Amer Sports (NYSE:AS) Valuation Check After 31% One-Year Gain and Strong Earnings Growth

Amer Sports stock reacts to improving fundamentals

Amer Sports (NYSE:AS) has been grinding higher this year, and the move is increasingly backed by fundamentals, with double digit revenue and earnings growth helping frame how investors think about the current valuation.

See our latest analysis for Amer Sports.

That steady backdrop helps explain why Amer Sports’ 1 year to date share price return of about 31 percent and roughly 31 percent 1 year total shareholder return suggest momentum is still building from growth investors rather than fading.

If strong execution in sportswear has your attention, it could be worth seeing what else is out there using our screen of fast growing stocks with high insider ownership.

With revenue and earnings climbing, and the share price still trading at a discount to analyst targets despite a strong run, is Amer Sports undervalued today or is the market already pricing in its next leg of growth?

Most Popular Narrative Narrative: 19.1% Undervalued

With Amer Sports last closing at $37.84 versus a narrative fair value estimate of $46.75, the storyline leans toward meaningful upside built on future earnings power.

The rapid global expansion of Salomon and Arc'teryx, especially their footwear and women's categories, driven by increased participation in outdoor and active lifestyles (particularly among younger and female consumers in APAC and EMEA) is creating significant white space growth opportunities and unlocking higher revenue and gross margin potential.

Curious how robust revenue growth, rising margins, and a rich future earnings multiple all fit together? Want to see the exact profit roadmap this narrative is betting on?

Result: Fair Value of $46.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on Asia Pacific demand and aggressive direct to consumer expansion could pressure margins and derail the upbeat earnings narrative.

Find out about the key risks to this Amer Sports narrative.

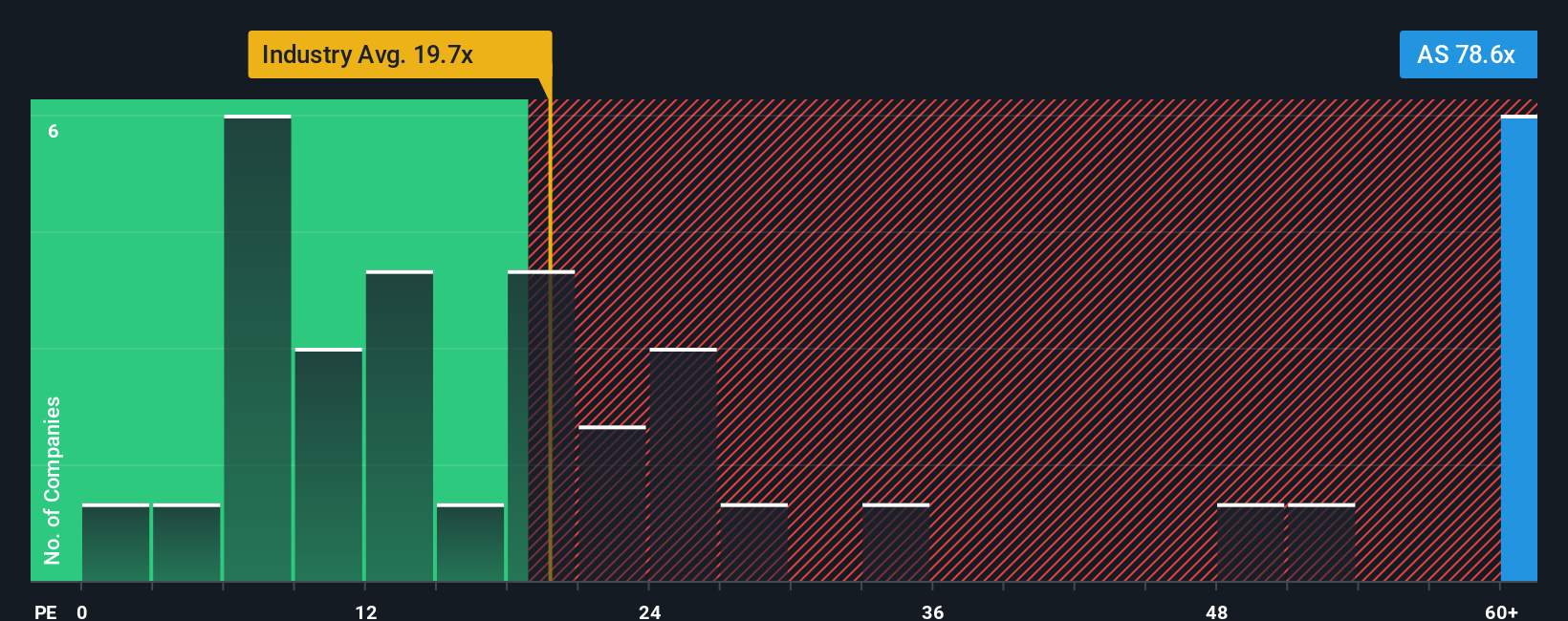

Another View: Market Multiple Flags Rich Pricing

While the narrative fair value suggests upside, the market ratio tells a tougher story. Amer Sports is trading on a P/E of 67.4 times versus 19.9 times for the US Luxury industry and a 28.7 times fair ratio, which raises the risk that sentiment, not fundamentals, is doing more of the heavy lifting.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Amer Sports Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a fully customized narrative in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Amer Sports.

Looking for more investment ideas?

Before you move on, lock in an edge by scanning fresh opportunities on Simply Wall St, where targeted screens can reveal ideas you might otherwise overlook.

- Capture potential mispricings by checking out these 904 undervalued stocks based on cash flows that strong cash flow analysis suggests the market is underestimating.

- Harness the momentum of transformative technology through these 24 AI penny stocks at the forefront of machine learning and automation.

- Strengthen your income stream with these 10 dividend stocks with yields > 3% that combine attractive yields with sustainable payout potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal