Assessing ABB (SWX:ABBN) Valuation After New Canadian Space Agency ALExIS Spectrometer Contract

ABB (SWX:ABBN) just landed a new contract with the Canadian Space Agency to design the ALExIS infrared spectrometer for Canada’s upcoming lunar rover, putting its space instrumentation credentials firmly in the spotlight for investors.

See our latest analysis for ABB.

The ALExIS win comes on top of a solid run, with ABB’s share price up meaningfully this year and a strong multi year total shareholder return suggesting momentum is still building rather than fading.

If this space contract has piqued your interest in what other industrial innovators are doing, it is worth exploring aerospace and defense stocks as a way to spot similar opportunities.

Yet with ABB trading above the average analyst target and screens flagging the shares as expensive on intrinsic value, investors have to ask whether this momentum story still merits attention or if future growth is already reflected in the price.

Most Popular Narrative: 4.8% Overvalued

With ABB shares last closing at CHF59.14 against a narrative fair value near CHF56.44, the valuation debate hinges on whether medium term growth can fully validate today’s premium.

The analysts have a consensus price target of CHF51.106 for ABB based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CHF65.13, and the most bearish reporting a price target of just CHF36.98.

Want to see what justifies paying up for an industrial name? This narrative leans on rising margins, steady growth, and a valuation multiple usually reserved for higher growth sectors. Curious which specific profit, revenue, and earnings paths underpin that stance, and how a single discount rate ties it all together? The full story connects those assumptions into one cohesive fair value roadmap.

Result: Fair Value of $56.44 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat outlook could unravel if Chinese demand stays weak, or if aggressive local competition in robotics and automation squeezes ABB’s pricing power.

Find out about the key risks to this ABB narrative.

Another Angle On Valuation

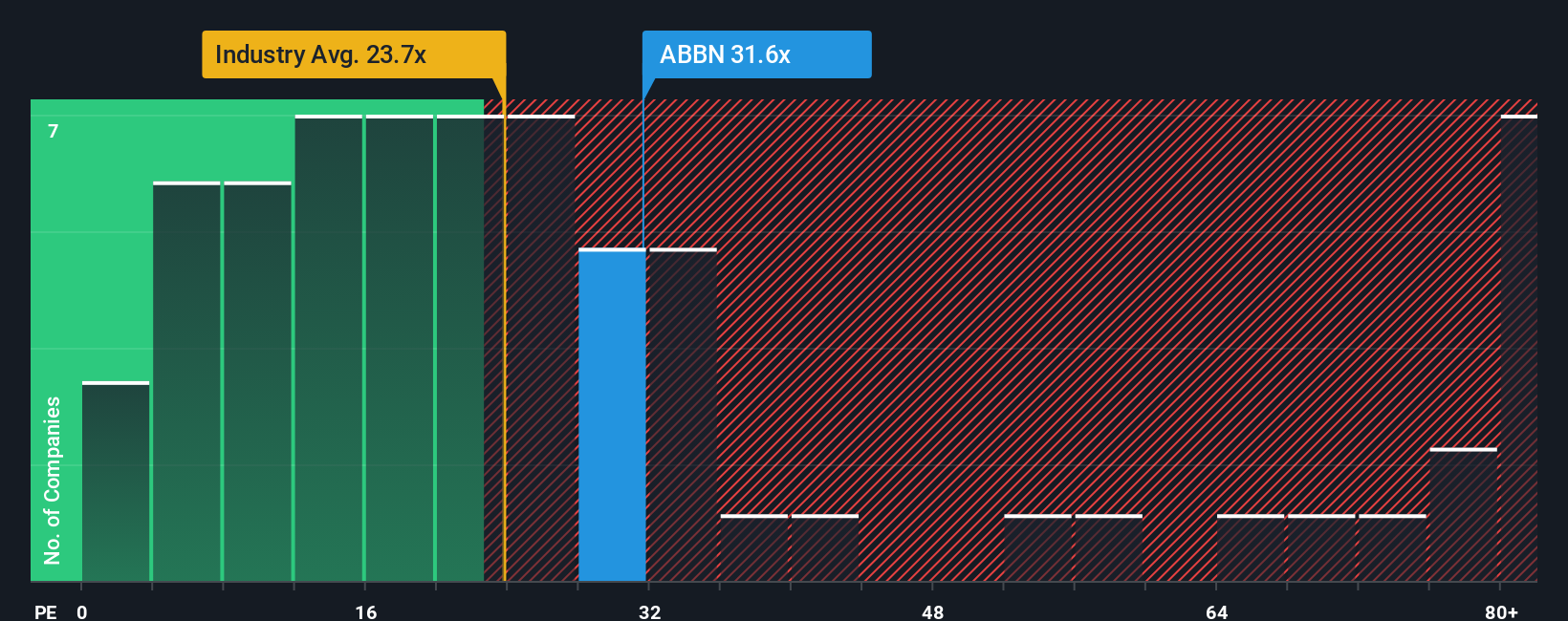

Step away from narrative fair value and the earnings multiple paints a sharper picture. ABB trades on 30.7 times earnings versus 24.2 times for the European electrical sector and 27.9 times for peers, while our fair ratio sits even higher at 36.7 times, suggesting meaningful valuation tension rather than a clear bargain. Which of these signals do you trust most?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ABB Narrative

If you think the outlook should look different, or want to crunch the numbers yourself, you can shape a custom view in minutes: Do it your way.

A great starting point for your ABB research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Use the Simply Wall Street Screener to uncover fresh opportunities right now, before the broader market catches on and pushes prices beyond attractive entry points.

- Capitalize on mispriced potential by checking out these 904 undervalued stocks based on cash flows that currently trade below what their cash flows suggest they are worth.

- Ride the next wave of innovation by targeting these 24 AI penny stocks positioned to benefit from accelerating adoption of artificial intelligence.

- Boost your portfolio income by focusing on these 10 dividend stocks with yields > 3% that combine attractive yields with the potential for long term stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal