Asian Dividend Stocks To Consider In December 2025

As we approach the end of 2025, Asian markets are navigating a complex landscape marked by Japan's significant interest rate hike and China's mixed economic indicators. In this context, dividend stocks in Asia offer an attractive proposition for investors seeking stability and income, especially amidst fluctuating market conditions.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.75% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.26% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.84% | ★★★★★★ |

| NCD (TSE:4783) | 4.00% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.98% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.15% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.50% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.82% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.68% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.29% | ★★★★★★ |

Click here to see the full list of 1030 stocks from our Top Asian Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

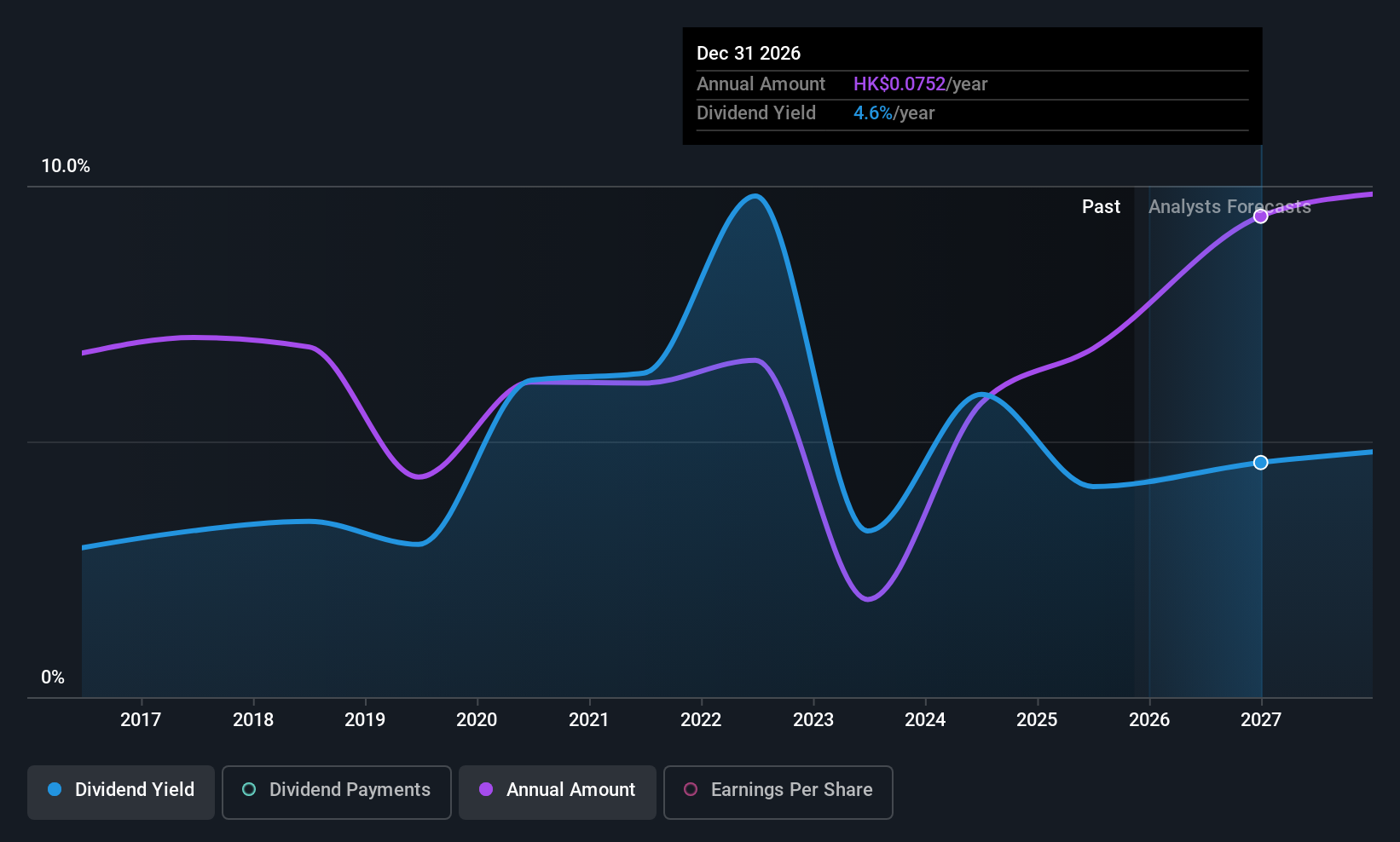

China Reinsurance (Group) (SEHK:1508)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Reinsurance (Group) Corporation operates as a reinsurance company both in the People's Republic of China and internationally, with a market capitalization of approximately HK$73.07 billion.

Operations: China Reinsurance (Group) Corporation generates revenue primarily through its Life and Health Reinsurance segment (CN¥13.26 billion), Property and Casualty Reinsurance segment (CN¥43.61 billion), Primary Property and Casualty Insurance segment (CN¥46.72 billion), and Asset Management segment (CN¥1.38 billion).

Dividend Yield: 3.2%

China Reinsurance (Group) offers a mixed dividend profile, with payments well-covered by earnings and cash flows, evidenced by a low payout ratio of 19.2% and a cash payout ratio of 14.2%. Despite this, its dividend yield of 3.22% lags behind the top quartile in Hong Kong's market. Recent amendments to its Articles of Association may impact governance but don't directly affect dividends. Earnings have shown consistent growth, yet historical dividend volatility remains a concern for investors seeking stability.

- Unlock comprehensive insights into our analysis of China Reinsurance (Group) stock in this dividend report.

- According our valuation report, there's an indication that China Reinsurance (Group)'s share price might be on the cheaper side.

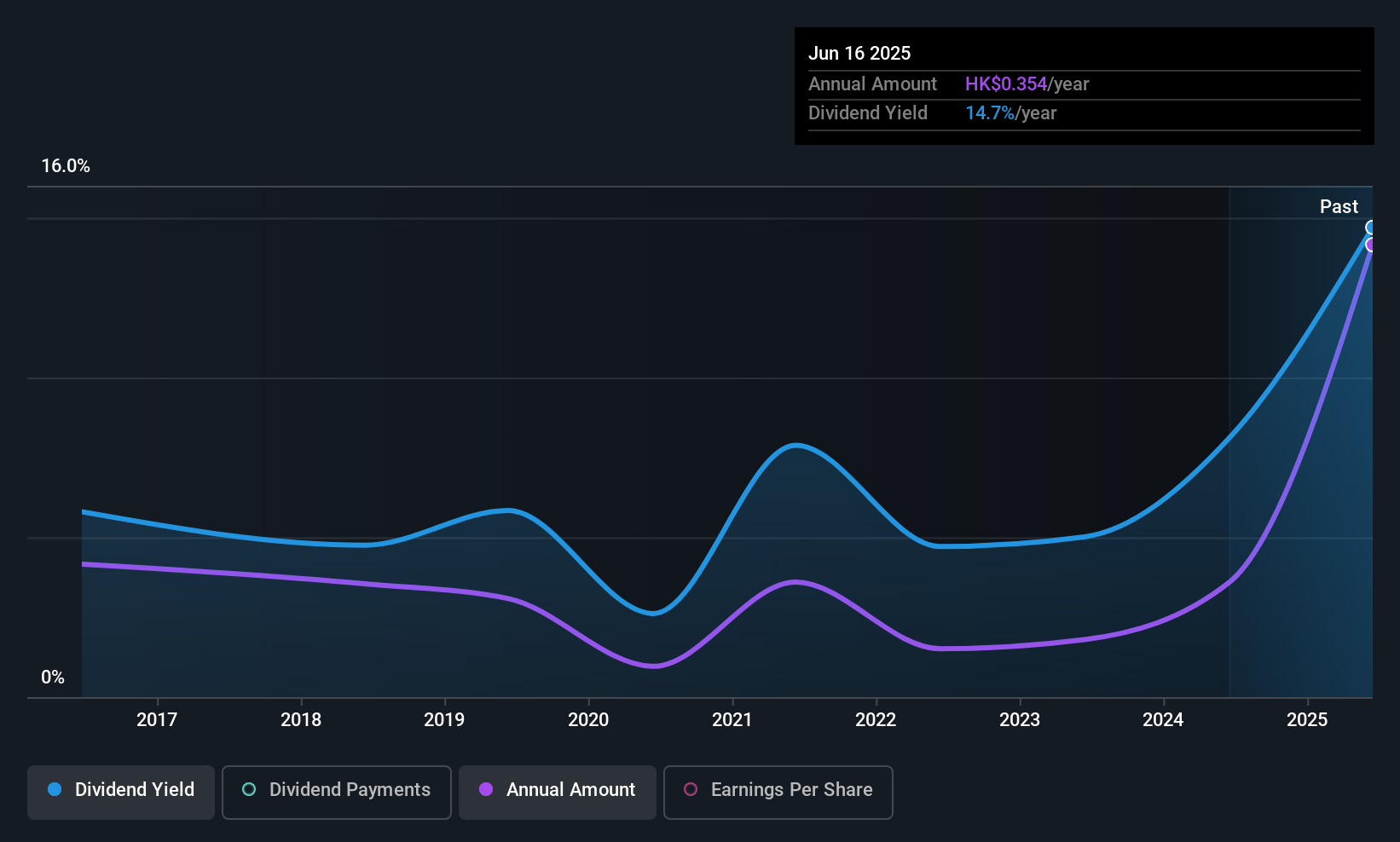

SinoMedia Holding (SEHK:623)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SinoMedia Holding Limited is an investment holding company that offers TV advertisement, creative content production, and digital marketing services for advertisers and advertising agents in China and internationally, with a market cap of HK$904.40 million.

Operations: SinoMedia Holding Limited generates its revenue primarily from advertising, totaling CN¥462.77 million.

Dividend Yield: 18.7%

SinoMedia Holding's dividend yield of 18.66% ranks among the top in Hong Kong but raises sustainability concerns, given a high cash payout ratio of 516%. Despite a reasonable payout ratio of 42.7%, dividends are not well covered by free cash flows and have been volatile over the past decade. Earnings grew by 30.7% last year, yet historical unreliability in dividend payments may deter investors seeking consistent income streams.

- Navigate through the intricacies of SinoMedia Holding with our comprehensive dividend report here.

- According our valuation report, there's an indication that SinoMedia Holding's share price might be on the expensive side.

Shenzhen Kaizhong Precision Technology (SZSE:002823)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shenzhen Kaizhong Precision Technology Co., Ltd. operates in the precision technology sector and has a market cap of CN¥5.27 billion.

Operations: Shenzhen Kaizhong Precision Technology Co., Ltd. generates its revenue from various segments within the precision technology sector.

Dividend Yield: 3.2%

Shenzhen Kaizhong Precision Technology's dividend yield of 3.23% places it in the top quartile among Chinese dividend payers, with dividends well covered by earnings and cash flows due to a low payout ratio of 18.1% and a cash payout ratio of 40%. However, the company's eight-year history of volatile dividends may concern those seeking stability. Despite this, recent earnings growth—55.5% over the past year—indicates potential for future improvement in financial health.

- Delve into the full analysis dividend report here for a deeper understanding of Shenzhen Kaizhong Precision Technology.

- Our valuation report here indicates Shenzhen Kaizhong Precision Technology may be undervalued.

Seize The Opportunity

- Take a closer look at our Top Asian Dividend Stocks list of 1030 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal