3 European Penny Stocks With Market Caps Over €30M To Watch

The European market has recently shown signs of steady economic growth, with major stock indexes rising and the pan-European STOXX Europe 600 Index ending 1.60% higher. This positive momentum, coupled with looser monetary policies, highlights a fertile ground for exploring investment opportunities in lesser-known areas such as penny stocks. Although the term "penny stocks" may seem outdated, these smaller or newer companies often present unique growth opportunities at lower price points. By focusing on those with robust financials and a clear growth trajectory, investors can uncover potential gems within this segment of the market.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.518 | €1.56B | ✅ 4 ⚠️ 3 View Analysis > |

| Orthex Oyj (HLSE:ORTHEX) | €4.75 | €84.35M | ✅ 4 ⚠️ 1 View Analysis > |

| Mistral Iberia Real Estate SOCIMI (BME:YMIB) | €1.05 | €22.87M | ✅ 2 ⚠️ 4 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €221.21M | ✅ 3 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.10 | €65.75M | ✅ 3 ⚠️ 3 View Analysis > |

| Hultstrom Group (OM:HULT B) | SEK3.00 | SEK182.52M | ✅ 2 ⚠️ 2 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.37 | €386.24M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.265 | €313.07M | ✅ 3 ⚠️ 1 View Analysis > |

| Dovre Group (HLSE:DOV1V) | €0.0718 | €7.72M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 296 stocks from our European Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

ABIONYX Pharma (ENXTPA:ABNX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: ABIONYX Pharma SA is a biotech company focused on discovering and developing therapies for renal and ophthalmological diseases, with a market cap of €121.37 million.

Operations: ABIONYX Pharma SA has not reported any revenue segments.

Market Cap: €121.37M

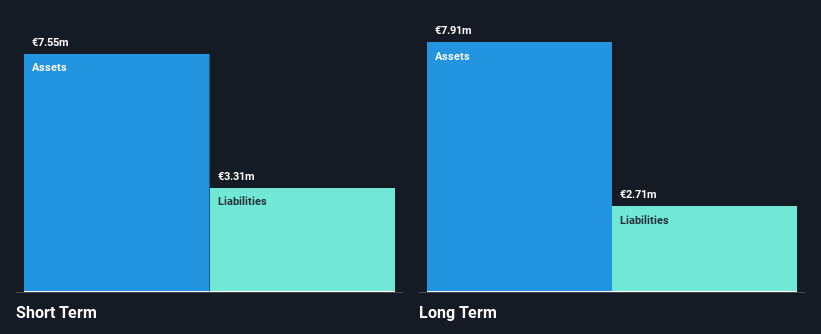

ABIONYX Pharma, a biotech firm with a market cap of €121.37 million, remains pre-revenue but has shown recent developments that could impact its future trajectory. The company recently raised €1.8 million through a follow-on equity offering and reported third-quarter revenue of €3.06 million, indicating some financial activity despite its pre-revenue status in prior periods. Strategic alliances with SEBIA and IHU SEPSIS highlight ABIONYX's focus on sepsis treatment innovation, potentially enhancing its scientific credibility and market positioning. However, the firm faces challenges such as high volatility and ongoing unprofitability, with earnings forecasted to decline over the next three years.

- Dive into the specifics of ABIONYX Pharma here with our thorough balance sheet health report.

- Explore ABIONYX Pharma's analyst forecasts in our growth report.

MEMSCAP (ENXTPA:MEMS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: MEMSCAP, S.A. offers micro-electro-mechanical systems (MEMS) based solutions across aerospace and defense, optical communications, medical, and biomedical sectors globally with a market cap of €32.70 million.

Operations: MEMSCAP, S.A. does not report specific revenue segments.

Market Cap: €32.7M

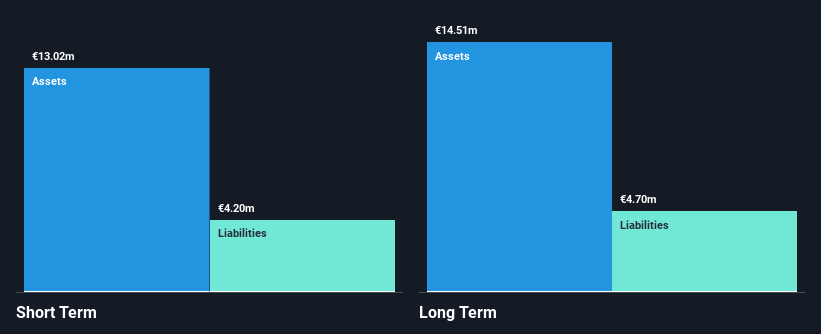

MEMSCAP, S.A., with a market cap of €32.70 million, has demonstrated stable financial performance despite recent earnings setbacks. The company reported Q3 2025 sales of €2.62 million and net income of €0.176 million, slightly down from the previous year. Its strategic partnership with Parker Hannifin Corporation in aerospace fluidic systems highlights its potential growth in high-precision pressure sensing solutions for aerospace applications—a sector valued at several hundreds of millions annually. While MEMSCAP's profit margins have decreased recently, it maintains a satisfactory debt level and stable weekly volatility, positioning it as a promising yet cautious investment opportunity within penny stocks.

- Click here to discover the nuances of MEMSCAP with our detailed analytical financial health report.

- Learn about MEMSCAP's future growth trajectory here.

Anora Group Oyj (HLSE:ANORA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Anora Group Oyj is involved in the production, importation, marketing, distribution, and sale of alcoholic beverages across Finland, Europe, and internationally with a market cap of €250.62 million.

Operations: Anora Group Oyj generates its revenue from three main segments: Wine (€310.3 million), Spirits (€218.2 million), and Industrial (€226.2 million).

Market Cap: €250.62M

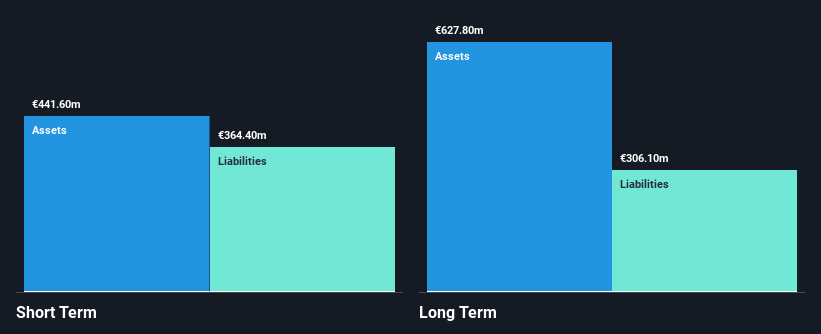

Anora Group Oyj, with a market cap of €250.62 million, has shown improved financial stability and profitability recently. Its earnings have turned positive, though past five-year profits declined significantly. The company’s debt is well managed, supported by operating cash flow covering 25.6% of its debt and a reduced debt-to-equity ratio from 78.2% to 46.9%. Anora's short-term assets exceed both short and long-term liabilities, indicating strong liquidity positions. Despite these strengths, the dividend yield of 5.93% is not well covered by earnings, suggesting caution for income-focused investors amidst recent board changes enhancing governance dynamics.

- Click to explore a detailed breakdown of our findings in Anora Group Oyj's financial health report.

- Gain insights into Anora Group Oyj's future direction by reviewing our growth report.

Seize The Opportunity

- Take a closer look at our European Penny Stocks list of 296 companies by clicking here.

- Want To Explore Some Alternatives? We've found 10 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal