Assessing Dave (DAVE) Valuation After Analyst Commentary and Rising Investor Interest

Recent remarks from a senior research analyst have pushed Dave (DAVE) back into the spotlight, as its short term lending model and steady growth trends draw fresh attention from investors watching consumer finance.

See our latest analysis for Dave.

That upbeat commentary is landing just as momentum is heating up, with a 1 week share price return of 16.12 percent and a year to date share price gain of 164.96 percent. This reinforces a three year total shareholder return of 2555.73 percent that suggests investors are steadily repricing Dave’s growth and risk profile.

If Dave’s surge has you thinking bigger about fintech and digital platforms, it could be a good moment to explore fast growing stocks with high insider ownership.

With analyst targets still sitting well above the current share price and profitability improving, the key question now is whether Dave is trading below its true value or if the market is already pricing in that future growth.

Most Popular Narrative Narrative: 25.4% Undervalued

With Dave last closing at $228.69 versus a narrative fair value of about $306, the latest consensus frames this rerating as only partially complete.

Analysts are assuming Dave's revenue will grow by 17.5% annually over the next 3 years. Analysts assume that profit margins will increase from 12.7% today to 27.5% in 3 years time.

Want to see what kind of business can nearly double margins while still growing revenue at a brisk clip, then justify a premium future earnings multiple? Read the complete narrative.

Result: Fair Value of $306.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, tighter regulation of fee based lending or rising customer acquisition costs could quickly squeeze margins and undermine the current growth narrative.

Find out about the key risks to this Dave narrative.

Another Way To Look At Value

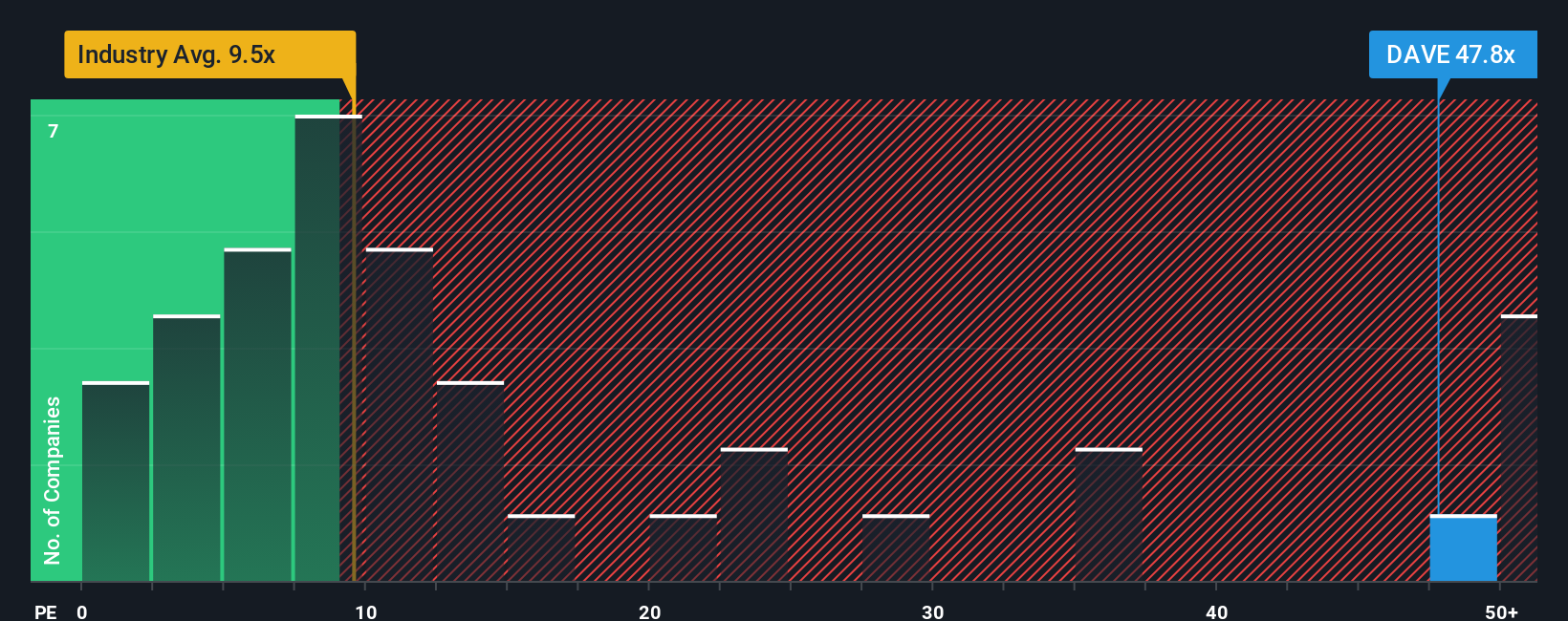

On earnings, Dave looks pricey, trading at about 21 times profits versus roughly 10 times for the wider US Consumer Finance group and 11.5 times for peers. Yet that is close to its 22 times fair ratio, suggesting only a slim margin for error if growth or margins disappoint.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dave Narrative

If you would rather challenge these assumptions and dig into the numbers yourself, you can craft a personalized view of Dave in minutes: Do it your way.

A great starting point for your Dave research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Do not stop with just one opportunity. Use the Simply Wall Street Screener to uncover targeted ideas that match your strategy before the market moves without you.

- Capture potential mispricings early by scanning these 904 undervalued stocks based on cash flows that strong cash flow analysis suggests the market is overlooking.

- Ride structural shifts in automation and data by backing the innovators inside these 24 AI penny stocks before they become widely followed.

- Explore income potential by reviewing these 10 dividend stocks with yields > 3% offering yields above 3 percent that may enhance your portfolio's cash generation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal