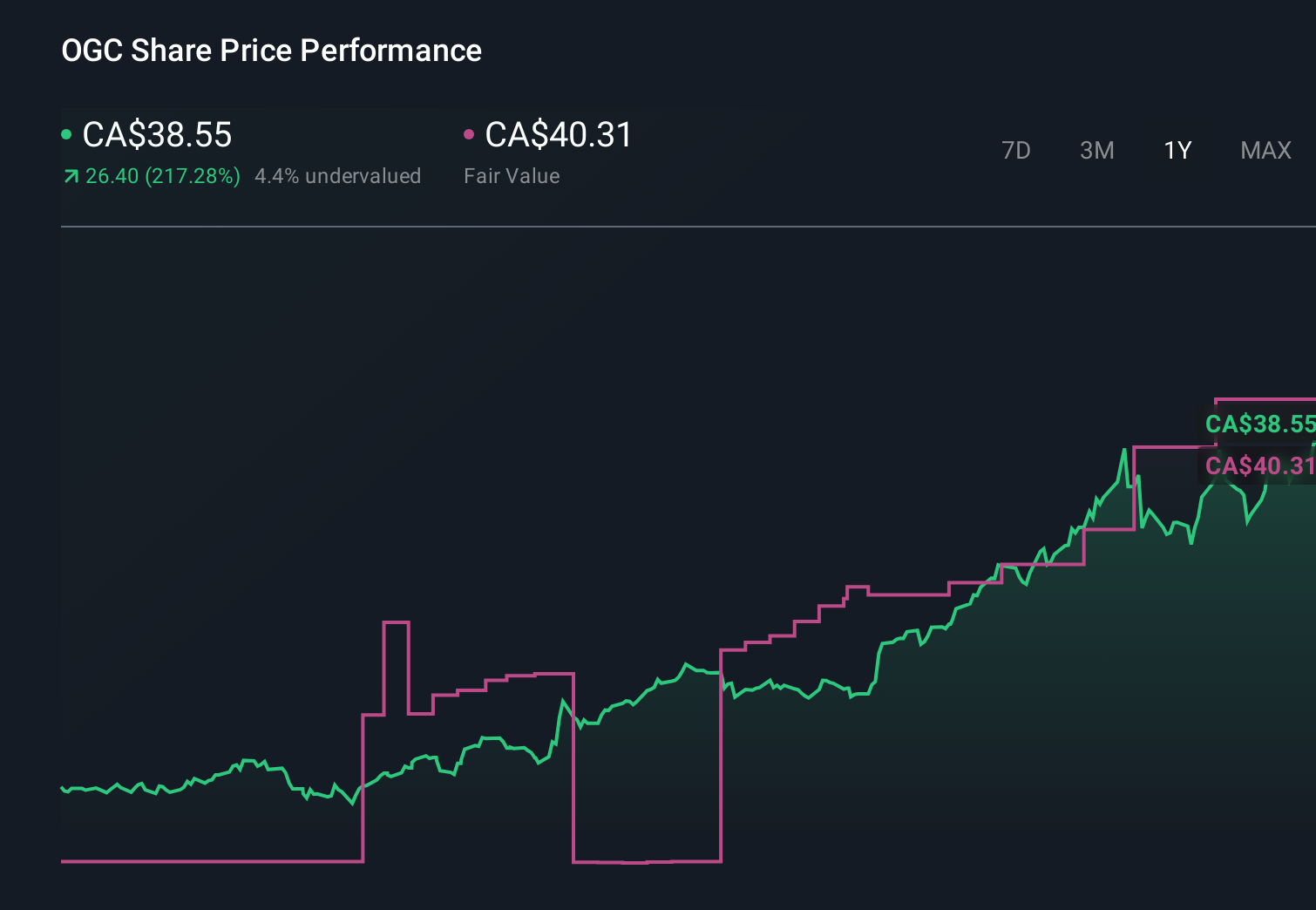

Uncover how OceanaGold's forecasts yield a CA$40.31 fair value, in line with its current price.

Exploring Other Perspectives

Eight fair value estimates from the Simply Wall St Community span roughly CA$5.87 to CA$145.18 per share, showing how far apart individual views can be. Set against that wide range, the long lead time and execution risk embedded in projects like Wharekirauponga give you another reason to compare several perspectives before deciding how OceanaGold might fit in your portfolio.

Explore 8 other fair value estimates on OceanaGold - why the stock might be worth less than half the current price!

Build Your Own OceanaGold Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OceanaGold research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free OceanaGold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OceanaGold's overall financial health at a glance.

No Opportunity In OceanaGold?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal