Enel (BIT:ENEL) Valuation After São Paulo Concession Dispute and 2025–2027 Grid Investment Plans

Enel (BIT:ENEL) is back in the spotlight after publicly rejecting the idea of selling its São Paulo power distribution unit, even as local authorities threaten to revoke the concession following a series of outages.

See our latest analysis for Enel.

The backdrop to this standoff is a stock that has quietly rebuilt momentum, with a roughly 25 percent year to date share price return and a three year total shareholder return above 100 percent, signaling that investors are warming to Enel’s long term grid and renewables story despite periodic regulatory flare ups.

If this kind of regulated utility drama has you reassessing your watchlist, it could be worth scanning for other resilient operators through stable growth stocks screener (None results).

With the shares now close to consensus price targets and longer term returns already impressive, the key question is whether Enel still trades at a discount to its growth ambitions or if the market has already priced them in.

Most Popular Narrative Narrative: 2.8% Undervalued

With Enel last closing at €8.77 against a narrative fair value of about €9.02, the story leans toward modest upside driven by fundamentals.

Enel's significant investment in digitalization (e.g., smart grids, automation, BESS capacity now at 11.5GW) and grid modernization is yielding improved operational efficiency, evidenced by €1 billion in cash cost savings already realized toward its 2027 target, supporting margin expansion and sustained net income improvement.

Curious how steady, single digit growth assumptions and a richer earnings multiple combine to justify that higher fair value line? The full narrative unpacks the earnings, margins, and discount rate math that could keep pushing this utility beyond its regulated comfort zone.

Result: Fair Value of €9.02 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentrated European grid investment and persistent Latin American FX volatility could quickly undermine those steady growth assumptions and pressure Enel’s valuation narrative.

Find out about the key risks to this Enel narrative.

Another View: Multiples Paint A Richer Picture

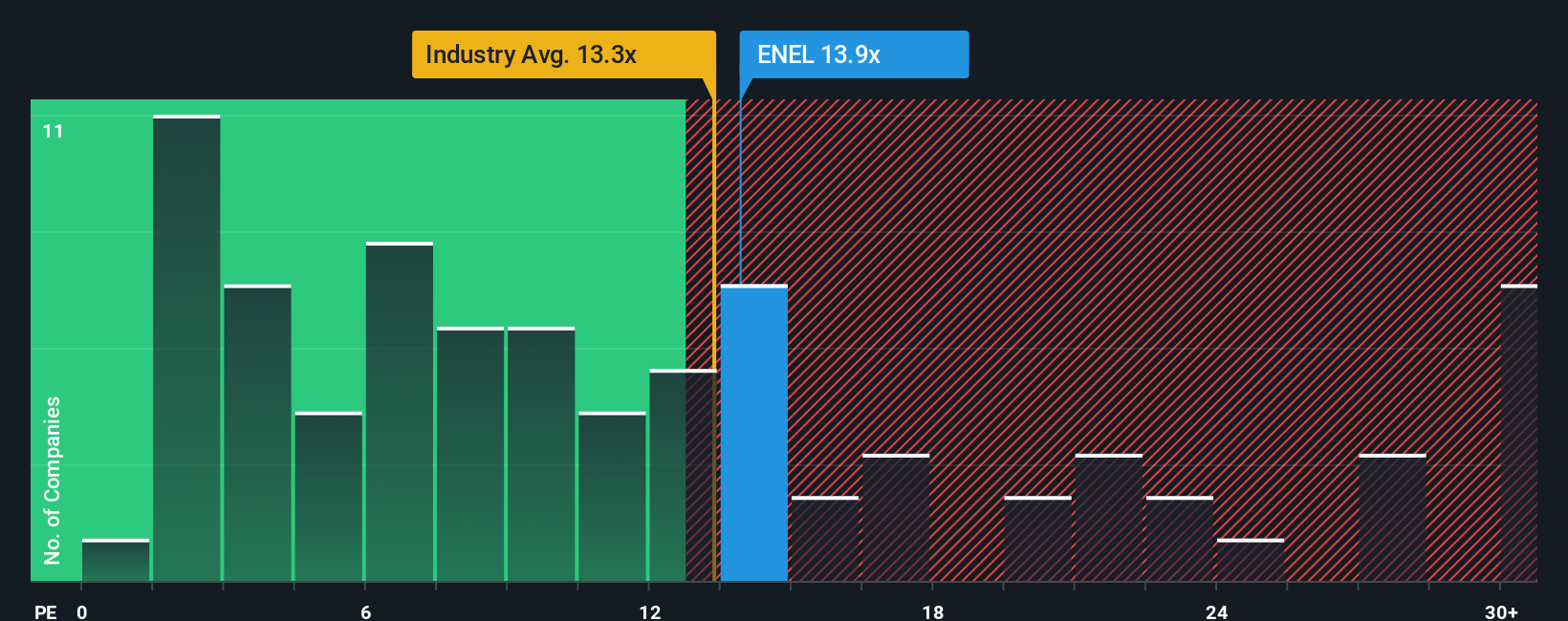

Step away from narrative fair value and the numbers look less generous. Enel trades on a price to earnings ratio of 14.4x, slightly above the European utilities average of 14.1x, yet below a fair ratio of 18.9x. This leaves a narrow margin of safety if growth underwhelms.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Enel for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 904 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Enel Narrative

If you would rather challenge these assumptions and interrogate the numbers yourself, you can build a personalized storyline in just minutes: Do it your way.

A great starting point for your Enel research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next potential opportunity by scanning these targeted stock ideas on Simply Wall Street that many investors overlook.

- Capture potential mispricings by reviewing these 904 undervalued stocks based on cash flows that could offer stronger upside based on discounted cash flow analysis.

- Supercharge your growth watchlist by targeting innovation leaders through these 24 AI penny stocks at the intersection of artificial intelligence and structural demand tailwinds.

- Strengthen your income strategy by assessing reliable payers in these 10 dividend stocks with yields > 3% that combine yield with fundamental resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal