Assessing GameStop (GME) Valuation After Recent Volatility and Profitability Turnaround Narrative

GameStop (GME) just delivered another swing in a stock that rarely sits still, and investors are again asking whether the latest move reflects fundamentals or simply shifting market sentiment.

See our latest analysis for GameStop.

Zooming out, the latest move slots into a choppy stretch where the 30 day share price return is modestly positive, but the year to date share price return and one year total shareholder return remain sharply negative. This comes even after a strong five year total shareholder return that hints the long term story is still very much alive, just with fading near term momentum.

If recent volatility in GameStop has you rethinking where the next big swing could come from, it might be worth scanning fast growing stocks with high insider ownership as a fresh hunting ground for ideas.

With fundamentals mixed, sentiment fragile, and the stock still trading far below many estimates of intrinsic value, investors now face a familiar crossroads: is GameStop a contrarian buying opportunity, or is the market already pricing in all the growth ahead?

Most Popular Narrative Narrative: 82.1% Undervalued

Compared with GameStop's last close at $21.53, the narrative's fair value of $120 points to a radically different view of what the business is worth.

GameStop’s Q1 2025 financials, combined with an amazing shareholder community, just showed its takes money to buy whiskey strategy at work, demonstrating its status as a compelling investment as the retail investors have been saying for years while fighting a corrupt legacy media, bots, social media manipulation and hedge funds. Gamestop delivered a stellar adjusted EPS of $0.17, beating estimates by 325%, and achieved a $44.8 million net profit, reversing last year’s $32 million loss.

According to prime_is_back, this bold valuation hangs on a sharp profitability turnaround, a rich future earnings multiple, and disciplined margins that aim to transform the balance sheet into a growth engine.

Result: Fair Value of $120.0 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that bullish case still faces risks, including execution missteps on the digital strategy or a reversal in Bitcoin prices that could undermine balance sheet strength.

Find out about the key risks to this GameStop narrative.

Another Lens On Valuation

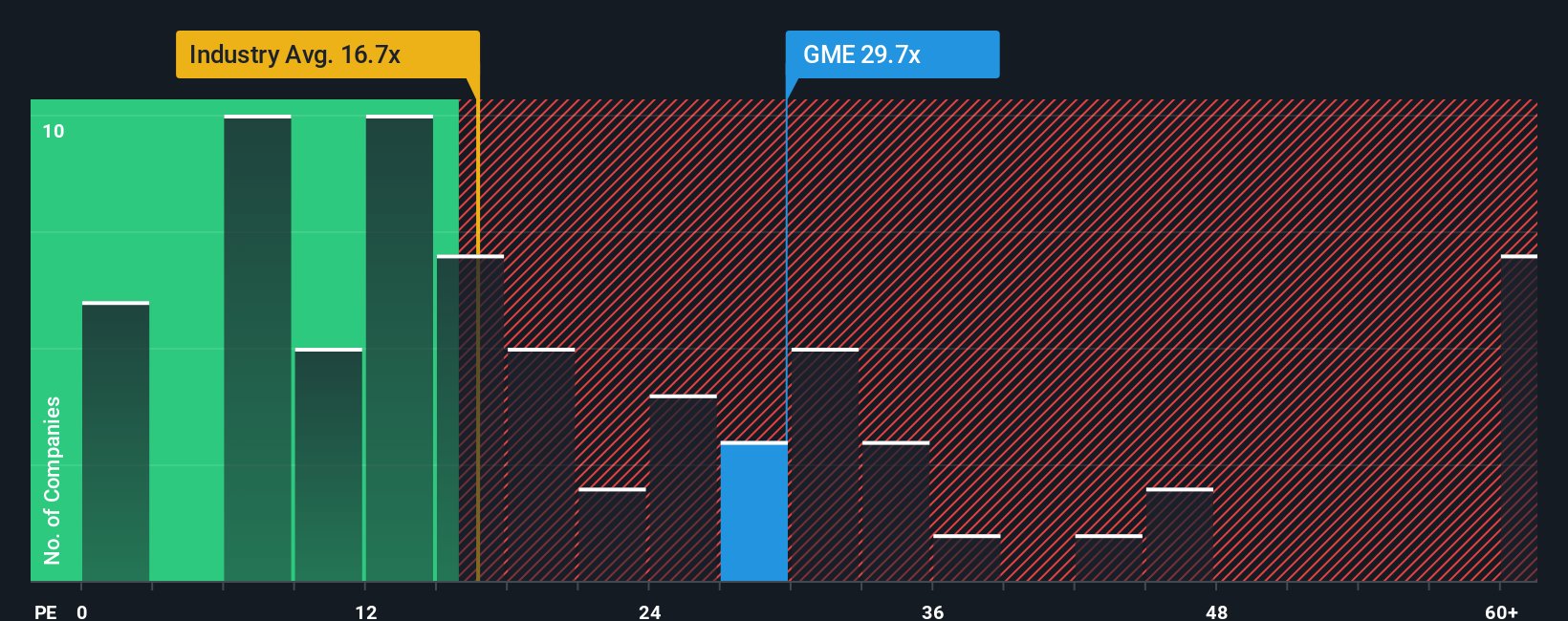

While the narrative points to deep undervaluation at $120 per share, our valuation checks based on the price to earnings ratio tell a tougher story. At 22.9 times earnings, GameStop trades richer than both the US specialty retail industry and peer average of 19.9 times, which could limit upside if growth slows.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own GameStop Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a complete view in minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding GameStop.

Looking for more investment ideas?

Do not stop with one stock when you can quickly compare fresh opportunities using the Simply Wall Street Screener and line up your next smart move.

- Capture early growth potential by scanning these 3630 penny stocks with strong financials that pair smaller market caps with financial strength many investors have not noticed yet.

- Ride structural shifts in automation and data by targeting these 24 AI penny stocks shaping how businesses, consumers, and industries adopt intelligent software.

- Lock in stronger return potential by reviewing these 10 dividend stocks with yields > 3% that combine attractive income with balance sheets designed to support payouts through multiple cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal