Exploring Gimv And 2 Other Undiscovered Gems In Europe

As the European market experiences a rise in major stock indexes, buoyed by signs of steady economic growth and looser monetary policy, investors are increasingly on the lookout for promising opportunities within this dynamic landscape. In such an environment, identifying stocks that exhibit strong fundamentals and potential for growth becomes crucial; these qualities can often be found in lesser-known companies poised to benefit from favorable economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| FRoSTA | 5.37% | 4.80% | 13.56% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Evergent Investments | 3.63% | 11.51% | 22.05% | ★★★★★☆ |

| KABE Group AB (publ.) | 3.82% | 3.46% | 5.42% | ★★★★★☆ |

| Freetrailer Group | 38.17% | 23.13% | 31.09% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| VNV Global | 15.38% | -18.33% | -18.19% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Gimv (ENXTBR:GIMB)

Simply Wall St Value Rating: ★★★★★☆

Overview: Gimv NV is a private equity and venture capital firm that focuses on direct and fund of funds investments, with a market capitalization of €1.63 billion.

Operations: Gimv generates revenue from various segments, with Sustainable Cities contributing €143.02 million and Smart Industries providing €34.19 million. The Health & Care segment, excluding Life Sciences, adds €48.73 million to the revenue stream.

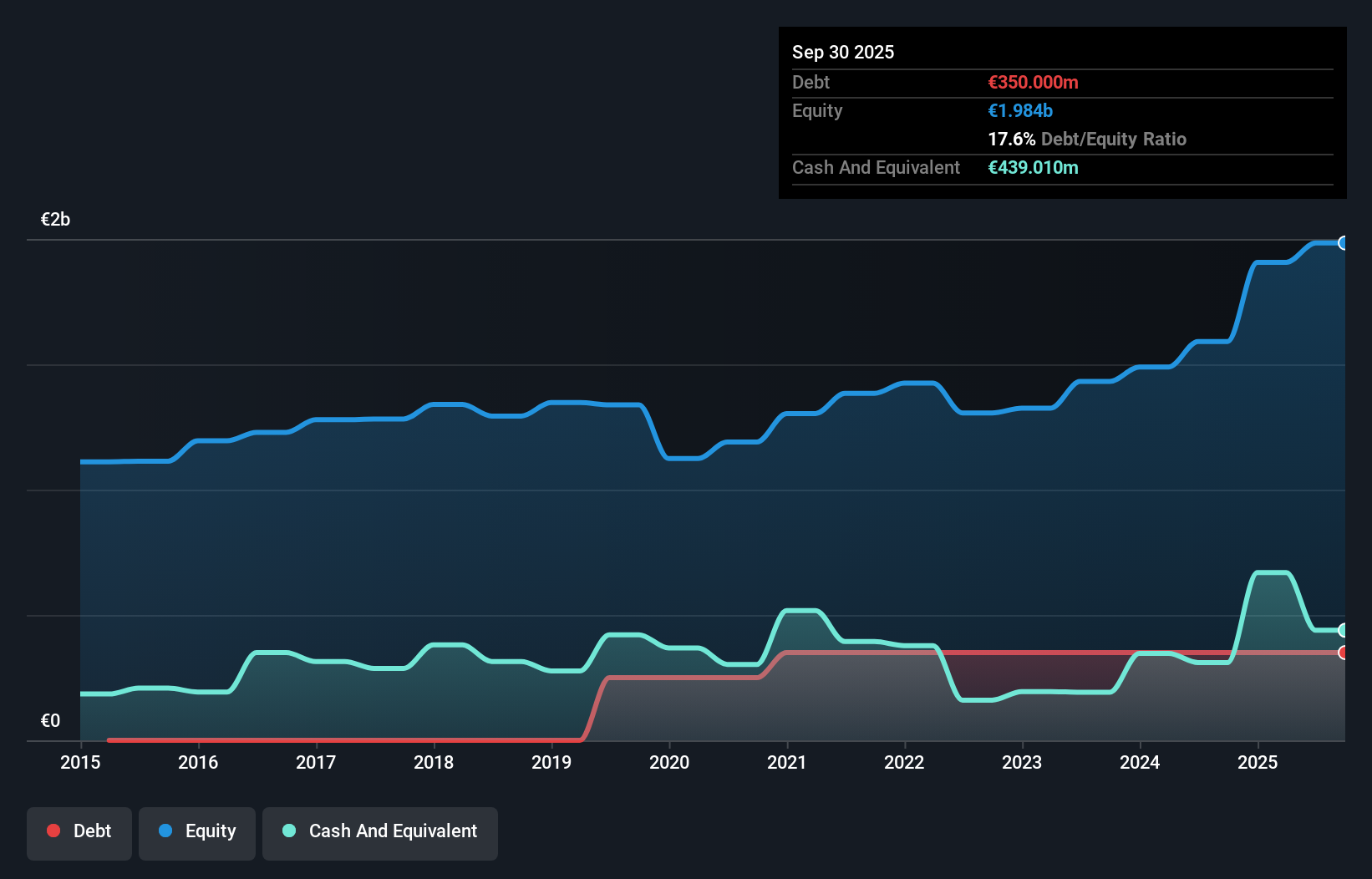

Gimv, a notable player in the European market, has been trading at 48.1% below its estimated fair value, presenting an intriguing opportunity for investors. Over the past five years, it reduced its debt to equity ratio from 21% to 17.6%, reflecting improved financial health despite recent shareholder dilution. The company reported net income of €126.93 million for the half year ending September 2025, down from €144.87 million in the previous year; basic earnings per share also decreased to €3.53 from €5.15 a year ago. While negative earnings growth of -1.4% contrasts with industry averages, Gimv's high-quality past earnings and sufficient interest coverage suggest resilience amidst challenges.

- Delve into the full analysis health report here for a deeper understanding of Gimv.

Evaluate Gimv's historical performance by accessing our past performance report.

Norconsult (OB:NORCO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Norconsult ASA is a consultancy firm specializing in community planning, engineering design, and architecture across the Nordics and internationally, with a market capitalization of NOK14.06 billion.

Operations: The company generates revenue primarily from its operations in Norway, Sweden, and Denmark, with the Norway Head Office contributing NOK3.33 billion and the Norway Regions adding NOK2.99 billion. The Renewable Energy segment accounts for NOK971 million, while Digital and Techno-Garden bring in NOK1.10 billion.

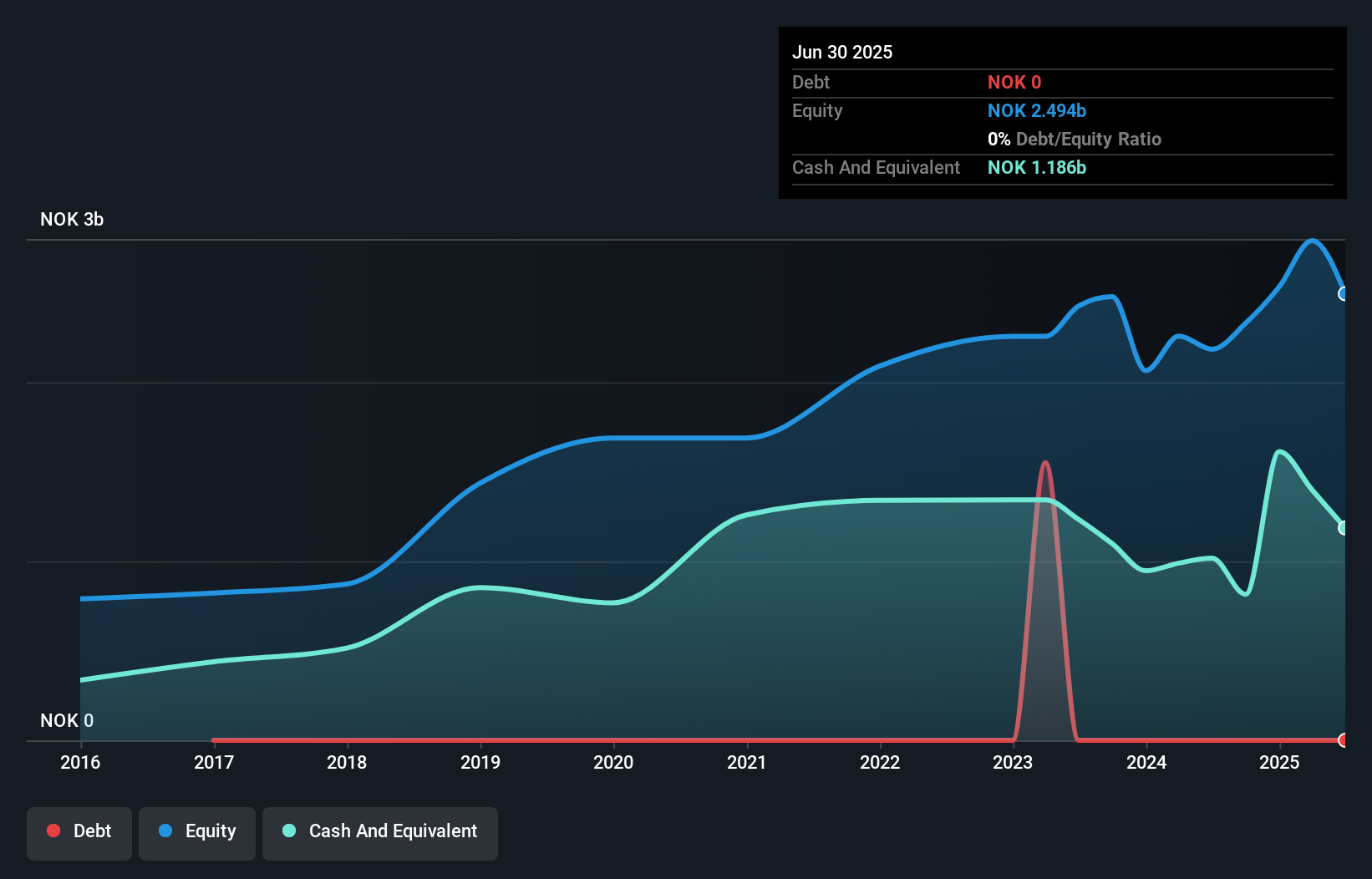

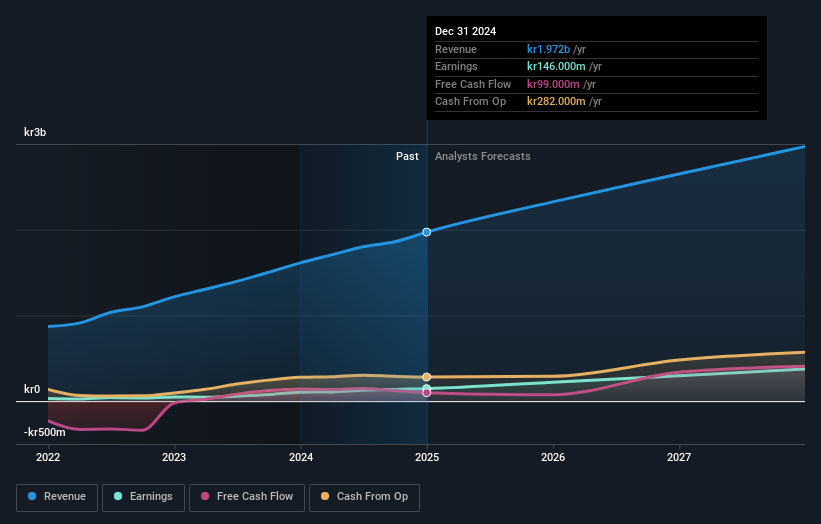

Norconsult, a notable player in the European engineering consultancy sector, is making waves with its robust financial performance and strategic projects. Over the past year, earnings surged by 92.1%, outpacing industry growth and reflecting high-quality earnings. The company's net debt to equity ratio stands at a satisfactory 2.9%, indicating prudent financial management. Recent client announcements highlight Norconsult's contract with Norsk Hydro for the Illvatn hydropower plant project, poised to generate 107 GWh of renewable power annually. With third-quarter sales reaching NOK 2,467 million and net income at NOK 132 million, Norconsult continues to demonstrate impressive growth potential in its niche market.

- Get an in-depth perspective on Norconsult's performance by reading our health report here.

Gain insights into Norconsult's historical performance by reviewing our past performance report.

Dynavox Group (OM:DYVOX)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Dynavox Group AB (publ) focuses on developing and selling assistive technology products for individuals with impaired communication skills, with a market capitalization of SEK11.08 billion.

Operations: Dynavox Group generates revenue primarily from its Computer Hardware segment, amounting to SEK2.38 billion. The company's financial performance can be analyzed through its gross profit margin, which reflects the profitability of its core operations.

Dynavox Group, a tech player with promising potential, has shown resilience despite challenges. The company reported SEK 606 million in sales for Q3 2025, up from SEK 483 million the previous year, though net income dipped slightly to SEK 38 million. Over nine months, sales rose to SEK 1.79 billion from SEK 1.39 billion year-on-year while net income was relatively stable at SEK 90 million. Despite a high net debt to equity ratio of 134.9%, its interest payments are well covered by EBIT at a multiple of 5.2x, and earnings grew by nearly five percent last year compared to the industry’s decline of -12.5%. Trading below its estimated fair value suggests room for growth as earnings are forecasted to increase significantly annually by over thirty-eight percent.

- Unlock comprehensive insights into our analysis of Dynavox Group stock in this health report.

Assess Dynavox Group's past performance with our detailed historical performance reports.

Taking Advantage

- Explore the 304 names from our European Undiscovered Gems With Strong Fundamentals screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal