Does Ford’s US$19.5 Billion EV Pivot Reshape The Bull Case For Ford Motor (F)?

- In December 2025, Ford Motor outlined a major overhaul of its Ford+ plan, redirecting capital away from select larger electric vehicles where the business case has weakened and recording about US$19.50 billion in special items, while also reshaping its EV manufacturing footprint through a planned exit from the BlueOval SK joint venture in Kentucky and adjusting its global van lineup.

- Behind the headlines, Ford is doubling down on a flexible Universal EV Platform for smaller, more affordable models, expanding hybrids and extended-range EVs, and using AI-driven tools like the Wings platform rollout in South America to improve operational execution and local market fit.

- We’ll now examine how Ford’s US$19.50 billion capital redeployment and pivot toward hybrids and smaller EVs reshapes its investment narrative.

We've found 10 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Ford Motor Investment Narrative Recap

To own Ford today, you need to believe the company can translate its Ford+ overhaul into steadily higher, more resilient earnings while managing a complex transition across EVs, hybrids and ICE trucks. The US$19.50 billion in special items and capital redeployment sharpen this pivot but do not materially change the near term catalyst, which still centers on improving margins in Ford Pro and North American trucks. The biggest risk remains execution whiplash around Ford’s evolving electrification roadmap.

The December 15 Ford+ update is the key announcement here, as it clarifies how Ford is shifting away from select larger EVs toward its Universal EV Platform for smaller models, hybrids and extended range vehicles. This matters for the catalyst around operational efficiency and product mix, because the plan explicitly targets profitability improvements in Model e from 2026 while also aiming to support Ford Blue and Ford Pro earnings through a richer mix of trucks, vans and services.

But while Ford is tightening its plan, investors should be aware that recurring warranty and recall costs could still...

Read the full narrative on Ford Motor (it's free!)

Ford Motor's narrative projects $183.9 billion revenue and $6.6 billion earnings by 2028.

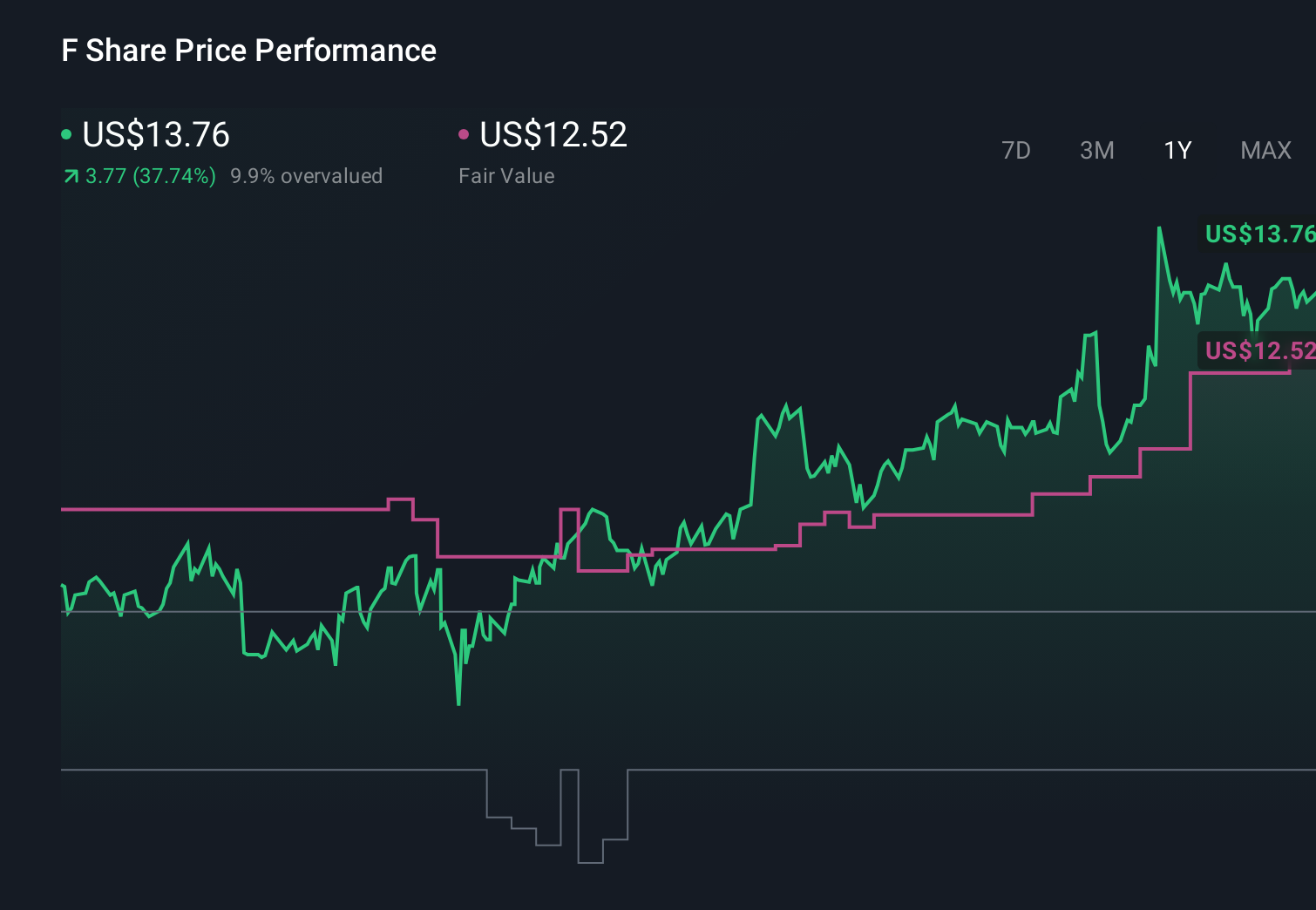

Uncover how Ford Motor's forecasts yield a $12.52 fair value, a 6% downside to its current price.

Exploring Other Perspectives

Thirteen members of the Simply Wall St Community currently see Ford’s fair value between US$8.00 and about US$15.67, reflecting very different expectations about its future. As you weigh those views, the company’s shifting electrification strategy and reliance on profitable trucks and SUVs could have a meaningful influence on how Ford’s performance ultimately unfolds.

Explore 13 other fair value estimates on Ford Motor - why the stock might be worth as much as 17% more than the current price!

Build Your Own Ford Motor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ford Motor research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Ford Motor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ford Motor's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal